As a buyer, there’s a good chance you’re not even considering what your exit will look like, but you absolutely should be.

Why?

Your exit is a major way you get a return on your investment (the other being the equity buildup and value creation that occurs while you own it).

Your exit is also the guiding beacon that helps you make decisions on behalf of your business. Without a clear destination in mind, you’ll never know for sure if the decisions you’re making in your business are contributing to the results you want – even if they look good on paper.

Now, let’s talk about what an “exit” looks like. No one is telling you that you have to sell your business. But whether you choose to sell your business or not, you do need to know what your journey will look like as a new business owner so you can adequately plan for it.

For example, let’s say for the first six months of running a business, you’re content managing the day-to-day operations of the business. It’s an excellent opportunity to learn how the business works and discover areas for improvement, after all.

However, do you want to run the day-to-day operations of the business until you retire?

If you do, that’s okay. Everyone has their personal preference on how they want to run a business, and, fortunately, as the boss, you get to decide how you spend your time.

That said, small business owners typically fall into one of two categories (or both at different times) in their progression:

- Buy & Hold: Either work in the business yourself or hire someone to manage the day-to-day operations.

- Buy & Sell: Buy a business with the intention of growing it and then selling it

If you’re sitting on a cash cow of a business, one you love growing and working on, then you may not want to do anything else. You may enjoy doing just that, especially if you have a manager running the day-to-day of the business.

There’s another scenario where you buy and hold onto the business, but it becomes part of a portfolio of businesses own. So, similarly, you would need to hire or already have a manager in place to run the daily operations, but your role every day wouldn’t center just on that one business — but multiple.

In the buy-and-sell approach, you’re buying a business with the intention of selling it.

That could mean that you buy it and hunker down in the daily operations of the business, without hiring someone to manage the business for you. This way you can create as much value and profitability simultaneously, only to sell it 5-10 years down the road.

That could also mean you hire someone to handle the day-to-day while you create the most value in a visionary position, driving scale and growth, versus optimizing just the customer experience, as an example.

Now that you understand the landscape of what it means to exit your business, I hope you can see that it’s never too early to plan ahead. Any one of these scenarios will dictate what your actions need to be today.

Although an exit can mean different things for different business owners, today we will explore what it means to sell your business and how you will need to prepare for it.

We’re going to divide exit preparation into two timelines (and two separate posts):

- From day one to one year out from selling

- One year from the projected sale

From Day One

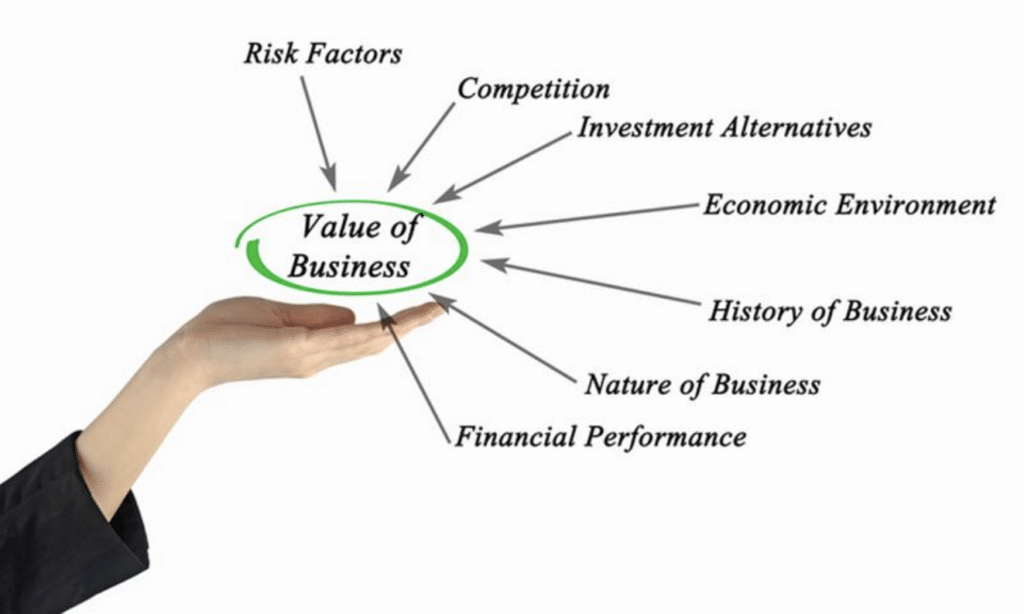

First, let’s talk about what you can do within your business from day one to increase its value to the future buyer. In order to do that, we need to understand what makes a business valuable from a buyer’s standpoint. These things happen to be very similar to what make up a higher valuation of a business.

Here are a few factors:

- Profitability

- Growth year over year

- Recurring revenue/Contracts

- Concentration (SKU/Channel/Supplier)

- Scalability

- Age of business

- Transferability to the new owner

- Lifetime Value/Average Order Value/Customer Acquisition Cost

We could tell you how to improve these specific elements of the business, but honestly, you can figure that out by researching it on your own or asking a mentor. It’s not rocket science to figure out how to increase the profitability of a business.

However, if we’re teaching a man how to fish, we need to take a more macro approach.

How do you manage and grow a business? Here are the five main steps:

- Measure

- Set Targets

- Optimize

- Codify

- Rinse & Repeat

Putting yourself into the buyer’s shoes, you want to know what metrics will need to “impress” the buyer when your business is on the market. You should be tracking and improving those metrics, in addition to other ones that reflect the health of your business.

Let’s discuss.

Measure

First, it’s important to understand what metrics as a whole you’ll measure the business by and in what frequency, to ultimately track the progress of the business.

You’ll want to make sure the data you collect is accurate and that you’ve established reporting processes.

Set Targets

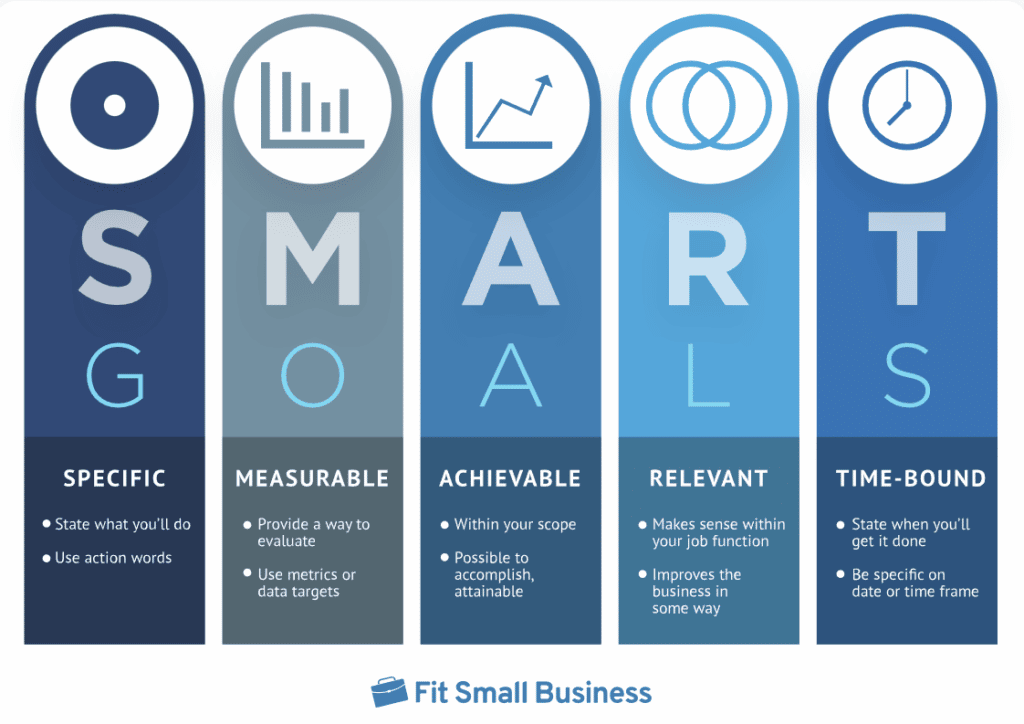

After measuring where you are today (point A), it’s time to set a target for where you want to be (point B). Following the SMART goal model, you want to make sure the targets you set are:

- Specific

- Measurable (already addressed above)

- Achievable

- Relevant

- Timebound

Make sure the targets you’re setting are specific end goals that are realistic to attain. Put a timeline on it, and ensure they are helping you to achieve your overall goal of a successful exit. This is why we discussed what metrics are important in valuation and to a business because this will dictate the success of the exit.

Optimize

Once you measure your progress, you’ll determine if you hit your targets or not. What worked and what didn’t? What could be improved? What could help you achieve your targets next time if you didn’t successfully hit them this time around?

Conducting a review process after a given cycle is key to the iteration necessary to keep your business growing.

Codify

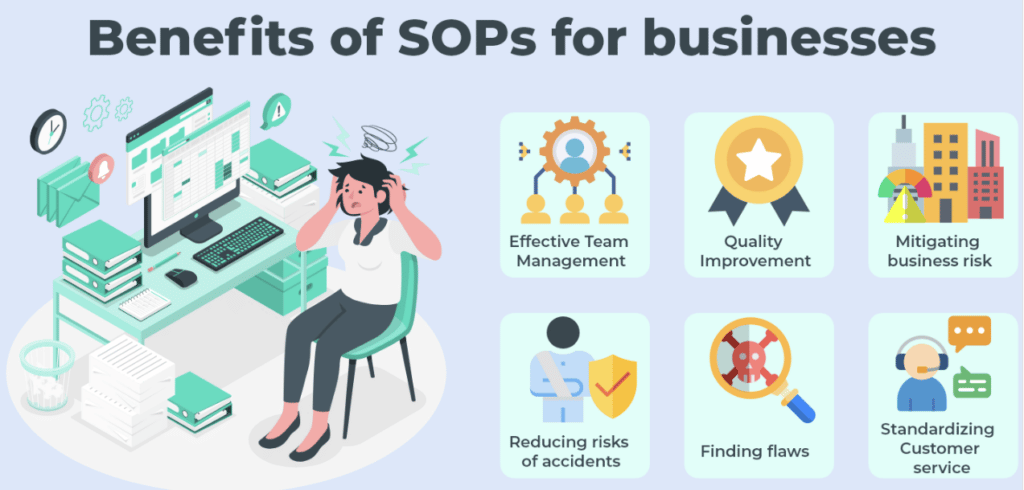

What’s the value in being successful in your business if you can’t repeat it? A large part of the repeatability and scalability of a business comes down to its processes. Once you’ve hit your targets and optimized the process for getting there, put it on paper.

Create standard operating procedures (SOPs) and tutorials that anyone can follow to effectively repeat the success you have been able to achieve.

Rinse & Repeat

You’ve created the most beautiful training manual on how to run your business.

Unfortunately, it’s collecting dust, either literally on your shelf or figuratively in the depths of a Google Drive folder no one has opened in years.

There’s no value in building out processes that aren’t followed, managed, and updated.

An idea is nothing without execution.

So how do you make sure your SOPs will actually be used?

- Regularly review and update them, with the team’s assistance and input.

- Ensure they are easy to access.

- Measure the business to highlight if SOPs are being used or not.

- Make them a part of the everyday conversation within your team.

To wrap this up, I’ll give you a quick example. Let’s say we want to improve the Average Order Value (AOV).

First, we need to measure our current AO). Then we establish a realistic goal for where we want our AOV to be. We come up with a plan on how we’re going to increase our AOV to hit that target and we implement that plan. Once we’ve done that, we analyze how we did. Did we hit the target? Could we have done better?

After we’ve gotten to a point where we have a good process in place for increasing or maintaining an industry-high AOV, we create SOPs around this. Did we create an order minimum? Maybe we built tempting bundles for our customers to purchase, or we could have added an accessory to our product line that was easy for customers to purchase upon check out. We write out exactly how we were able to achieve success in a way that’s replicable.

Then, we have whoever on our team is responsible for the AOV to follow the process we built.

Lastly, we keep tracking. We keep measuring.

Stay tuned next week for the continuation of our exit planning series, where I’ll discuss what you should do one year out from selling your business to get it ready for sale.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.