Investors: a hot topic in the acquisitions world.

There’s so much to gain from working with the right ones, but if you choose the wrong ones, your business can end in disaster.

Because of the potential upside and downsides to working with investors, it’s not a simple “yes” or “no” proposition.

There’s a lot to consider when thinking about bringing on investors to purchase a business, and we’re going to start that conversation today. This is the first post in the series on investors and everything you wanted to know about working with them.

Let’s get started.

Who Are Investors?

An investor is a person who will provide you with capital in exchange for financial returns. An investor can be a person, firm, or mutual fund.

Investors generate financial returns by providing capital either as equity or debt investments. With equity investments, investors will take stock in your company, and with debt investments, investors will loan you money.

Investors look to earn a rate of return in order to meet their financial objectives, whatever they may be.

Why Do We Work With Investors?

You need funding to buy and grow your business, whether that’s your own capital or someone else’s. Luckily, we don’t always have to rely on ourselves to purchase a business. There are many means of financing an acquisition, and working with investors is one approach of many.

The purpose of working with investors is to build a win-win partnership between the business owner and the investor. The business can benefit, more than just monetarily, from partnering with an investor, and, ideally, the investor benefits by gaining a return on his or her money.

Even if you’re not in a position where you need help with financing, investors offer much more than capital. Their resources and expertise can make and keep your business successful for some time to come.

Benefits of Working With Investors

“What are those benefits?” You ask.

- Lower your risk

Working with investors allows you to not put all your financial eggs in one basket.

If you’re considering using a significant portion of your retirement savings or the equity in your home to finance your next acquisition, working with investors who can help finance the purchase will lower your risk as a buyer. By sharing the liability with other investors, you don’t have to jeopardize your entire net worth. - Tapping into investor’s expertise and network

You’ve heard that having a mentor can shave years off a learning curve. Having investors on your team can provide the same benefit.

Investors are typically in a position to invest because they have spent their careers building expertise, experience, and a network that allowed them to thrive. Because they are invested in the success of your business, they are more than happy to share their wealth of experience and contacts with you, so you both can ultimately profit. - Help selling your business on the other side

Investors live in the world of valuations. They know what makes for a valuable business and what doesn’t. This is vital knowledge that they can share with you, especially as you eventually get ready to sell your business.

While you’re growing your business, investors will keep an eye out for ways to maximize the value of your business so you can sell the business at the highest multiple down the road. - Overcome financial obstacles

One of the main reasons businesses fail is due to underfunding.

Money is the life blood of businesses, and it doesn’t only keep the business alive — it allows the business to grow as well. Having an investor can help you overcome financial obstacles that you might normally face if running a business on your own.

Additionally, getting a loan approved from a bank can be challenging. If you’re already working with an investor, it can be less of a struggle to get the capital you need to develop your business. With access to more money, you can reinvest more in your business and scale it quicker. - Less financial pressure

Because an investment isn’t classified as a loan, you won’t necessarily be held to the same strict repayment rules of a loan.

Although investors will expect a return on their investment, you may not be subjected to the same deadlines, repayment schedules, and interest rates that a bank would impose. The nature of repayment can take the pressure off of you as a business owner, allowing you to focus on growing your business instead.

Downsides to Working With Investors

I’ve already prepared you to understand that working with investors isn’t always a walk in the park. Here are a few downsides you may encounter and should anticipate before entering a partnership with any investor.

- Differing visions

A vision is crucial in defining the direction a business will go. It helps to align a team and rally them toward one common goal. However, when you bring on an investor, there’s a good chance that you and the investor will have different ideas of what the vision should be. You may be focused on helping your customers as much as possible, whereas the investor might be more interested in padding the bottom line.

When there are conflicting visions for a company, it can create confusion for employees, customers, and stakeholders alike. That confusion can cause a business to stagnate and do the complete opposite of what everyone would like it to do: grow. - You won’t be able to take as many risks

Taking risks is synonymous with being an entrepreneur, and as a new business owner, there’s a good chance you have ideas you want to experiment with to see if they can scale the business. However, an investor is trained to manage risk and keep it as low as possible, while maintaining the highest profitability.

If an investor is involved in the direction and management of your business, you won’t be able to take all the risks that you’d like to. You’ll have to strike a balance between your desire for innovation and the investor’s expectation for financial return. - Give up control and management

If this point wasn’t obvious, yet, the main detractor from working with investors is how much control and management you’ll have to give up in order to work with them. There certainly can be an upside to making this sacrifice, but you may feel hamstrung as a business owner to have the weight of responsibility without the complete freedom of being the CEO. - Company culture will change

As a new business owner, one of the things you hope to achieve is a sense of impact. That comes from many different places within a business – handling problems, increasing customer satisfaction, taking care of employees, potentially giving back to a larger cause, and more.

Working with an investor whose values and end goals are different from yours can shift the culture of your company. There’s a good chance the investor may be more preoccupied with getting his or her desired return on investment than fulfilling any desire for impact. If that’s the case, these differing values will negatively affect the feel of your company, for your stakeholders all the way down to your customers. - Not conducive to building confidence

Working with an investor is in many ways like riding a bike with training wheels. There’s a much higher chance you’re not going to tip over and fall, but you also can’t say you know how to ride a bike, since you’ve never done it without training wheels.

If you’ve been a business owner before, this may not be a disadvantage you need to worry about. However, if you’re new to running a business, you may face self-doubt in your abilities as the CEO. This self-doubt can negatively impact your experience and the reward you get from being an entrepreneur. You may want to consider building your career capital and confidence first before you decide to work with investors.

When Do You Need Investors?

So how do you know when it’s the right time to work with investors?

There are three things you need to consider:

- Your goals

- Benefits of debt versus equity financing

- What you’re willing to give

Your Goals

You have to ask yourself what your goals are and determine if an investor will help your goals or potentially hinder them.

Do your goals revolve around having a certain lifestyle? Financial return? Autonomy? Impact? Next, when do you hope to achieve your goals by? How long can you forego what’s important to you for the greater good?

It might be a worthwhile exercise to write down exactly what your goals are and prioritize them by importance, indicating which ones are non-negotiable from day one.

Pros and Cons of Equity and Debt Financing

There are many different ways to finance an acquisition. If you are looking to buy a business but cannot qualify for a loan or you cannot afford the down payment, you may consider bringing on an investor to help with financing.

If you can qualify for a loan and the down payment on your own, you may consider bringing on an investor to help because of the intangible benefits they provide the business. You can see the value they would bring to the business, and it may be worth it to you to part with some of your equity in order to make that happen.

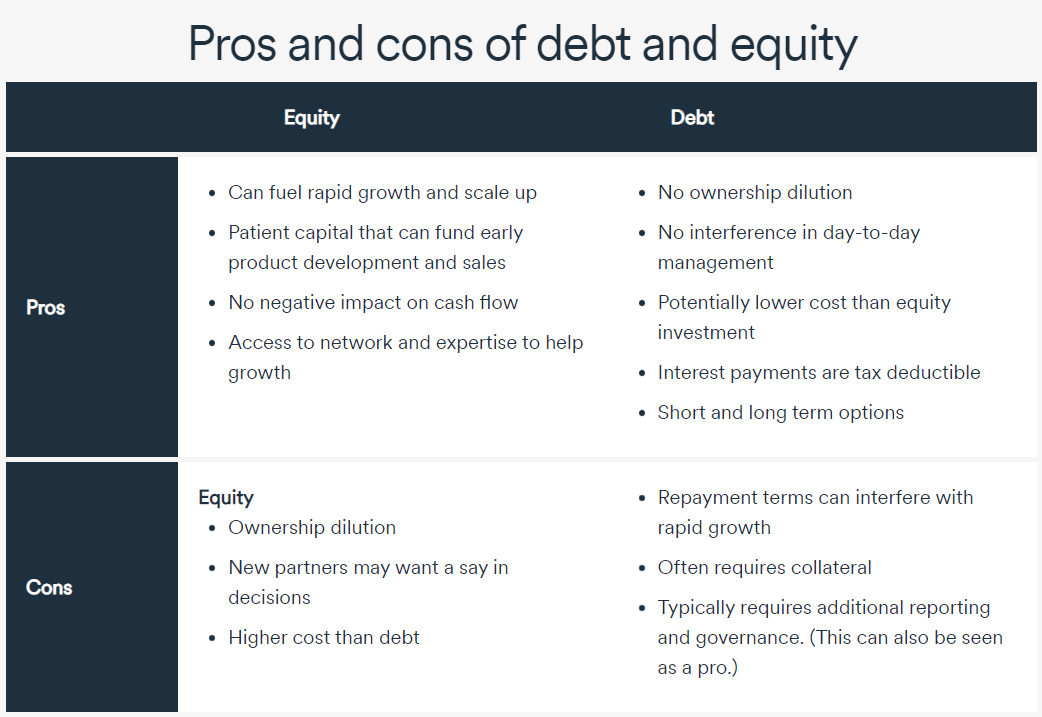

When buying a business, typically you’ll consider debt or equity financing. There are advantages and disadvantages to both.

You’ll want to weigh both sides before you decide to bring on an investor.

Define What You’re Willing to Give

The most difficult part of a negotiation with an investor is setting the valuation for your business. How much will they invest and what will you give up?

Self-reflection is important in helping you understand “what you must have, what you want to have, and what you’re willing to trade.”

You want to reflect on your goals, as we covered above, understand the pros and cons of investor financing, and find the optimal mix of type of financing that will fuel your company’s growth and ensure you reap the rewards of your hard work.

It might be a good idea to financially model different scenarios to see the difference in cost (financially and otherwise) between different funding options over the next several years.

What’s Next?

If you’re interested in bringing on an investor, the best way to get started is to begin networking.

Reach out to mentors who can provide advice on your journey. Preferably, find mentors who may have worked with investors in the past.

Talk to friends and family. Early investors often come from this pool, investing over $60 billion per year. 38% of startup founders report raising money from friends and family, with the average amount being $23,000.

Reconnect with alumni groups and professional associations. Start having conversations about what it is you’re trying to do and what you’re looking for.

Having this network will help set the stage for when you are ready to bring on investors.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.