Stocks, bonds, ETFs, index funds, real estate, crypto, retirement accounts, collectibles, precious metals…

What do all these things have in common?

These are the most commonly advertised vehicles for wealth generation.

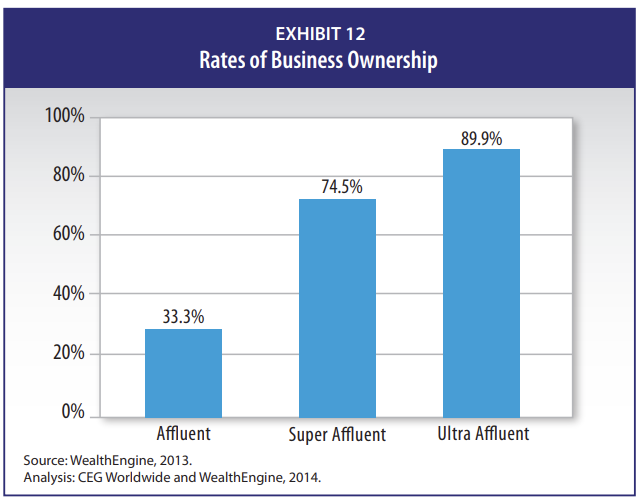

However, with 89.9% of the ultra-affluent ($25MM+ of investable assets) owning at least one business, it amazes me that business ownership is never advocated. The investments people generally advise on have much lower returns and you have less control over their performance.

We can talk all day about the number of ways there are to build wealth, but your time, energy, and effort are precious. Why do many things when you’d be better off doing a few?

The most important question when it comes to wealth is: what’s the little thing that makes the biggest difference?

Today, I want to address acquisition entrepreneurship as a viable, if not the best, way to close the wealth gap.

The 2014 CEG Worldwide State of the Affluent report referred to above mentions, “An important part of the wealth of the affluent can be attributed to business ownership.”

If you read The Millionaire Next Door, you’ll learn that “self-employed people are four times more likely to be millionaires than those who work for others.”

Even the SBA purports that the self-employed are wealthier than the non-self-employed.

There is no denying that, of all the investment vehicles available to us, private businesses have been a powerful engine of wealth for those at the very top. The 1% own 57% of private companies, according to the Federal Reserve.

Now that I’ve made my case about the correlation between business ownership and wealth, let’s be clear: just because you own a business does not mean you will be wealthy.

However, the reverse is true.

The wealthier you become, the more likely you will own a business.

In this case, owning a business is the little thing that makes the most significant difference.

When I was growing up, my grandfather owned a feed company. Eventually, there was a consolidation happened, where a bigger company came in and bought him out. My grandfather exited on the day the bigger company bought him out.

What did he do with that money? He took it and went out to buy a new company, a filter factory. Then he continued to run and grow that company.

He used to tell me the only way to make money is to own your own business.

After I got my MBA, I searched for a business to purchase, and ultimately I bought my first company in 2008. I ran it from 2008 to 2013, and at that point, I sold that company and had my first seven-figure exit at 37.

Putting a Jetpack on Your Job

When you own a business, not only are you paying yourself a salary for what you’re doing, but you’re also getting the benefits on your personal balance sheet.

Let me explain. If you buy a company with a percentage of debt, let’s say 10-20% since that’s fairly common with SBA loans, the business is paying the debt down while the equity is going up. This equity buildup increases the assets on your balance sheet, without you personally having to pay that debt down.

Growing your company can be considered active investing. It’s like putting a jetpack on your job because with all the effort you put into your business, you’re getting paid a salary while at the same time growing an appreciable and valuable asset.

And why are assets important? Because wealth is the cumulation of all the assets you own.

It’s not just you working hard to build your wealth, either.

Everyone that works for your company is continuing to add value to the customers and clients, and by doing so, they are effectively creating value for the company.

The company YOU own.

None of this is a secret, but it’s not as frequently talked about. That’s why I wrote Buy Then Build. I wrote down exactly what I did when I acquired my businesses, and I shared what other people who bought businesses did as well.

What Makes a Good Investment?

Acquisition entrepreneurship has the best of investing and entrepreneurship.

What makes buying businesses a good investment?

- Good return on investment (ROI)

- Margin of safety

- Value appreciation

Let’s discuss this.

Good ROI

Even in an inflationary environment, there’s no better asset class than investing in your own business. It’s unparalleled to any other asset class.

The best way to illustrate good ROI is to show you an example.

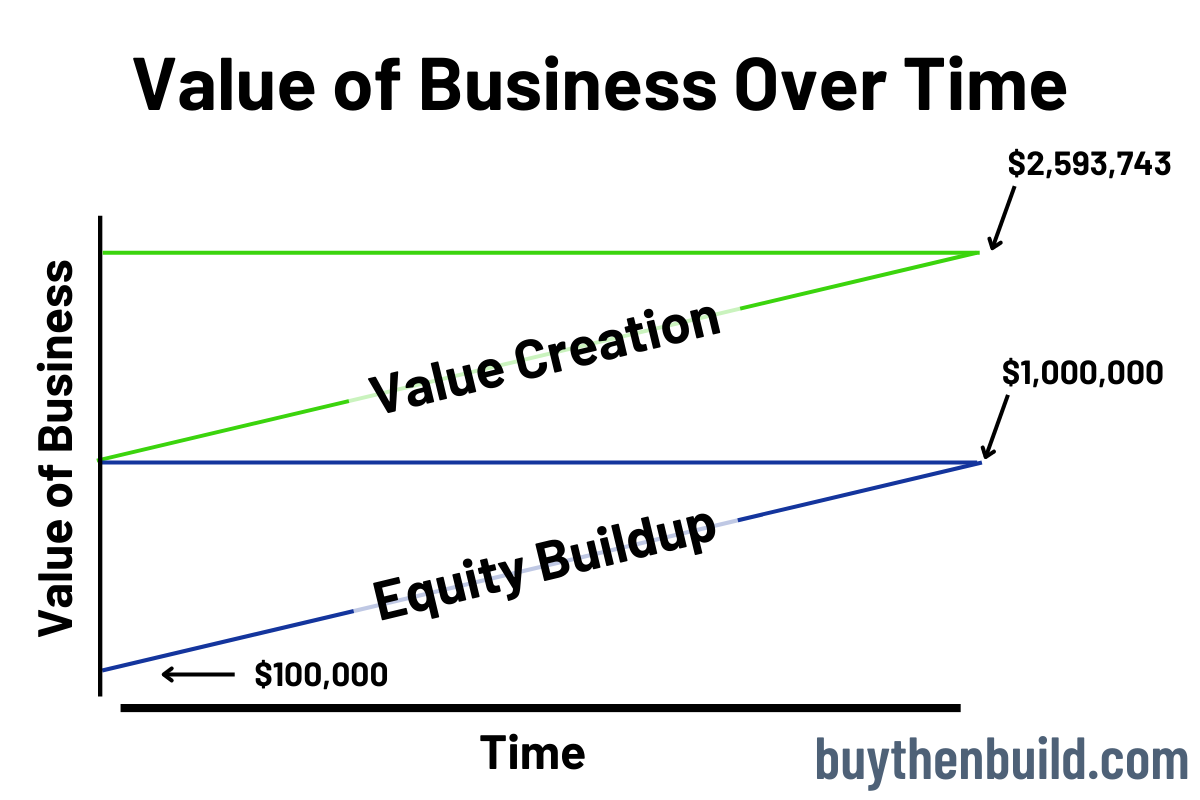

Let’s say you buy a $1 million business with $100,000 down. You’re using an SBA loan with a 10% injection that has a ten-year term on it.

Two things are happening in the span of those ten years.

You’re building equity in that business as the business is paying off the principal on the loan. Over the ten years, you’re taking your initial $100,000 investment and turning it into $1 million.

Additionally, this business isn’t staying stagnant. It’s appreciating, partly due to it being an inherently appreciable asset and partly because of the work you’re putting into it as the CEO.

Let’s say your efforts and ability to create more value in your business contribute to a modest 10% year-over-year (YOY) growth.

From year one to year ten, you have grown the business from $1 million to $2,593,743.

You’ve taken your initial investment of $100,000 and 26X’d it in ten years.

Where can you find another investment vehicle that can reliably produce this type of return? You can’t.

Margin of Safety

There are elements of business acquisition that make it inherently a less risky option than other investment vehicles. This comes down to the reliability of the business you’re buying, comparatively low multiples, and the control you have over the appreciating value of the company.

In the history of SBA business acquisition loans, going over decades of research, less than 2% have defaulted. I was the keynote speaker at an entrepreneurship-through-acquisition talk at Duke University, and when I shared this fact, a representative from Live Oak Bank, the largest SBA lender in the country (and the world, for that matter) was there in the audience and validated that point right there and then.

Having such a low default rate proves that when you buy an SBA-qualified business, the business doesn’t fall apart the second you take it over. Quite the opposite, in fact. The business’s historical performance and growth trajectory are generally solid and reliable enough to weather even a transition of ownership.

Secondly, when you look at the Mergers and Acquisitions (M&A) market as a whole, the multiples you’re going to pay for smaller businesses are much less expensive than if you were to purchase a larger company. This lessens the monthly debt service you have on your business and the overall risk you’re taking on.

Lastly, when you acquire a business, you’re not starting a business from scratch. When you start a business from scratch, you’re vulnerable to a statistically high failure rate, with no guarantee you’re going to be successful.

However, when you acquire a business, it already has an existing product market fit. It may have been around for decades. It has the infrastructure, customers, vendors, operations, and more. All these existing elements increase your margin of safety.

Appreciation

If you’re looking at the stock market, as an example, as a potential investment vehicle, what type of returns are you projecting? You may achieve a reliable six to eight percent over a period of time.

If you refer to the example above, you can 26X your initial return – a return that blows stock market returns out of the water.

Not only will a business appreciate in an expanding economy, but when you own a business, you’re working in it and creating more value.

With your skills and effort as a business owner, there is no limit to the amount of value you can appreciate in the business.

How Can I Do It?

I know what you’re thinking.

“Walker, I can’t do it. Only the wealthy can afford to buy a business.”

That’s not true. Buying a business is absolutely doable and much more affordable than you think.

Business ownership is the number one vehicle for wealth creation, period.

Unless you have a trust fund or are independently wealthy, you need a vehicle you can drive on the path to wealth, and business ownership will get you the highest return for the highest margin of safety out there.

What can you do now?

If you’re interested in buying a business to build a life of wealth and freedom, you have three options.

Do It Yourself (DIY): You can buy my best-selling book, Buy Then Build, which will lead you through the entire acquisition process from start to finish. You can utilize that book as a guide as you venture forth in your search and it will help you every step of the way.

Hire a Buy-Side Advisor: Hiring a buy-side advisor can help you find a business that meets your targets and get you through the acquisition process, without a lot of effort on your end. Be prepared to spend $150,000 – $200,000 over the entire course of your search process to work with one.

Apply for the Acquisition Lab: The Acquisition Lab is the best of both worlds. We provide you with instruction, group coaching, tools, and a vetted and strong community to ensure you reach the finish line in your business acquisition.

I founded the Acquisition Lab to create the largest group of vetted, educated, and pre-qualified buyers so we as a group can learn together, search together, and do better deals. We help you in a do-it-with-you advisory program, so you don’t have to make a seven-figure decision on your own.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.