When it comes to buying a business, what makes a good deal is a combination of two factors: you and the business.

What I mean by that is that unlike the stock market, there’s much more that goes into the return on investment (ROI) than simply the appreciating value of the asset or the equity buildup that inevitably happens from paying off your debt service.

The third driver of ROI is value appreciation, where you, as the business owner, are working in the business and creating more value everyday.

So when you are analyzing a business for its opportunities, you need to compare your strengths and weaknesses as a business owner with the strengths and weaknesses of the business. This will allow you to determine the business’s biggest needs and understand how you are uniquely positioned to solve them, in turning growing the business.

There are three steps to this process:

- Evaluating the business

- Evaluating yourself

- Determining the overlap

Let’s talk about what this looks like.

Evaluate the Business

There are many different ways to analyze a business’s strengths and weaknesses, but for the sake of simplicity, we’ll talk two common ways:

- Porter’s Five Forces

- SWOT Analysis

Porter’s Five Forces

Porter’s Five Forces was created by Harvard Business School professor Michael E. Porter in 1979 as a framework for analyzing a business’s competitive landscape. This concept is commonly taught in MBA programs across the country.

The Five Forces are often used to “measure competition intensity, attractiveness, and profitability of an industry or market.” It can help highlight where the pressure lies in a business, and, as a buyer, it can help you identify the threats you may need to anticipate if or when you buy the business – especially in an inflationary environment.

The Five Forces are:

- Industry Rivalry: How competitive is the industry itself? Are there a ton of competitors or is there a monopoly?

- Supplier Power: Does the current supplier have the power to make unilateral decisions that can dramatically affect your business’s operations and sales?

- Substitutes: How easy is it for buyers to find a substitute company or product to replace yours?

- New Entrants: How easy is it for new companies to break into the industry and become formidable competitors?

- Buyer Power: Is there customer concentration in this business? Do your customers have the power to drive down prices?

Analyzing listings through Porter’s Five Forces can help highlight where the weaknesses and threats lie.

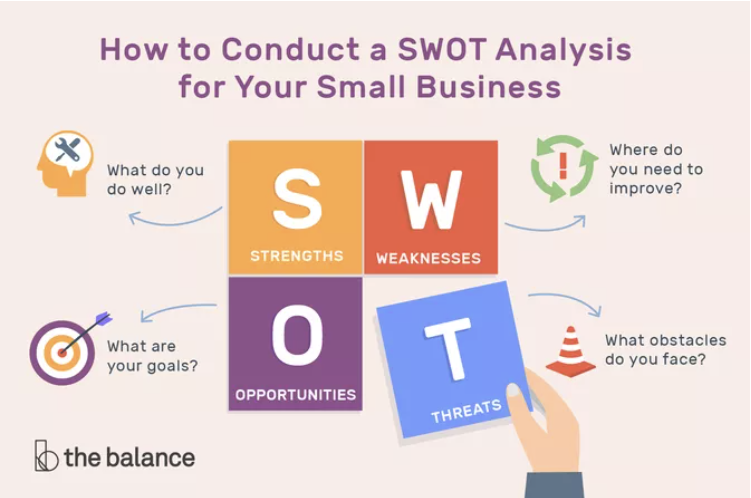

SWOT Analysis

SWOT analysis is a framework that uncovers a business’s Strengths, Weaknesses, Opportunities, and Threats (SWOT). It’s used to analyze a business’s competitive position and develop strategic planning.

Similar to Porter’s Five Forces, what’s useful about a SWOT analysis is that it’s an evidence-based assessment of the internal and external factors that drive the success of the business – currently and in the future.

Let’s talk about the four parts.

Strengths: These are what a business does well at, and more importantly, what separates it from the competition. Here are some examples:

- Patents

- High average order value

- Strong profit margin

- Low seasonality

- Strong brand

Weaknesses: Conversely, weaknesses prevent a business from performing at its best and are areas where it needs to improve to be competitive. Here are some examples:

- Large amount of debt

- Low employee retention

- Low customer satisfaction

- High overhead

- Easily replicable product

Opportunities: These are external factors and circumstances that can provide a business with a competitive advantage. Here are some examples:

- Increased demand (e.g. Zoom during the pandemic)

- Tax benefits or writeoffs

- New technology

- Expansion into new markets

- Government programs

Threats: The opposite of opportunities, these are outside factors that can potentially harm a company. Here are some examples:

- Business has no exclusivity with manufacturer, creating limitless competition

- Regulation changes

- Increased competition in the industry

- Loss of consumer interest

- Increased tariffs

Evaluate Yourself

The next step is to evaluate yourself, which in some regards is harder than evaluating a business.

How do you go about understanding yourself?

There are many ways to increase your self-awareness, but the simplest way is to conduct a personal SWOT analysis.

How to Conduct a Personal SWOT

The purpose of this exercise is to identify your personal SWOT profile and give you an insight into the types of businesses that will suit you and those that won’t.

Strengths

First, make a list of all of your career accomplishments to date and what behaviors drove those results. Consider what challenges you have overcome. What have you committed yourself to and achieved exceptional results with?

What activities do you enjoy actually doing? Do you enjoy coordinating lots of people’s activities? Digging into metrics? Calling on big accounts? Solving problems? Those are all great, high-level descriptions, but what about the details? Do you enjoy talking on the phone or managing emails all day? Running daily production meetings? Keeping the accounting tight? Going on sales calls? Managing the depths of an online marketing campaign? Integrating new systems into an organization?

These are your strengths.

Weaknesses

Just as important as knowing what you’re good at and what you enjoy is knowing what type of activities you should avoid. What areas, tasks, and even possible industries are off limits for you? What activities just absolutely do not interest you? What assignments do you drag your feet on? These should be identified so you can concentrate on working within your sweet spot and focus on what you do best.

Opportunities

Once you’ve examined where you thrive and what to avoid, it’s time to build your resume and identify the opportunities that appeal to you. Record your relevant work experience and what your role was in each position. Be sure to use action verbs to frame your accomplishments; quantify the specific results you achieved.

This helps to emphasize what really stands out in your career, where your interests lie, and where and how you get the best results. It also serves to identify what your role should be moving forward. Do you excel in marketing, sales, process implementation, or accounting? What areas are you comfortable growing into and which ones do you want to hire assistance for?

Threats

Finally, quantify the threats to your success. Where are you likely to make mistakes? What problems are you likely to misjudge or overlook? This exercise can be difficult to undertake alone, so consider involving trusted friends or even professionals.

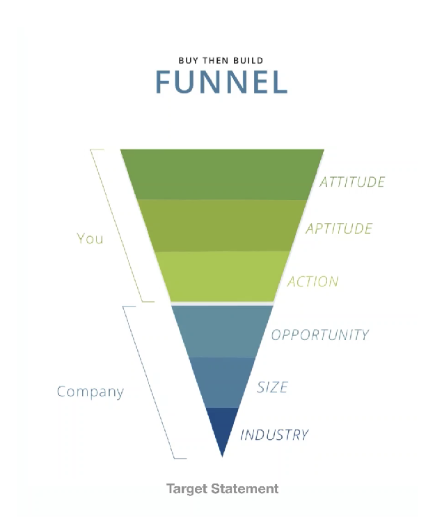

Craft a Target Statement

Once you’ve determined your strengths, weaknesses, opportunities, and threats, you can begin to creat your target statement.

A target statement looks something like this:

I am looking for a [choose product, distribution, or service] company with [enter the type of growth opportunity], generating [define size by seller discretionary earnings (SDE) range], with [enter any limiters].

In it, you want to outline these four things:

- Type of company

- Type of growth opportunity

- Seller’s Discretionary Earnings (SDE)

- Any limiters (e.g. geographic preferences, certain industries, etc.)

To get you started, here are a few examples:

“I am looking for a distribution company with strong sales and marketing processes but needing operational excellence, generating $300,000 to $400,000 in SDE, in or around the Chicago area.”

“I am looking for a manufacturing company with no current eCommerce presence, generating $250,000 to $300,000 in SDE.”

Determine the Overlap

Once you create your target statement, you can now search for and evaluate listings strictly based on those criteria.

Line up listings against your target statement. What overlaps do you see?

Remember, expertise is more valuable than experience. Experience is simply time spent doing something, but expertise is excelling at something. You want to make sure that the needs of the business are aligned with what you are currently or could be good at – not something that you’ve just had experience with.

By finding a business where your strengths and its needs overlap, you can fast-track your way to wealth.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.