“Is it a fair multiple?”

This is one of the biggest questions we get with first-time business buyers in the Acquisition Lab, and it’s a great question.

We all know that the return and value we’ll get from a deal largely depends on the numbers we agree to up front. Regardless of the inherent value of a business or its potential growth opportunities, there is such a thing as getting a “good” deal or a “bad” deal.

What does a “good” deal come down to? First off, let’s talk about what goes into a business valuation.

How Are Businesses Valued?

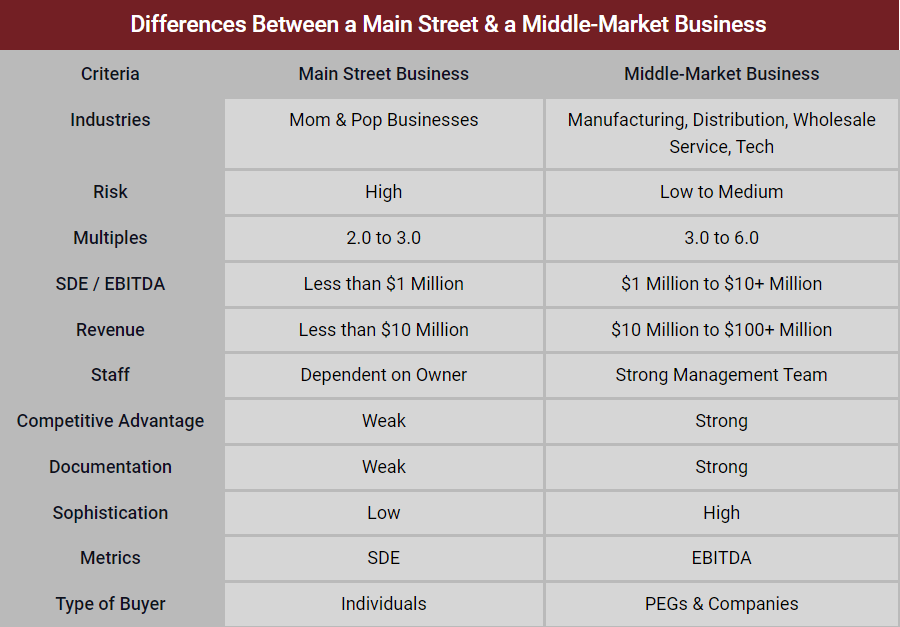

For Main Street businesses, businesses with under $5 million in revenue, a business’s listed purchase price is typically a multiple of the Seller’s Discretionary Earnings or SDE. SDE is the total pre-tax cash flow benefit to the owner. It’s calculated by taking a business’s net profit and adding back certain discretionary expenses, such as:

- Salary

- Payroll taxes on salary

- Personal insurance

- Vehicles

- Cell phone bill

- Other personal expenses run through the business

- Any other one-time expenses

What Goes Into a Multiple?

First off, what is a multiple?

When the term multiple is used in regards to how much someone is willing to pay for a business, it is referring to a ratio of business performance. It could be a multiple of earnings or a multiple of revenue or other performance metrics.

So in this market, when someone says they’ll pay a 3 times multiple then that typically means they will pay 3 years of annual earnings for a business.

Now, what determines the multiple?

The asking multiple depends on the size and type of business you’re looking to purchase.

For Main Street businesses, you’re looking at 2-3x SDE, but for lower Middle Market companies, you’re looking at 2.5-6x SDE. At that size, you might start to consider an Adjusted EBITDA or EBITDA instead of SDE. Where the multiple falls depends on a few factors:

- Historical growth of the business

- Earnings of the business

- Growth of the industry

- Transferability to new ownership

- Brand recognition

- Growth opportunities for the future

As you can see, analyzing a business’s SDE and determining its multiple are only two pieces of the business valuation puzzle.

My Question Still Remains: What’s Considered a “Fair” Multiple?

Now that we’ve talked about how businesses are valued and what dictates a business’s multiple in the listing price, let’s talk about the elusive fair factor.

“Is the multiple fair, Walker?”

You’re not going to like my answer, but it’s the best answer you’re going to get: It depends.

The fairness of the multiple depends on a combination of two things: the business itself and you.

Here’s what I mean. The factors that contribute to the fairness of a multiple are:

- The inherent value of the business (there are seven elements that go into this, which we talk about at length in the Acquisition Lab)

- How you perceive and weigh that value

- How you envision your role in the business based on your unique background and skill sets

Once you have analyzed the business’s standalone worth by evaluating the seven elements, you have to weigh its value against:

- Your preferences (location, job expectations as an owner, and more)

- Target statement (business type, needs, size, and industry)

- Your strengths coinciding with the business’s needs

A Business That’s Fair for One Person… But Not for Another

Let’s say you’ve gone through the process of self-evaluation, a thorough and very necessary part of the journey in buying a business. You’ve assessed yourself as an entrepreneur, developed your long-term goals, analyzed your strengths and weaknesses, and fully understand your three A’s (aptitude, attitude, and action).

You know you’re looking for an e-commerce business that has a big marketing need, with $650,000 in SDE. But you come across a service company that has a huge operational gap, with $750,000 in SDE, and located in Texas. It’s selling for a 2.5x multiple, a multiple that is, for all intents and purposes, highly competitive.

Is it worth it to you to purchase? Absolutely not.

Because regardless of how great that service business is (it even has a higher SDE!), it’s not a good fit for you. They could offer the business to you at 1x multiple, and it still wouldn’t be worth it, because the fairness of the multiple doesn’t just depend on the business itself – it depends on you.

Now, you have another person, let’s say your best friend Joe, who lives in New Mexico and has 20 years of experience in operations, is looking for a service business with $800,000 in SDE. This example business doesn’t completely scratch the itch for him, as the SDE is a little lower than his target SDE, and he’d have to move to Texas. But upon further thought, he can make $750,000 work, and he’s been looking for an opportunity to be closer to family in Dallas anyway.

The multiple isn’t “fair” for you, but for Joe, the multiple is incredibly fair.

Fairness Is in the Eye of the Beholder

When a person buys something significant to them, like their first house or a great suit, people don’t mind spending a little more on something they love. That’s because that house, suit, boat, or business is worth it to them to purchase, even if it means paying a little over market value.

There’s some subjectivity when it comes to analyzing whether or not a multiple is fair, and you should consider all the factors we’ve talked about before making up your mind.

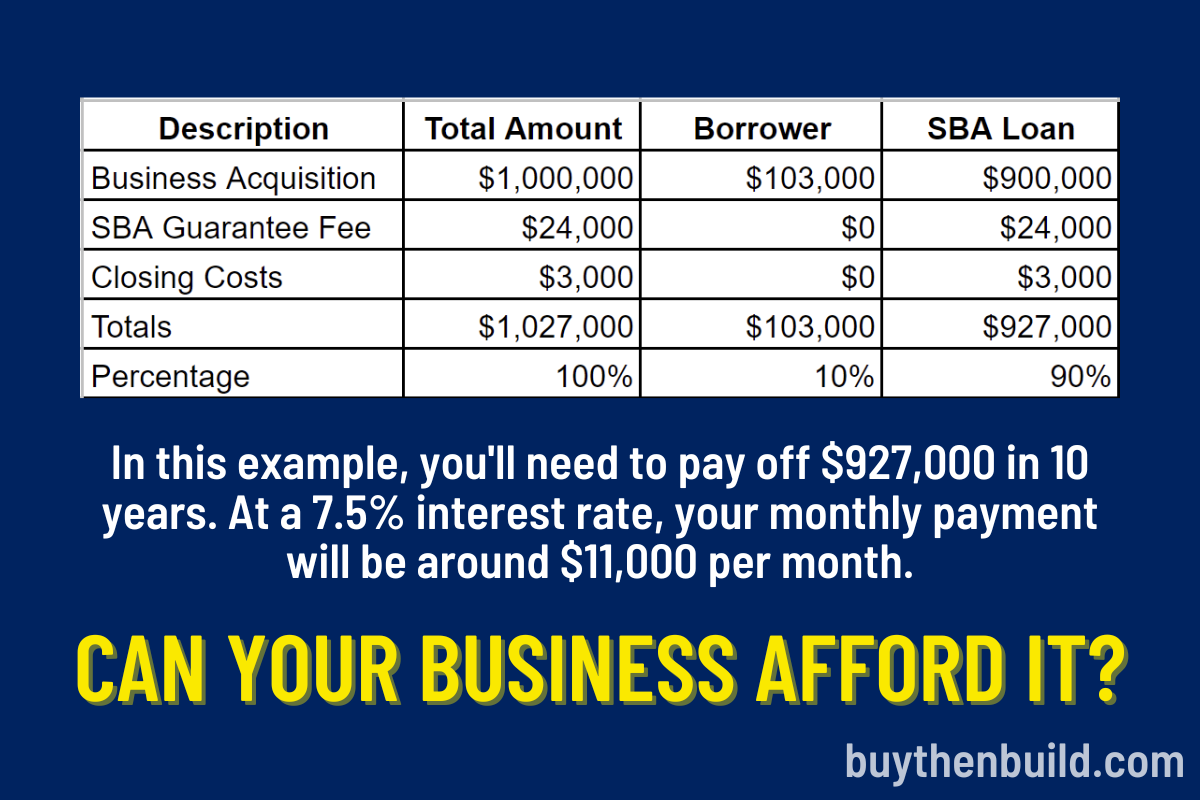

That said, although the fairness of the multiple is subjective, you do want to make sure that your business can easily pay off the monthly installments for whatever type of financing you procure AND still have enough cash flow to pay yourself, the rest of your business expenses, and whatever else you have plans for.

Know your upper limit of what you’re willing to pay based on whether or not the numbers make sense.

Don’t Sweat the Small Stuff

Fairness is a difficult thing to put your finger on because you’re relying on an intuitive metric, but once you gain more experience looking at businesses throughout your search process you’ll develop that muscle over time. You’ll get to the point where you can look at a business and know if it looks and feels right and when it doesn’t.

So what should you be looking for? The answer is simple: quality.

Look for quality and pay for it.

The multiple is simply a moving target, and once you take over the business, it’s up to you to decide which direction that multiple moves in.

Don’t get stuck in the weeds looking at details that aren’t going to answer your most important questions, or worse, paralyze you from ever buying a business to begin with.

Figure out if the quality is there. Then ask yourself if this is a business you’ll be able to grow.

Ready to hone your ability to spot a great deal? If you would like to acquire a business in the next 12 months, the Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.