When should you start thinking about selling your business?

Before you’re even considering it.

Here’s what I mean.

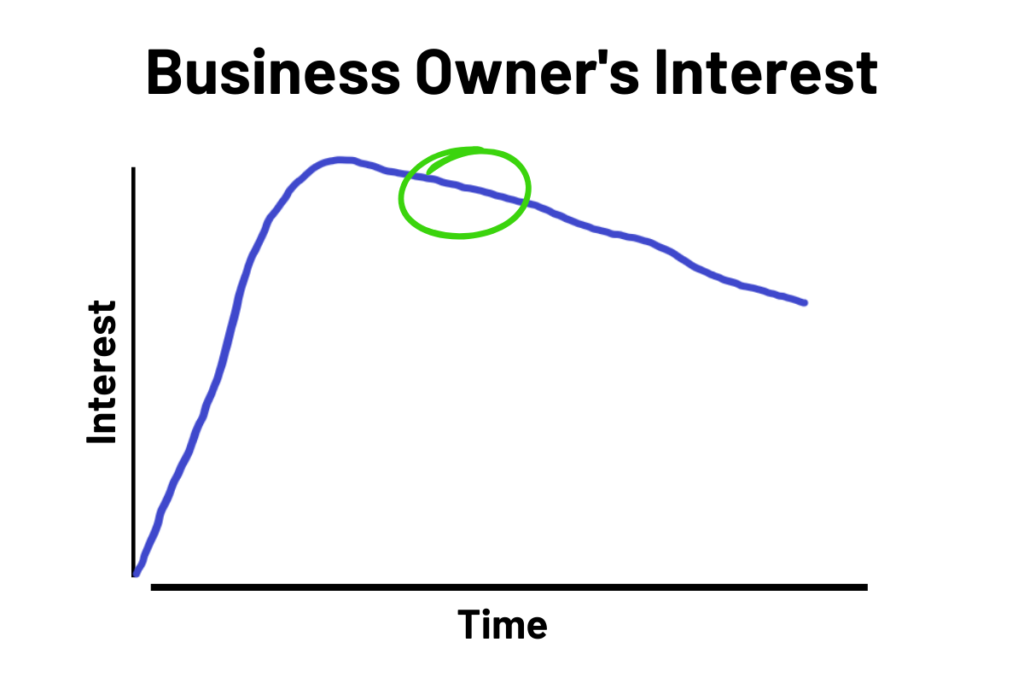

Along your path as a business owner, you may start to get bored, tired, or burned out with what you’re doing. It doesn’t necessarily happen to everyone, but it may happen to you. Just understand that it’s a possibility.

Even if you insist it’s not a possibility (you’ll just love what you do as a business owner and can’t envision doing anything else), there’s a chance you might encounter one of the four D’s: death, divorce, disagreement, or disability.

I certainly hope none of these happen to you while you’re running your business, but my point is: anything can happen, and you should always be prepared to make an exit, if necessary.

Barring the four D’s, the best time to sell your business is before you experience an inkling of boredom, fatigue, or burnout. Once you get to this point, it quickly becomes the point of no return, and your negative outlook will inevitably affect the performance of the business.

Once your business is declining, your business will be worth less and less, and you won’t be able to maximize the return on your business.

As a seller, you should consider selling when you’re still excited, still making money, but you can foresee in the near future that you’ll tire of what you’re doing now.

For convenience and probably a dash of accuracy, let’s say this is one year out from selling.

Planning for your sale at least a year in advance allows you enough time to know where you are today, make the improvements necessary to make your business more successful, and ideally sell at a higher price.

At the one-year mark, these are the things you want to begin doing:

- Get a Business Valuation

No matter how close you are to selling, it can be a good idea to get a valuation on your business.

Why?

As a business owner thinking about ways to increase revenue and customer satisfaction, you may not know the particulars that go into business valuation. You might be surprised what’s weighted in this consideration. By getting a valuation, you can learn what makes your specific business valuable. Conversely, you can also learn about what doesn’t make it as valuable – things you may have thought were more valuable than they actually are.

By getting a valuation, you can get a baseline of what your business is worth. It’s always useful information to know where point “A” is, regardless if you know where point “B” is, yet.

My next point is that simply knowing where point “A” is can give you clarity to what you want your point “B” to be. Knowing where you are today can allow you to set goals for growth. If you work with a business broker to get a valuation, they’ll likely be happy to help you plan the next steps to increase your business’s value.

Lastly, knowing what your business is worth can help you better negotiate if you entertain offers outside of a broker, especially if these offers are coming from aggregators or other firms that specialize in mergers and acquisitions (M&A) as they may be trying to low-ball you.

- Get Advisory Team in Place

The acquisition process isn’t something you should manage by yourself, as a buyer or a seller. As you’re getting ready to sell your business, you want to start getting your advisory team in place and consult them as necessary in preparation.

The two people you will need on your team are an accountant (or CPA) and a lawyer. The third person you may need is a business broker, but you will have to decide if you want to go through a business broker or if you would rather manage the sale yourself.

- Accountants understand the tax ramifications of selling your business and help explain this to you, so you can make informed decisions about when and how you want to sell your business. Your accountant should also be able to review your financial statements, tax returns, and bank statements before you need to present them to the buyer. Typically you’ll need the last two to three years of financial statements and tax returns.

- Lawyers can help you generate any contracts needed throughout the selling process, make sure terms in said contracts are fair, minimize chances of legal dispute down the road, and overall, they can provide you with clarity and confidence in the legal process.

You shouldn’t underestimate the importance of having confidence as you’re navigating a new and potentially tumultuous process such as selling your business. Having confidence that comes from having experts on your team allows for smooth sailing.

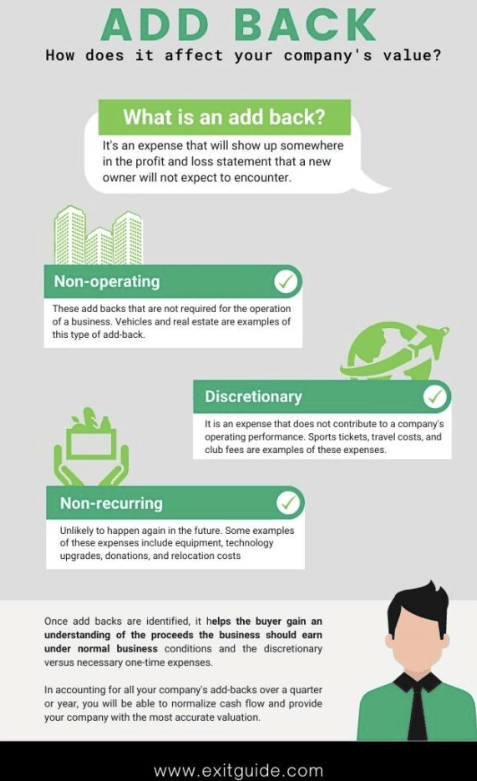

- Supporting Documents for Add-Backs

Typically, small businesses will sell for a multiple of Seller’s Discretionary Earnings (SDE), the most common way to measure their cash flow. Simply put, SDE starts with the profit that can be found on your financial statement and adds backs non-operational expenses, such as Owner’s Compensation, auto expenses, personal insurance, phone bills, and so forth. These are frequently referred to as add-backs, as they are added back to your profit to calculate the SDE.

As you get into due diligence, the buyer may request supporting documentation that proves the add-backs are legitimate. Being able to prove where the add-backs come from with any invoices, bank statements, or other financial documents can help solidify the SDE throughout due diligence.

- Succession Plan

As you’re thinking about selling your business, you need to put yourself in the shoes of the buyer. If you were the buyer, one of the first questions would probably be, “Great, I’m glad the seller has achieved so much success with the current staff and vendors, but will those same people want to stick around when I’m on board?”

It’s important to have a succession plan when it comes to management, your employees, and any key vendors.

Do you have a manager in place currently? Do you have employees that work for you? If you do, would they be willing to stay on with new management in town? There’s a chance they may not, and this would inevitably affect the transferability of the business. You can’t necessarily force people to stay on the team, and the tricky part is you can’t exactly ask them if you’re trying to keep the sale of your business as confidential as possible. Either way, this is an important factor to consider.

Additionally, one of the next questions a buyer will ask about the vendors who keep your business up and running is, “Will they honor the same agreement with me as the new business owner?”

If part of your financial success is due to an arrangement you have with your vendors, this is a key part that must transfer over to the buyer, and if it can’t, it can adversely affect what the true profitability of the business is, as they may have to factor in new expenses they weren’t thinking about beforehand. It’s probably safe to start asking your key vendors (such as a supplier and third-party warehouse) if they are willing to honor your agreement with the new business owner. Having that answer at the ready can help to put the buyer at ease.

- Create Standard Operating Procedures (SOPs) & Formulate Transition Plan

The biggest risk a buyer faces in buying an existing business is transferability.

Whenever someone sees a business’s numbers, immediately she or he say, “Yeah, but.”

Yeah, but will I experience the same success? And if not, why won’t I?

A buyer is constantly gauging the level of risk in acquiring a business, and one of the ways you can alleviate that risk is by developing standard operating procedures (SOPs) and coming up with a transition plan after they take over.

SOPs are outlines of how you complete any task in your business. It’s what allows your business to replicate its success over and over, no matter who is assigned to perform that task. They can simply follow the directions (in the SOPs).

If you don’t have them, yet, start to build out all the SOPs that govern every task that goes into your business’s operations. It’s a huge feat but one that will pay off when the buyer readily puts an offer down on your company, knowing they have SOPs they can fall back on.

Additionally, it’s common for sellers to stick around for a period of time after the sale of the business. This is what’s referred to as the transition period.

Transition periods can vary widely from one to six months, and the nature of that transition also varies. It can involve the seller being available in-person to make key introductions to customers, suppliers, or strategic partners. It can also involve the seller being available by phone to answer any questions. Ultimately, the length and nature of the transition period are whatever the buyer and seller both agree upon.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.