“A business owner is only going to sell if they’re at a point of distress.”

A student in a class I taught recently said that. Do you agree?

This is actually a common misconception people have – that business owners would only sell if they’re in dire straits. This could certainly be the case, but there are a number of other reasons why sellers want to sell.

Before we get into that, you might be wondering: why is it important to know why someone wants to sell?

When buying a business, the seller is not there to pitch you on a business that they’re “offloading” for some “real reason” they aren’t disclosing. In fact, in many cases, the seller has spent years, if not decades, of his or her life building a robust, valuable business and will only be keen to part with it if the right seller comes along.

As the buyer, it’s in your best interest to demonstrate to the seller that you’re a good fit to lead their business. Today, I’ll explain the mindset of a seller and how you can put yourself at the front of the line to buy someone’s business.

Common Reactions to Selling a Business

As a business broker, I reach out to potential sellers to provide them with a ballpark valuation on their business and see if they’re interested in selling their businesses. Here are the three typical responses I get:

- Yes.

- Not now.

- No way.

For sellers who say, “Yes,” this is pretty straight forward. I present them with an estimate of how much they’ll be able to sell their businesses for, and they like the sound of it. There are a number of reasons why they’ll agree to sell their business, which I’ll go through in the next section.

For sellers who say, “Not now,” usually going through the process of valuing their business and putting a price tag on it isn’t enough to make them want to commit to selling their business. In fact, it might remind them of the value they have in their business, and in turn, they’re reinvigorated to focus on their business.

For sellers who say, “No way,” a number of things can be happening here.

They either are not ready to sell their business at all or they don’t fully understand how valuation works. Many business owners think their businesses are worth a lot more and are often disappointed that the selling price is a two to four multiple of their annual earnings (SDE). If it’s not an issue of valuation, these business owners simply are not ready.

If you think these responses come down to the amount of money, you’re missing the bigger picture.

In the last 30 days, I’ve talked to three different business owners with three different reactions, and the person who would sell for the least amount of money was the person who said “yes.”

The person who would make the most amount of money? That person said “no.”

If you take Mark Zuckerburg as an example, he turned down $1B from Yahoo when he was 22 years old. Why? It wasn’t because of the amount of money – it was because he had a greater vision for the company he wanted to fulfill, which made him not ready to sell the business.

So if it’s not money, what is it then? Why are sellers so keen to sell their business, especially if it’s a good business?

Why Business Owners Choose to Sell

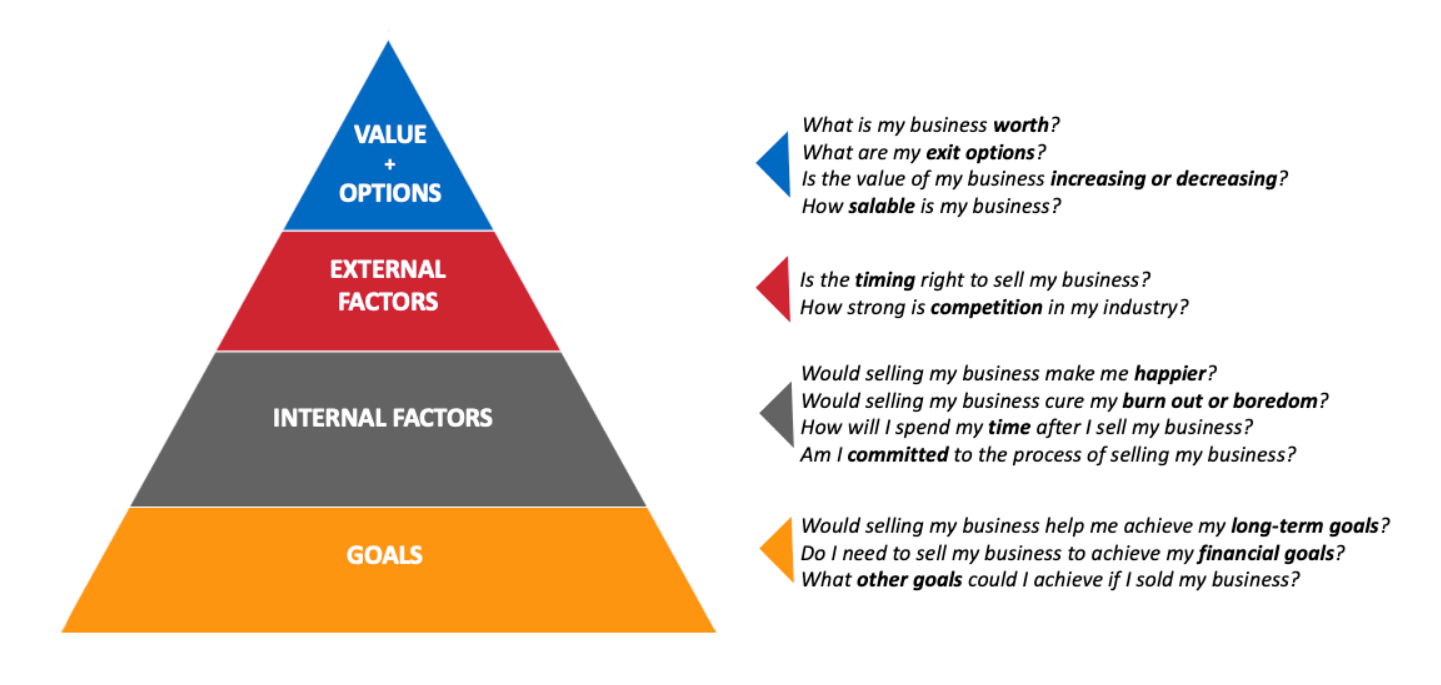

As I mentioned, business owners don’t choose to sell their business only when times are tough. Although a loss of footing (i.e. decline in industry, loss of major client, etc.) can be the catalyst, there is usually a confluence of personal and financial goals that contribute to a seller’s decision.

Here are the most common reasons business owners sell:

- Burnout

- New opportunities

- Declining revenues

- Negative industry changes

- Partner disputes

- Financial reasons (debt or bad decisions)

- Lifestyle change of owner

Although these are the reasons why people sell, the act of selling their company has to support three things: financial goals, personal goals, and legacy.

Financial & Personal Goals

Whether it’s escaping problems or running toward better opportunities, selling a business can help a seller meet his or her financial and personal goals.

50% of the value a business owner gains is when the business is sold, and it’s this large payout that can allow someone to retire, pursue a new opportunity, or simply handle any financial hardships (i.e. debt) they accrued in their business.

If the business owner is bored or burned out, they recognize it’s time to move on and pursue new opportunities that excite them. Boredom or burnout doesn’t mean the business is inherently distressed – it’s just no longer a fit for the business owner anymore.

For many entrepreneurs, exiting from a business itself is a stripe on the sleeve they hope to achieve, where they feel like they have gained true success and come full circle when they are able to exit their company.

Preserving a Seller’s Legacy

In addition to fulfilling personal and financial goals, many business owners also want to ensure their legacy in the business is continued once they move on.

Specifically, they want to make sure the incumbent owner will preserve the company’s values, customer happiness, and employees’ wellbeing. They’ve spent years of their lives not only generating revenue but also building relationships with vendors, taking care of customers, providing a living for employees, and more.

They will only entrust their business to the right person.

When Is a Seller Ready to Sell?

Every business owner is on their own timeline when it comes to selling their business, but all sellers follow this journey:

- Discover they can sell their business

- Determine who to talk to in order to sell their business

- Learn how much it can sell for

- Take that information and keep operating the business until they’re ready to sell

Most business owners today don’t even consider selling their business as a viable option. When they realize it is, they usually find out by:

- Talking with friends

- Hearing about someone else’s exit

- Searching online

- Talking to their CPA

Once they are aware they can sell their business, then they find someone like me who can give them a valuation.

Next, in the valuation process, they find out how much they can sell their business for, which is typically two to four years worth of earnings.

At this point, I’ll get one of the three responses listed above. For those who aren’t ready to sell their business, yet, they take this information about the value of their business and continue to operate their business until they’re ready to sell (usually triggered by a strategic time to exit, one of the 4 D’s, or being ready to spend their time doing something else).

You, as the buyer, have probably done your research and learned what an incredible deal there is to be had in buying a business. While the buyer is discovering how easy it is to afford a business that has value, for the seller, it’s often the opposite. They’re thinking,

“Wait a minute, I built this company for 20 years. I put all my kids through college, paid myself a nice salary, supported my employees, and helped our customers. And now someone is going to come along, pay 3x my earnings, and I’m just going to walk away?”

This doesn’t really sound appealing unless there’s a deeper reason why a business owner wants to sell already.

Typically, it’s a change in personal goals and how they want to spend their time that inspires business owners to finally take the leap and sell their business.

How Does This Help You, as the Buyer?

By this point, you already understand that the seller isn’t going to pitch you their company. It’s usually the other way around, where you’re interviewing to be CEO of their company and the right person to carry on their legacy.

How can you prepare yourself best?

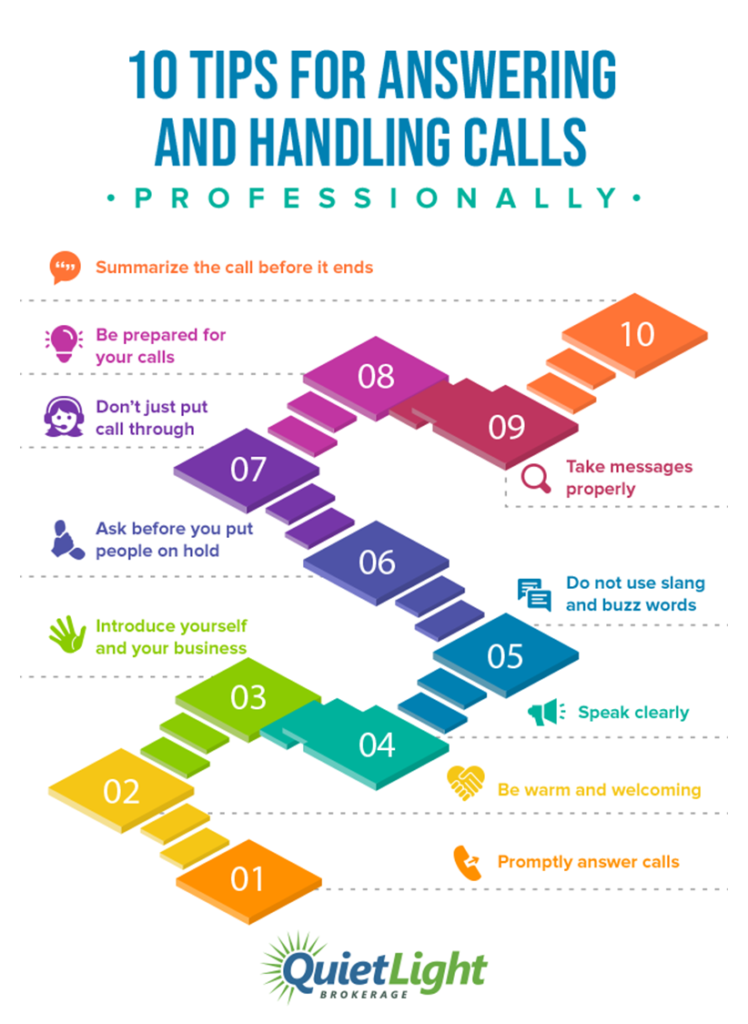

From the first call or meeting with the seller, you want to make sure you convey three things:

- You’re willing and able to close on this deal, if it’s right.

- You’ll be competent to manage and can get passionate about their business.

- You’re a trustworthy problem solver who can work side-by-side to achieve the common goal.

Throughout the acquisition process, you want to continue being this person when interacting with the seller.

Be enthusiastic about the business, demonstrate that you’re qualified to run their company, and be ready to work together with the seller to make sure this is a win-win situation for everyone involved.

Prepare for every call or meeting by taking calls in a quiet place, doing any research needed beforehand, and showing up with intelligent questions. Don’t hesitate to share where you intend on taking the business and how you plan to grow it.

Following these tips will help to build the seller’s trust and confidence in you, which are key to convincing them to sell you their business.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.