90% of people who look at buying businesses never do.

Why? To put it simply, they haven’t gone into the search process with the right mindset. Although people are attracted to the prospect of buying businesses for the opportunity it provides in building wealth, often they know so little about the landscape of acquisition entrepreneurship, that they don’t properly manage their expectations as they go into their search.

Today, we’ll discuss the top three things you need to succeed as a buyer. By incorporating these three things, you’ll be able to create the mindset you need to get to the finish line and purchase a business.

- Sell yourself to the seller

Years ago when I first started as an entrepreneur, I used to pitch institutional investors to raise capital for business ideas. Venture capitalist and institutional investors are analytical and critical when determining whether or not to invest in businesses. I’ve talked about this before:

“Consider first the trademarks of investing. Great investors are slow, deliberate and thoughtful. Their goal is to test your business model to the breaking point. When they see a pitch, their first move is to poke holes in it to try to uncover its fatal flaws. They aren’t entirely risk-averse, but the risks are carefully hedged.”

The challenge is, we believe in order to be a successful acquisition entrepreneur, we should approach deals under this same lens, but the opposite is true.

An established business has all the things investors are hoping a company will eventually have: cash flow, customers, and operations in place. A startup doesn’t.

“Startups fail all the time, and for many reasons. For 82% of small businesses, cash flow plays a major role. As many as 42% found that they simply didn’t have a market for their products. And most who have launched startups have felt acute pressure to be first to market with a great idea.”

When you’re evaluating a seller’s business, you’re vying for a valuable asset they’ve already created. You’re not in the same position as an institutional investor where you have to decide what idea has the most potential.

Accordingly, you have to treat the deal as if you’re interviewing to be the CEO of the seller’s company – to be the seller’s exit strategy. If the seller is going to introduce you to the customers, employees, and vendors of a successful business the seller has built over time, understand that you are not just a buyer and more a CEO in need of a company.

Understanding the seller and appreciating the necessity for a win-win in the search process will place you ahead of other searchers when looking at businesses to purchase.

2. Work with a sense of urgency

It can take searchers up to 12 months (if not more) to find and close on a business. However, in my experience, I believe if you work with a sense of urgency, you can find one in six. I’ve seen it time and time again in the Acquisition Lab, where we’ve helped over 250 searchers in the acquisition process.

There are two keys to moving quickly through the search process, and a lot of that comes down to “sharpening the axe.”

First, you need to decide at what point you need to dedicate a part-time or full-time effort to the search.

At the Lab, we don’t recommend conducting your searching completely part-time or full-time, but by utilizing a combination of both. In the beginning, you can start the search process while you have a full-time job, but there will come a point where you’ll want to dedicate full-time effort to the remainder of the search process.

Secondly, you need to create a routine where you evaluate deal flow and conduct broker outreach on a daily basis. At first, as you’re developing relationships with brokers and are starting to get access to various deals, the search process may feel slow. However, this daily routine is a flywheel, and once it ramps up, you’ll have continuous deal flow and build the confidence to evaluate them.

It’s a numbers game. The more deals you get, the more deals you evaluate, the higher the chances that one of them will pan out and be the business you’re looking to purchase.

3. Get clear on what it is you’re looking for

When it comes to buying a business, there’s a right way… and there’s a wrong way. We all know how the quote goes…

“If you aim at nothing, you will hit it every time.” – Zig Ziglar

So it’s one thing to tell you how important it is to get clear on what it is you’re looking for in a business, and it’s another thing to show you what exactly will help you get there.

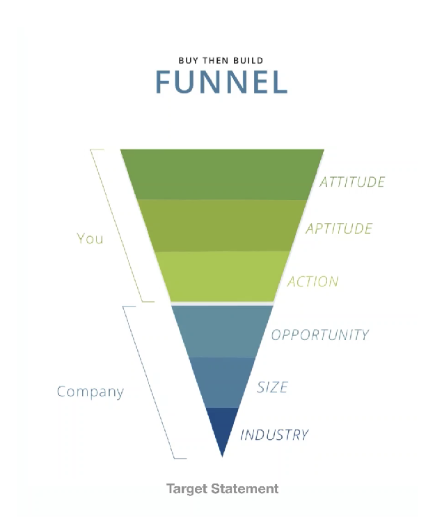

When evaluating businesses, you need to know two things: who you are and what type of business is a good fit for you.

Remember that the success of the business isn’t just dependent on its existing customers, employees, vendors, and operations in place.

It depends on you.

As the oncoming CEO, where will you drive the business? You can drive it toward success… or not. Unlike other types of investment vehicles, this is an asset that is largely dependent on how you choose to operate it.

What are the things you need to know about yourself?

At the Lab, we like to refer to this as a buyer profile, and this is something we help our members develop, with the help of a resume writing coach on staff. The buyer profile is a summation of your previous experiences, accomplishments, and what you enjoy (and don’t enjoy) doing professionally.

This clarity not only helps you, but it also helps the broker you share your buyer profile with, so they can understand and keep an eye out for the listings you’d be best suited for.

Next, what about the business itself? From a NAPA Auto Parts store to a SaaS business, the types of businesses out there vary widely. Although you’re searching for a business, you’re not searching for just any business.

We also help you hone these criteria in the Lab and work with you to develop an overall target statement. These criteria include:

- Size (by Seller’s Discretionary Earnings)

- Industry

- Growth opportunity

- Geographic limitations

In addition to all this, as is best practice when setting any goal, you want to make sure you have a timeline and a deep understanding of why buying a business is important to you. Ask yourself these two questions:

- By when do you want to purchase a business?

- What will happen if you don’t buy a business?

Anyone can leisurely look through business listings, but if you don’t intend to do much more than kick tires, you’re never going to close on a deal. The intentionality in which you show up to the search process is the key to successfully completing it.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.