If you’re reading this article, there’s a good chance you’re a first-time individual buyer who’s looking to purchase a business for yourself.

That said, it’s essential to understand the acquisitions landscape as a whole to see where you fit. When it comes to the mergers and acquisitions (M&A) playing field, it doesn’t consist of only individual buyers like yourself. There are many different types of buyers and arrangements out there, and they can often vary based on deal size.

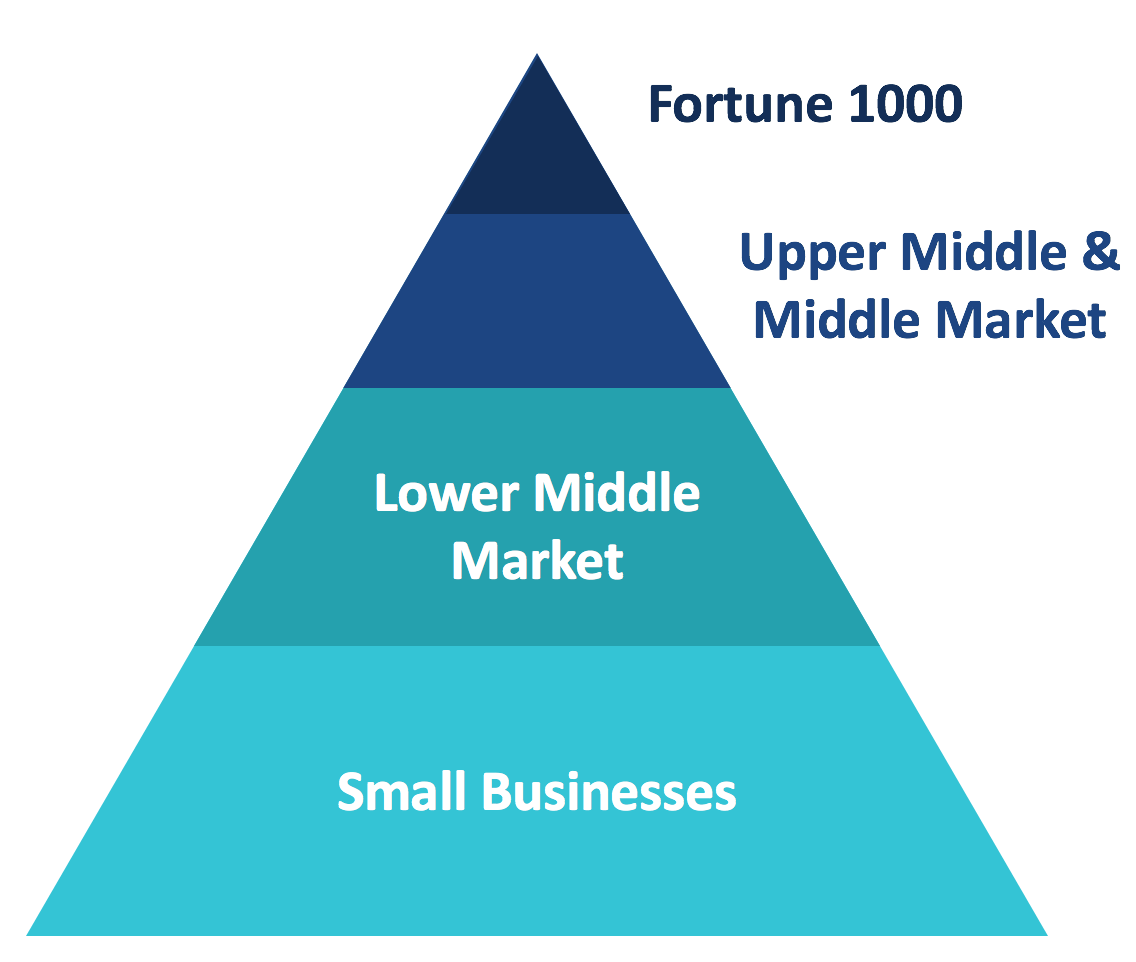

Typically, businesses you’ll see for sale will fall into one of three categories:

- Main Street: <$5 million in annual revenue

- Lower Middle Market: $5 – $50 million in revenue

- Middle Market: $50 – $500 million in revenue

Buyers on Main Street

Individual buyers such as yourself will generally be looking at Main Street businesses.

What defines an individual buyer outside of the fact that they are simply an individual?

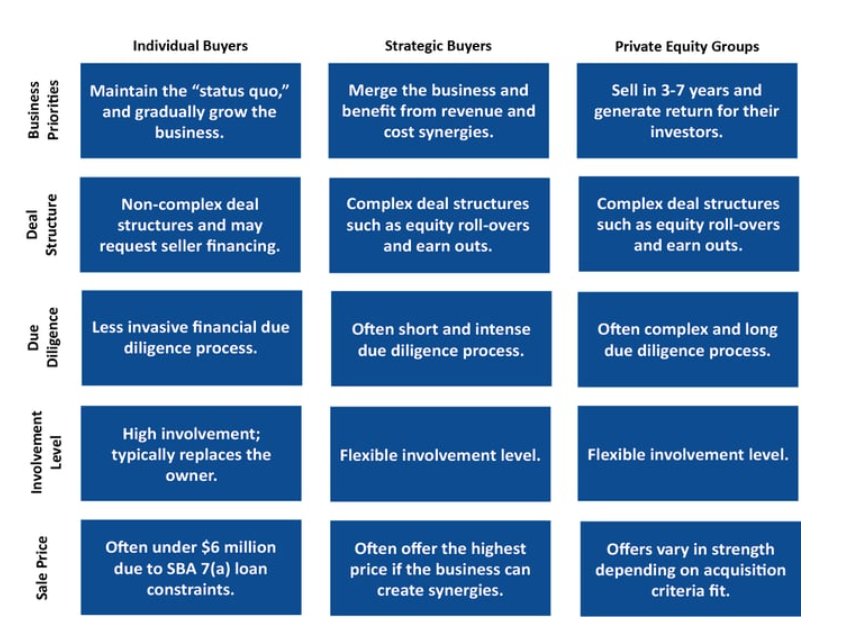

Individual buyers are people who want to acquire businesses as a way of life and typically look at smaller owner-operated companies. They are looking to replace their current job, so their primary focus is finding a business that will replace their income. Main Street businesses can have sufficient cash flow to provide a healthy salary for most people, so individual buyers do not necessarily need to look at larger businesses.

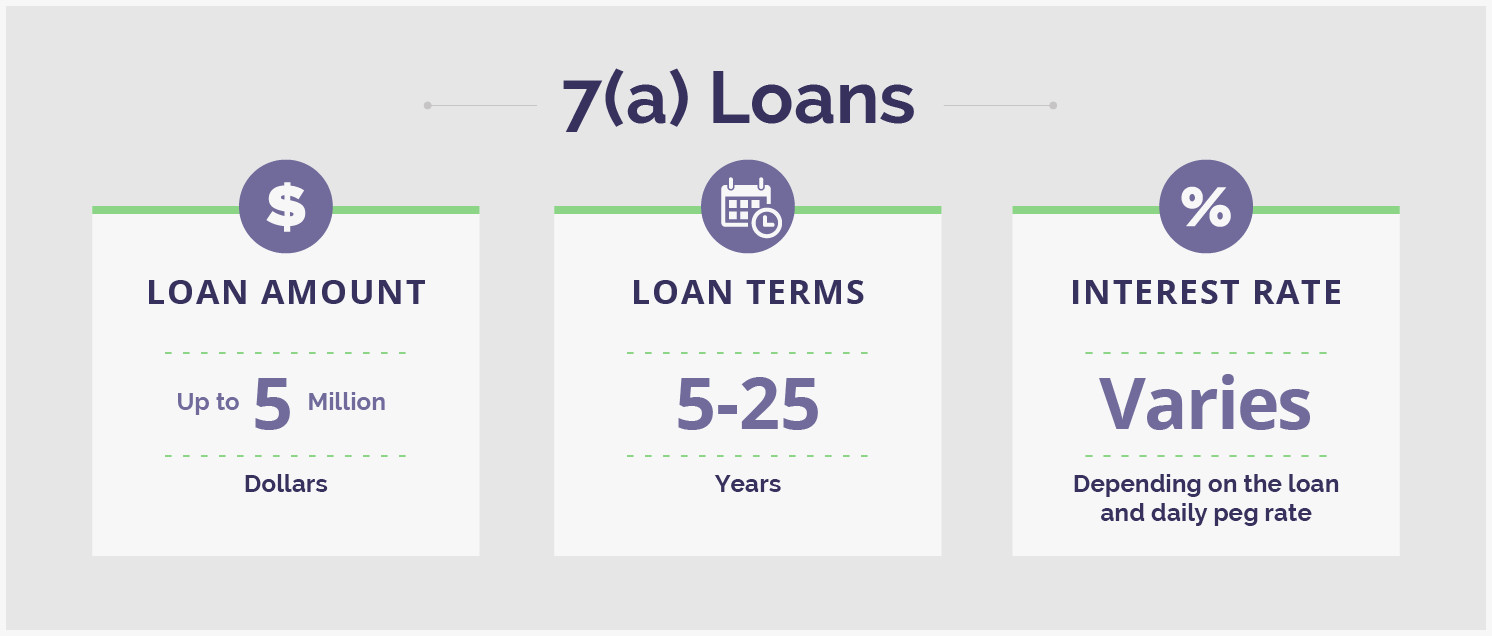

You’ll also find individual buyers clustered in the Main Street business market because of affordability. Typically, individual buyers are looking to get a combination of bank financing and seller-financing, in addition to the down payment they will need to put down to secure a loan. In fact, the SBA 7(a) loan was created to open up business buying opportunities to smaller, individual buyers, and the lending limit for an SBA loan is $5 million.

Because of that limit, and because buyers in the Lower Middle Market range tend to have access to other sources of capital, SBA loans are generally not used in Lower Middle Market deals.

Buyers in the Lower Middle Market

For Lower Middle Market businesses, this is where you’ll find independent sponsors, private equity groups, and family offices.

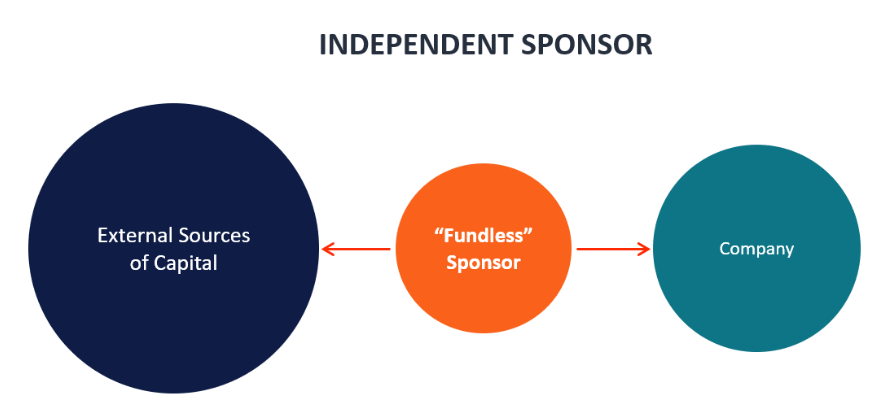

Independent sponsors are individuals looking to acquire a business but don’t have the funding to do so. They will find a business to acquire, go through due diligence, and search for an investor to come in at the end to assist with financing. They will operate the company and receive certain fees and equity for their involvement. Investors may include private investment funds, family offices, high net worth individuals (HNWIs), and institutional investors.

Can you become an independent sponsor?

Unless you’re an experienced operator, a private equity professional, or some other type of industry veteran with sector-expertise and access to “off-market” deals, you may not qualify as an independent sponsor. if you’re looking for investor funding, you may just want to find an investor (or investors). Independent sponsors are able to build capital by bringing credible and relevant industry experience to the table.

Private equity groups are investment partnerships that buy and manage companies, only to sell them down the road for a profit. They raise money from institutional investors and HNWIs, and they hold onto businesses for no more than 7-10 years, although the average is typically 5 years.

Family offices are private wealth management firms that serve and represent ultra-affluent families (typically with a net worth of $250 million or more). They provide a broad spectrum of services within wealth management, including financial planning, investment management, insurance, charitable contributions, wealth transfer services, tax planning, and more.

Less commonly, you’ll find search funds in this range as well.

Search funds are another type of investment vehicle where investors come together to financially support an entrepreneur in sourcing, acquiring, managing, and growing a privately held company.

Pros & Cons of Search Funds

Finding or creating a search fund to be a part of is a viable option, but there are drawbacks to search funds, for both the buyer and the seller.

As a buyer working with a group of investors, you’ll find that 25% of search funds never make it to acquiring a business, and it’s typically because there are too many cooks in the kitchen. There aren’t just one or two people making decisions related to the acquisition of a business. Even if you find the perfect business, the delay and potential disagreement common in investor groups can prevent an acquisition from ever happening.

From a seller standpoint, sellers may be reluctant to work with buyers who are part of search funds because they tend to be green entrepreneurs with limited industry experience. If a seller has a choice to work with a buyer who requires less training, he or she may opt for that buyer instead.

Where Do Financial and Strategic Buyers Fall?

When we talk about financial and strategic buyers, we’re talking about the key value in an acquisition for a buyer.

Financial Buyers

For financial buyers, their primary goal is to see a maximal return on their investment. They’ll be more concerned about the cash flow a business will generate and how they can maximize the return on the back-end, by selling the business or even looking at the option to take the business public. The timeline they operate under is generally 5-7 years.

Financial buyers frequently use a significant amount of leverage in their acquisitions, and these entities include private equity firms, hedge funds, family offices, and HNWIs.

Strategic Buyers

For strategic buyers, they view the acquisition as part of a larger strategy. The business they’re looking at may be a related business to one they already own.

An example is when Amazon purchased Whole Foods in 2017 for $13.7 billion. Amazon was looking for a way to turn into an even more frequent shopping habit for consumers by breaking into grocery shopping (which people still like to do in person) and having physical locations throughout the country.

Because a strategic buyer cares more about the long-term strategy it’s fulfilling, it’s less concerned about the immediate financial returns and in some cases is willing to pay more for an acquisition because of the unique synergy it can provide an existing business.

As you can see, there are many different types of buyers in the M&A landscape that deal with various-sized deals and have widely varying objectives when acquiring a business.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.