The textbook definition of retirement is “no longer being part of the workforce and living off of savings and investments.” When you retire, instead of working, now you can finally focus on leisure and enjoying life the way you want.

Isn’t that what we think of when we envision retirement?

We know, in theory, that a textbook doesn’t define our individual life’s path. But even though we all get to choose the life we want to have, many of us still have fallen into the same model we’ve been taught since we were young: work today and live for tomorrow.

As the saying goes, “It’s called work for a reason.”

But what if there was a different way to live life – one where you could enjoy your life and generate wealth today?

There is, and in short, it’s through acquisition entrepreneurship. But before we get to the good stuff, let’s talk about how acquisition entrepreneurship flips the traditional model of retirement on its head.

The True Value of a Business

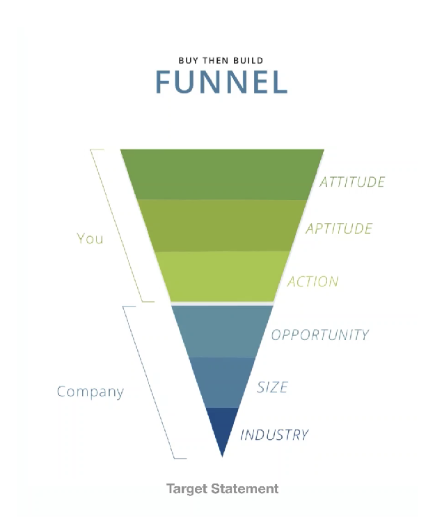

The most important thing in acquisition entrepreneurship that people fail to realize is that you’re not simply buying a business. What you’re buying is the special combination of you AND the business.

Because when you buy the business, as the new owner and leader of that business, you will either take it to unimaginable success, devastating failure, or somewhere in between.

The success or failure of that business doesn’t solely depend on the business and its own merits – it depends on YOU. The nature of the unknowable future value of your business is different from other asset types out there that have inherent value on their own, but you can stack the odds in your favor by understanding three things before you make your purchase.

In the Acquisition Lab, we often talk about the “Three A’s”:

- Attitude

- Aptitude

- Action

When you align your attitude, aptitude, and action with a specific business opportunity, you are buying a business that is a perfect fit for you. When you do that, work doesn’t feel like “work” anymore – believe it or not. It suddenly becomes rewarding, engaging, full of impact, and enriches your life as a whole.

Flipping Retirement on its Head

When you enjoy your job, suddenly the traditional model of toiling away, saving money, and investing in your Roth IRA for your golden years doesn’t quite make the same sense it used to.

If, through this new model, you suddenly find yourself living for today, versus tomorrow, you’ve just stumbled upon a life you not only can sustain, but want to sustain, for years to come.

Through acquisition entrepreneurship, you can generate wealth, impact, and fulfillment – now.

Not to mention, as an acquisition entrepreneur, you don’t need to sacrifice years of getting paid like you would if you started a business from scratch. You can make money from a business you purchase from day one.

Making Money as an Acquisition Entrepreneur

Let’s talk about that.

How do acquisition entrepreneurs make money? Here are the three ways:

1. Equity Buildup

Just like real estate, as you continue to pay off the loan you used to purchase the business, you will own more and more equity in the business. Here are two distinct differences:

Unlike a traditional 30 year mortgage, a loan you’d get to finance an acquisition might have repayment terms of 7-10 years. If the business includes real estate then the length of the loan can be upwards of 20 years!

Secondly, although you may have personally paid for the initial down payment on the loan (10-20% let’s say), now that you own the business, it’s the business paying off your loan and providing you equity, not you personally paying it off.

Then, as your debt-to-equity ratio improves, you can begin to pay yourself more, reward staff with bonuses, or reinvest in the growth of the business.

2. Appreciation

Remember how we said the value of the business you purchase is a combination of the business and you? Appreciation is what we mean by that.

Although in real estate, a house may appreciate on its own over time, the value of the business appreciates with what you bring it and what you do for it. This is why it’s so key to bring your particular set of three A’s to a business in need of those things.

When you add value to the business, it goes from being worth what you paid for it to worth what you paid for it plus the appreciation in value.

Here are some quick examples of ways to add value to your business:

- Simply bringing new energy and focus that maybe the previous owner didn’t have

- Creating new procedures and systems to streamline operations

- Purchasing new equipment to increase production

- Utilizing technology and software to automate crucial processes

- Hiring the right people for the right jobs

Adding value to the business can increase its revenue and profitability, and now you have more money to either pay yourself, pay employees, or reinvest into the business.

Down the road, you can either hold onto the business as it keeps making money or you can sell the business for significantly more than you purchased it for.

3. Cash Flow

When you buy a business, you’re typically buying a business with positive cash flow. Although there are buyers that focus on distressed businesses, that’s not generally what buyers look for.

The price you pay for a business is a multiple of the Seller’s Discretionary Earnings (SDE), so inherently, the business is going to have cash flow from day one.

Included in this cash flow is the money you get to take home and the money you get to reinvest into your business to grow it.

That said, as the business owner, you’re the one who decides where the money goes. Because you’re in the unique position of being liable for the business, making strategic decisions, and working long hours (especially at first), you should pay yourself accordingly.

Time, Wealth, and Fulfillment – Now

Here’s the bottom line.

Acquisition entrepreneurship gives you the three things you’re waiting until retirement to have: time, wealth, and fulfillment.

As a business owner, you get to decide how you’ll spend your days, so you’ll have more control over your time than you do in a typical job. And chances are, you’ll be so engrossed in what you’re doing that whether you spend 2 hours or 8 hours a day working, you’ll enjoy the entirety of your day – on and off the clock.

Meanwhile, your business is generating money for you in the ways we covered above.

Lastly, when you’re directly responsible for the livelihood of your employees and provide a positive experience for customers, there’s a sense of fulfillment and reward you gain from entrepreneurship that’s tough to beat.

You don’t have to wait until the end to “retire.” If you would like to acquire a business in the next 12 months, the Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.