In an ideal world, we would be able to finance our business acquisitions purely through cash. We wouldn’t have to obtain financing, complete all the paperwork, maintain good credit, and delay the acquisition process even further.

That said, in most cases, people use financing of some sort to afford a business purchase. Whether it’s the seller, a bank, or another type of lender, if someone is agreeing to provide you with financing, there’s typically something at stake for you, as the borrower, to mitigate their risk.

If you don’t have cash to pay for a business, you’ll need collateral, either business or personal assets, or a personal guarantee to obtain the loan.

Is a personal guarantee required to buy a business?

As with most things… It depends.

In this post, I talk about what a personal guarantee is, the different types of personal guarantees, different types of financing you can obtain for acquisitions, and in what situations you would reasonably expect to sign a personal guarantee in order to buy a business.

What is a Personal Guarantee?

A personal guarantee is more than a verbal commitment.

A personal guarantee is a legal promise that if your business is unable to repay its debt, the bank or lender can come to you personally to repay the balance. This includes having your assets available for repossession. For lenders, requiring a personal guarantee provides them with an extra level of protection.

There are two different types of personal guarantees:

- Limited

- Unlimited

They are exactly as they sound.

With a limited personal guarantee, the lender can only hold you (and any other owners with 20% or more equity) accountable up to a given threshold for repaying the loan. This is most common in cases where there are multiple investors who have 20% or more of the total share. It goes without saying that a limited personal guarantee limits the risk the borrower(s) carry, since they will only be accountable to a certain portion of repayment in the event of a default.

In the case of unlimited personal guarantees, the borrower(s) is on the hook for the entire balance of the loan, offering you no financial protection in the event your business goes belly up. This is the more common type of personal guarantee for SBA loans.

Should I Worry About a Personal Guarantee?

A personal guarantee shouldn’t be something you worry about if you’re looking to buy a business, and here are three reasons why.

- SBA Pre-Qualified Businesses Have Been Vetted: Businesses have to meet strict requirements to be considered for an SBA loan and SBA loans are cash-flow based. With those two things in mind, the SBA will not agree to guarantee a loan for a business that doesn’t have a solid foundation. Although an SBA pre-qualification doesn’t suddenly make due diligence moot, you can certainly view it as a positive sign if a business can qualify for an SBA loan.

- You’re Invested in Its Success: Secondly, you’re not buying a business because you don’t care about its success. As the owner, you have a vested interest in the business succeeding, and you will do everything in your power to make that happen. Ideally you’re buying a business that you have a very solid and clear path for success identified.

- Historical Default Rate is Low: After decades of people using SBA loans to buy businesses, the default rate on business acquisition loans has been consistently under 2%. Although there’s always a chance something can go awry, it’s been proven rare that it will.

I know what you’re thinking.

“But what if the unimaginable were to happen? What if the business failed and all the capital was lost – what would happen then?”

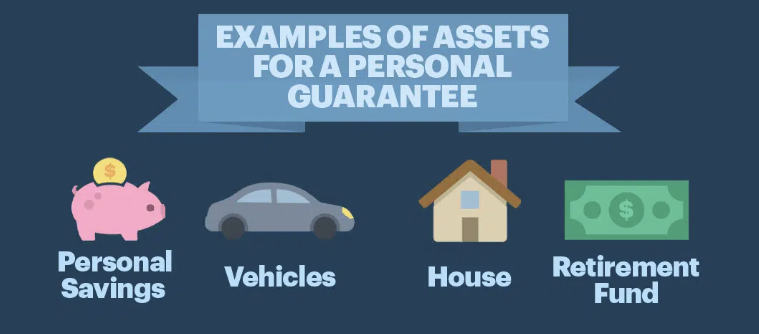

In the event you defaulted on your loan, the lender could claim your personal assets, including:

- Personal bank accounts

- Real estate assets

- Vehicles

- Any other liquid assets

This is why, even though defaulting on a loan is a rare occurrence, signing a personal guarantee is an act of faith on your behalf, when you don’t have other money or inventory to help collateralize the loan. It demonstrates that you are willing to pledge your personal assets, as a show of being able to take on the financial burden.

That said, there are also laws in some states, such as Texas, that prevent someone’s primary residence from being seized. It’s also important to recognize that if you don’t carry substantial equity in your assets then it’s unlikely that it can be seized, and only assets that are yours individually or collectively (through marriage) can be liened.

Different Ways to Finance an Acquisition

Before we talk about when a personal guarantee might be required, let’s discuss the different ways you can finance an acquisition:

- SBA Loan

- Equity Financing

- Seller Financing

- Asset-Based Loans

- Conventional Loans

- Alternative Lending

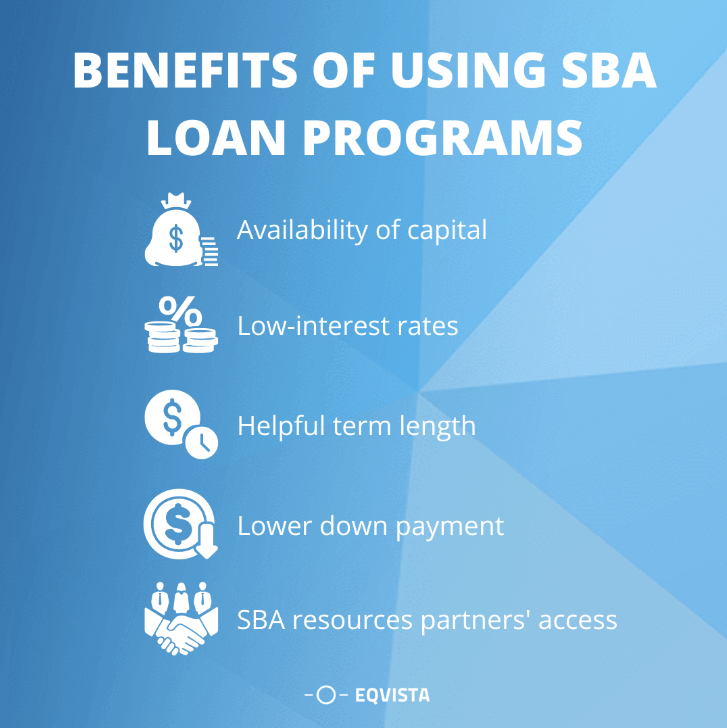

SBA Loan: A bank loan guaranteed by the SBA. A business must meet strict requirements to qualify, but rates are competitive and repayment can be made over a longer time period (seven to ten years).

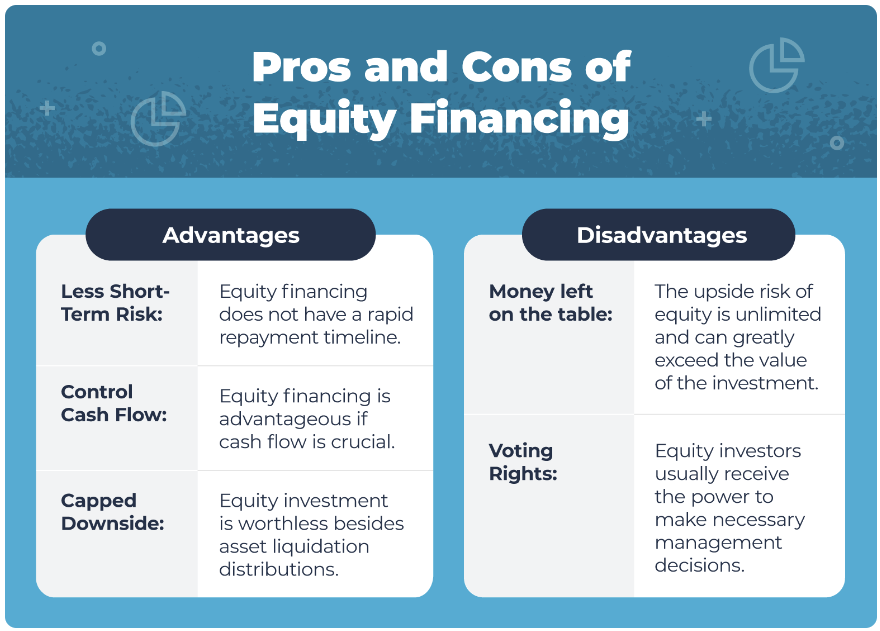

Equity Financing: Also known as investors, investors help purchase a business with their own money in exchange for ownership in the business. There are benefits and drawbacks to this type of financing, as they are for all of them. There may be additional requirements when working with investors. Typically, investors will play a more active role in the management of the company, which is not the case for other types of financing.

Seller Financing: This is when the seller agrees to sell the business to you through financing. So instead of paying the seller the purchase price in full, seller financing allows you to pay the seller in monthly installments with interest. In some cases, the seller is looking to exit the business quickly and is more focused on selling the business than making money on interest.

Asset-Based Loans: Some commercial lenders will loan money to a borrower, and instead of issuing a personal guarantee, they will rely on the company’s assets as collateral. These are quicker to come by, but you risk forfeiting your assets in the event you default on the loan.

Conventional Loans: A conventional loan is any loan not backed by the government, i.e. SBA. Loans are typically between five and nine years and rates are competitive. The terms of a conventional loan depend on the collateral and the length of the loan.

Alternative Lending: Any lending that happens outside of a normal financial institution such as a bank or credit union is considered alternative lending. This can include direct online lending, private lending, marketplace lending, and crowdfunding. These options are not typically used to finance an acquisition.

The most common new form of alternative lending that is commonly used in online acquisitions is revenue-based lending through companies like Boopos.

When is a Personal Guarantee required?

So when can you expect to sign a personal guarantee to obtain financing for your business?

Personal guarantees are most common when getting SBA loans.

Why is that?

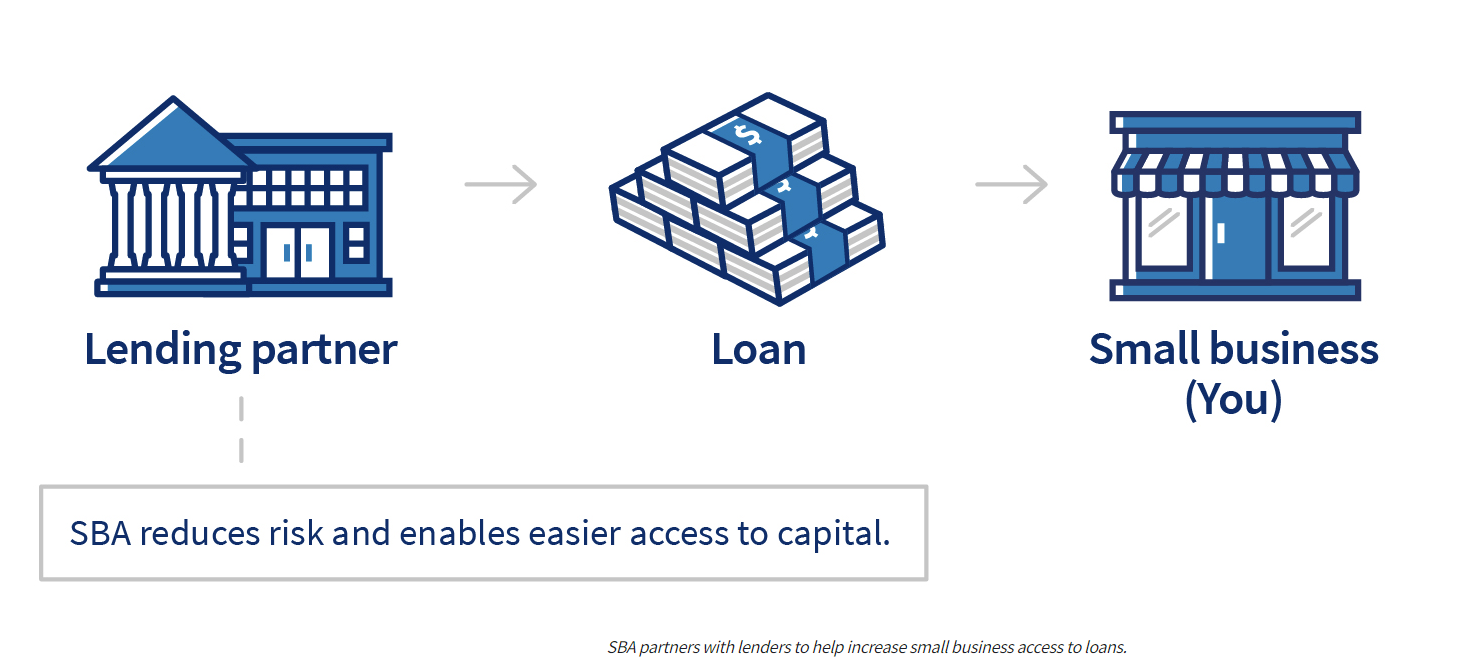

For starters, a SBA loan is not a loan given by the government. It’s a loan provided by a lender that is guaranteed by the SBA. That means the SBA will repay a substantial amount of the loan in the event the borrower defaults on the loan.

It’s only been since 2018 that SBA loans for small business acquisitions have even been around. The SBA realized that small businesses that transact under or around $5 million didn’t have the assets to provide collateral, so instead, the SBA decided to be that collateral for the bank, to encourage banks to provide lending.

By providing lenders with a guarantee, the SBA encourages them to grant credit to borrowers that might not be available to those borrowers otherwise.

Additionally, another benefit to the lender by having an SBA loan guarantee is that the loan will typically be longer term. The SBA guarantee can cover loans up to 10 years, which provide lenders with more consistent cash flow.

As a side note: If you’re considering a deal with investors, it’s important to note that SBA lenders will ask for a personal guarantee from anyone purchasing the business that will have 20% or more equity. On the other hand, the SBA will typically not guarantee loans where there’s not at least one owner that has 25% or more equity, so having all owners with less than 20% equity isn’t a viable workaround to the personal guarantee – at least one owner (if not more) will need to sign a guarantee of some sort.

What Are You Willing to Risk?

To have the life, wealth, and freedom you seek, you have to take risks. There’s no such thing as free money, and lenders will always need assurances that the balance will be repaid. Rightfully so.

The bigger the risk, the bigger the assurance required.

Personal guarantees are simply one way of ensuring repayment of debt. Even if you’re looking for a loan without a personal guarantee, most types of financing will require collateral or security of some sort.

That said, becoming an acquisition entrepreneur is just as rewarding as it is risky. Although being a CEO of a business is not a path for everyone, the rewards abound if you choose this journey.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.