“Walker, it’s easy for you to support acquisition entrepreneurship. You’ve been doing this only during decreased interest rate environments.”

That’s only partially true. I currently own businesses with outstanding loans to their name, so I’m still operating with the same increased interest rates everyone else is. But there’s no denying the number one thing on everyone’s mind right now is… interest rates.

Because of the increase in inflation, the Fed has raised Interest rates since the start of 2022, and they’ve deterred many buyers from acquiring businesses.

It makes sense: why would you choose to pay more for an asset? Moreover, if you’re considering a loan with variable rates, it makes no sense to take on the liability of a fluctuating (read: increasing) interest rate.

Correct?

Not exactly. There are multiple factors to consider when evaluating whether an investment decision is a good one, and the interest rate, however increasing, is just one of those elements. Today, I’ll discuss the importance (or unimportance) of interest rates when making decisions about business acquisitions.

To help illustrate my points, I’ll use a case study of a building my partner and I purchased recently.

In fact, I think this is a great example to use. Because the building is in a tertiary market, the appreciation value is essentially zero, so it eliminates a lot of the variables you might get in normal business acquisitions. This example comes down to simple math.

Let’s dive in.

So I own a manufacturing company here in the US, and I had the opportunity to buy the building for $775,000. The rent we were paying at the time was $7500 per month.

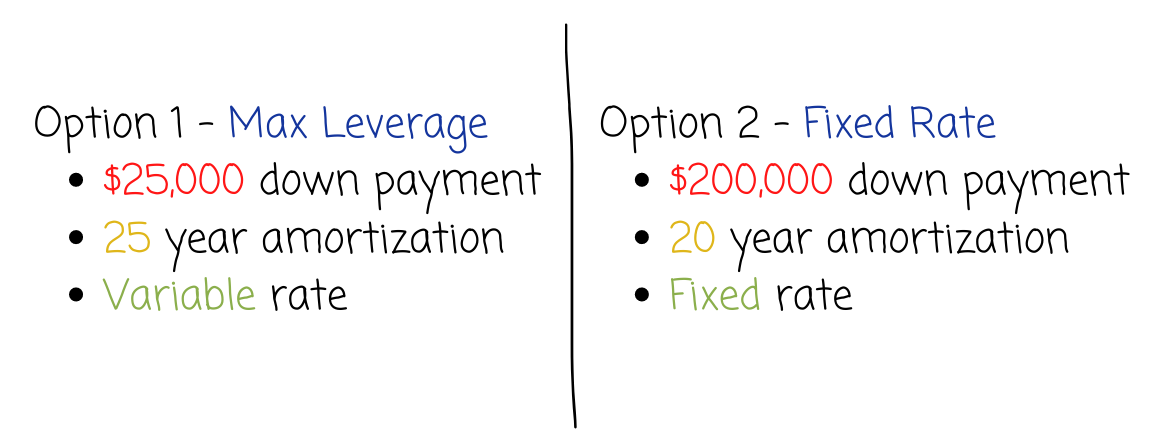

Here were the two options the bank was giving me:

Looking at these options, it was a tough decision for us, and in fact, my partner and I were split on which path we wanted to take.

Do you put more money down for less risk or put less money down and open yourself up to more risk?

Seeing that it was only a matter of time before interest rates rose, we considered option two, with a fixed-rate loan. This was the option my partner wanted to go with, and I don’t blame him.

Either way, either one of these options was going to lower the monthly payment – that much we did know.

Let’s calculate what the monthly payments were going to be.

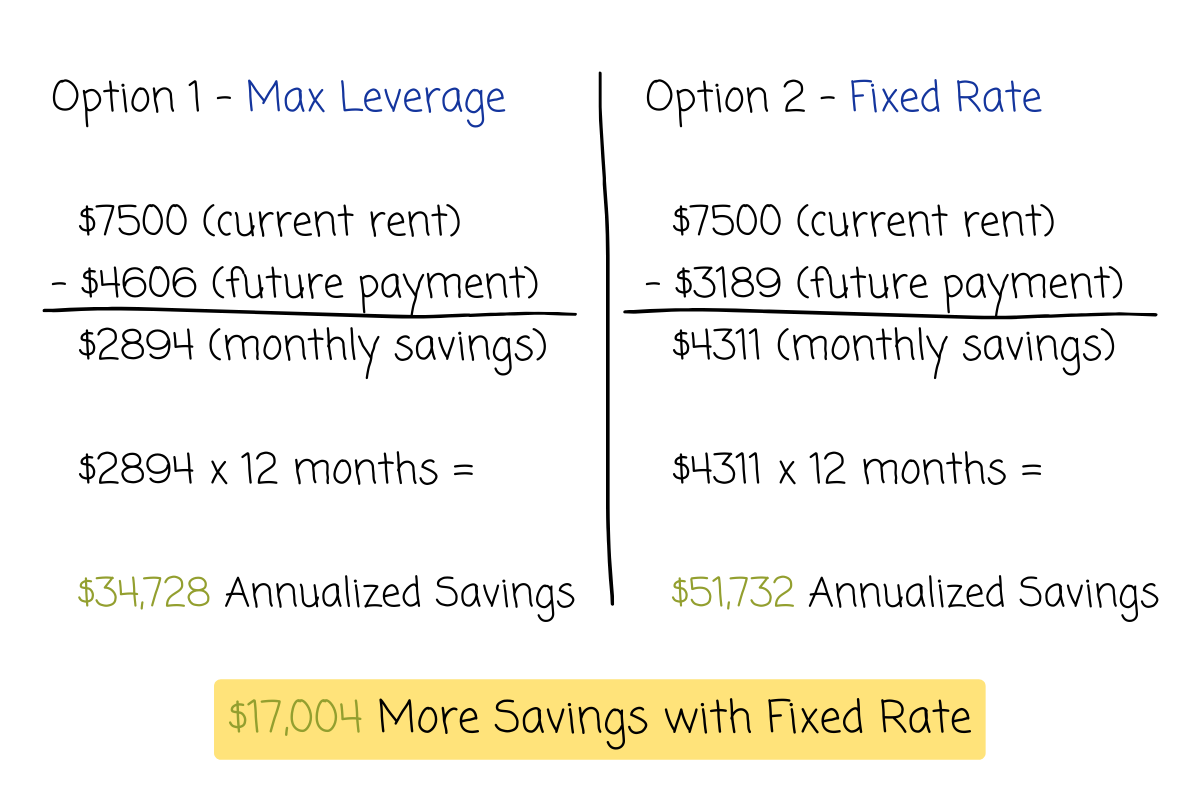

In option 1, which I’ll call Maximum Leverage, the new rent at an assumed 5.5% rate was going to be $4,606 per month.

In option 2, which I’ll call Fixed Rate, the rate was going to be 4%. However, to illustrate an even wider difference between these two examples, I’ll go with 3% in this instance. At the 3% rate, the monthly payment was going to be $3,189 per month.

So again, we either put down $25,000 and pay $4,600 per month or put down $200,000 and pay $3,200 per month.

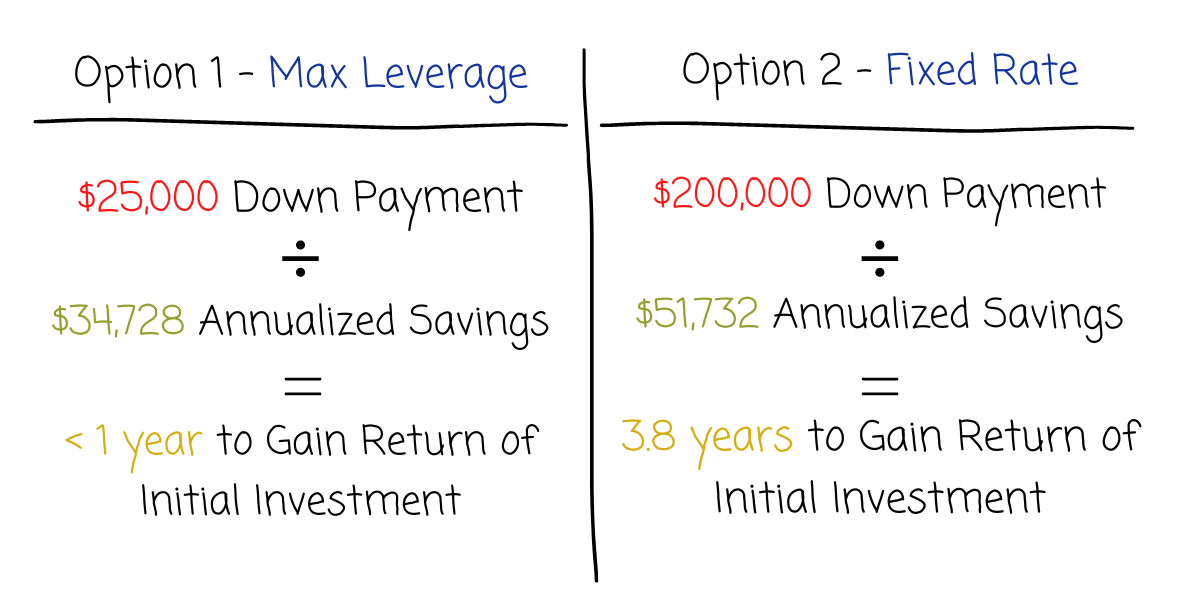

When you annualize the amount of money we’d save, in the maximum leverage scenario, we’d save $35,000 per year just by buying the building – assuming it stays at 5.5%, which it won’t.

By maximizing leverage, I’m getting a one-year payback on my initial down payment.

In the fixed rate scenario, we’d save $52,000 per year.

That’s $17,000 more than we would in the max leverage option. I’d rather save $17,000 than get a stick in the eye, but you have to consider that any savings a business makes will turn into profit unless we choose to reinvest it. Profit is taxed. So post-tax, you’re looking at an additional savings of $9,800 per year.

With the fixed rate option, it would take us just under four years to make back our original down payment of $200,000.

Based on these calculations, we’d save slightly more every year with the fixed rate option, but it would take us four times as long to regain our down payment.

Equity Buildup

The next point I want to discuss is equity buildup.

Assuming 0% appreciation, I’m taking $25,000 and turning it into $775,000 over 25 years. That comes out to a 13.75% YOY return on $25,000.

In the fixed rate option, I’m taking $200,000 and turning it into $775,000 in 20 years. That comes out to a 6.7% YOY return on $200,000.

The maximum leverage option wins on ROI, equity buildup, and return of original investment.

The Truth of Rising Interest Rates

I can hear you now, “But the interest rate, Walker!”

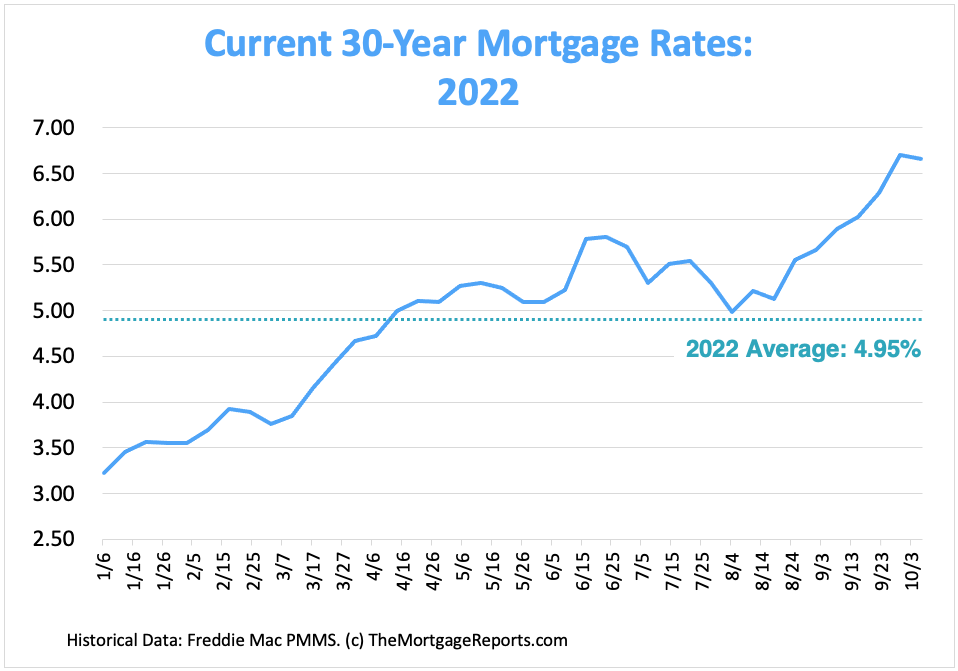

I know – I get it. People are worried about rates going up. When they see variable-rate loans, they run in the opposite direction. That said, we have to look at the history of interest rates to evaluate how much of a risk increased interest rates actually are.

Back in 1981, mortgage rates hit an all-time high of 16.83%. Compare that to our current mortgage rates of 5-7%. Today’s rates pale in comparison.

Also, rates didn’t increase overnight – they took time. It took ten years for mortgage rates to increase from 8% to a high of 16.83%.

But let’s say inflation is so extreme over the next several years that interest rates more than double – they go from 4% to 10%. In our maximum leverage scenario, we would be paying $6,815 a month, which is still less than the rent we’re currently paying. Keep in mind that rates won’t go up overnight.

However, if interest rates go all the way up to 10%, it also means the economic landscape has shifted. Supplies would cost more. Prices we’d charge our customers would cost more. Our building would be worth more.

So the $6,815 will feel like today’s $4,600 because of the cost of capital going up and the increase in prices all around.

Overall, the maximum leverage option has the lowest investment and the highest return with a marginal risk being accepted.

Sure, the interest rate in this scenario is variable, which makes it seem like the risk is limitless. The truth is, life is variable. As interest rates go up and things cost more, the dollars we earn and spend in all arenas are going to feel about the same. And looking back on historical mortgage rates, we see that interest rates, even if they’re increasing, will only increase so fast.

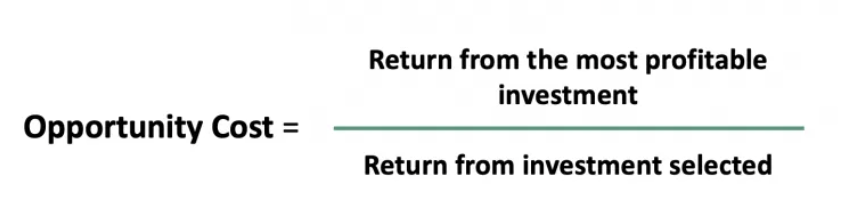

Opportunity Cost

In the fixed rate option, the idea is that we’d protect ourselves from interest rates going up. Interest rates going down isn’t a risk, since if that happens, we can easily refinance at a lower rate.

However, the biggest risk with the fixed-rate option, from an investor point of view, is: what else can you do with the $200,000 down?

Let’s say you took the difference between both down payments, $175,000, and you put it in a conservative portfolio in the stock market for the same period of time (20 years). At a 10% rate of return, that $175,000 would turn into $1.17 million.

Even in the four years your $200,000 will be tied up, you could instead gain over $250,000 in the stock market during that same timeframe – more than your down payment.

By going with the fixed rate option, opportunity cost is the biggest risk you take by tying up your money. By putting $200,000 down for a fixed-rate loan, you’re now unable to turn $175,000 into $1.15mm.

You’re saving an additional $17,000 per year with a slower payback simply to protect yourself against the negligible risk of increased rates.

I’d prefer to get my original investment back in one year.

A Third Option

Now, here’s a third strategy.

Buy the building with the maximum leverage terms, but don’t reduce rent. Continue to pay $7500 per month. Then in three years, you now own 25% equity in the building. Now you can qualify to refinance at a fixed rate.

You get the best of both worlds – fixed and variable – and you minimize the amount of time you allow the interest rate to be variable. So instead of taking a 25-year gamble, you’re simply accepting a variability in interest rate for the next three years.

Do You Pay More in a Low or High Interest Rate Environment?

In inflationary times, such as the one we’re currently in, it’s easy to be alarmed by interest rates going up and overemphasize the risk inherent in higher interest rates.

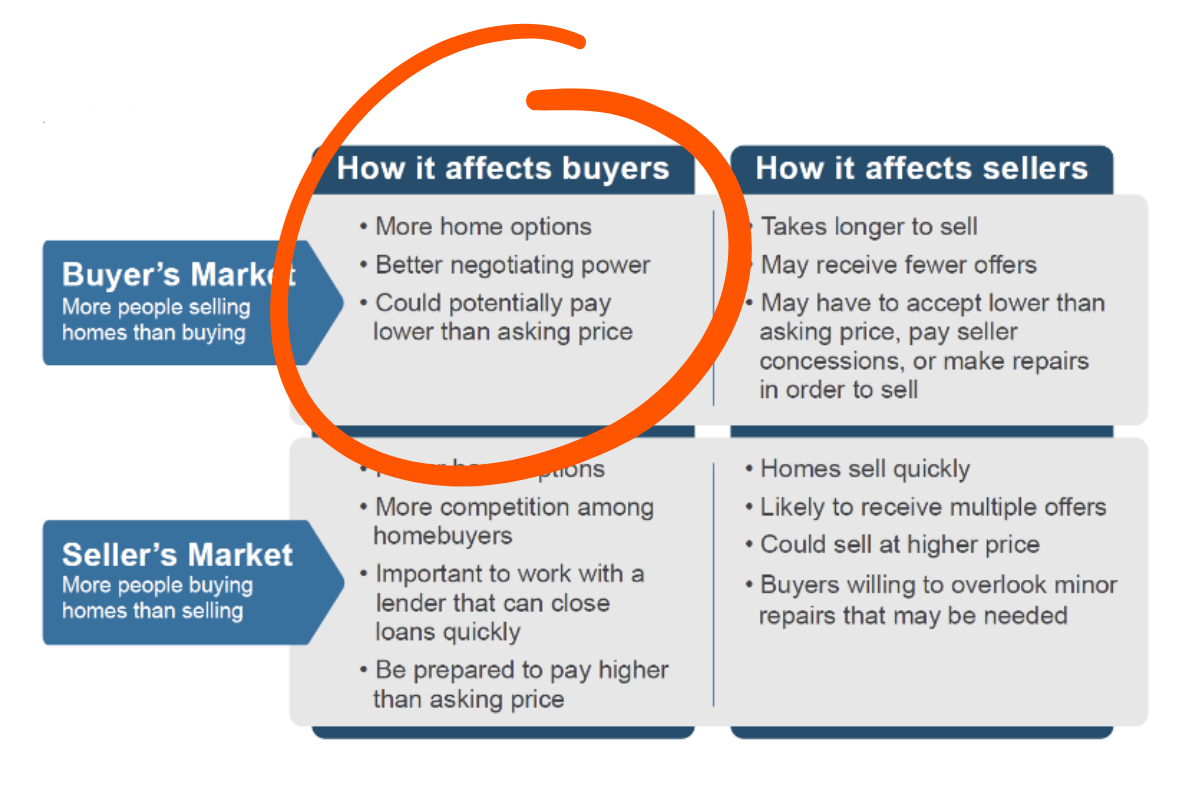

However, there’s a risk in lower interest rates as well. When interest rates are low, demand increases. And whether you’re looking at homes or business acquisitions, low interest rates turn the market into a seller’s market. When that happens, buyers are willing to pay more for the exact same asset. So although supply hasn’t increased, the low interest rates combined with increased demand force you to pay double for the exact same asset.

Monthly payments may be more affordable, but prices in low interest rate environments actually go up.

Me? I’d rather buy something in a high interest rate period when no one else is buying.

There are many factors that go into the decision-making process when considering an investment, and it’s important to quantify the risk associated with interest rates and weight the importance properly as you make your decision.

Don’t let the current interest rate environment be the one thing that prevents you from investing in a business and attaining the freedom and wealth that come with it.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.