At the end of the day, investors care about two things: income and appreciation.

Depending on how the deal is structured, an investor’s returns may come from selling an appreciating asset or dividends paid out by the company plus the eventual sale.

That said, who are the types of people that qualify as investors?

There are many different types of investors. Some operate in the acquisitions space and some don’t, preferring to invest in early-stage companies or companies they will own outright. Today, we’re going to talk about different types of investors and speak to the likelihood of you working with them to acquire a business.

Although we’ll discuss the different types of investors, as a whole, they can be categorized in one of two ways:

- Passive Investors: These investors look to passively manage assets, seeking average performance with good results in good markets and not great results in poor markets. They take a buy-and-hold approach to their investments.

- Active Investors or Value-investing Investors: Keeping emotion out of the equation, these investors invest more money in bargains and less in high-value assets. They help to drive the success of businesses they invest in to maximize the amount of value that business has.

Angel Investors

Angel investors can be individuals or a group of people who seek to invest in a company in the early stages, using their own money. Typically, angel funding bridges the gap between the early stages of a company and the time later on when venture capital is available for more mature businesses. When angel investors come together in a group, they operate as a fund or an accredited investor group, where they can collaborate on investments by pooling their capital together.

Generally, you won’t find angel investors in the acquisitions space; however, depending on the network you develop, you will come across high-net-worth individuals (HNWIs) who invest in a similar fashion–in exchange for equity in the company. HNWIs and angel investors are similar in the sense that both groups are accredited investors.

Private Equity

Private equity firms are partnerships that buy shares in and manage companies with the intention of selling shares for profit down the road. They pool capital from institutional investors and HNWIs to financially support these investments. Private equity firms are active investors, directly involved in managing and growing companies, maximizing their value before selling shares or the entire company years down the road.

Most private equity firms invest in more mature companies, versus startups. The average holding period of a private equity company was about five years in 2021.

Private equity firms generally source their own deals and will take majority, if not all, stake in a company.

Venture Capitalists

As of 2022, there are roughly 1,000 venture capital (VC) firms in the United States, capturing a market size of $63 billion.

Similar to private equity firms, VC firms raise capital from various investors and find companies to invest in. VCs are more active investors, as well, providing technical or managerial expertise to grow the businesses they invest in.

Differences Between Private Equity and VCs

That’s where the similarities end. Private equity and VCs will buy different types of companies, invest different amounts, and take different amounts of equity in companies they invest in.

VCs tend to be focused on higher-risk opportunities that have a higher potential for ROI, and these tend to be found in very specific industries that capitalize on innovation, such as tech companies. Private equity, on the other hand, invests in companies across all industries and they tend to be bigger and more mature.

Private equity will take majority, if not all, ownership in a company, whereas VCs will take a much smaller percentage of equity in a company. Because of this, private equity deals are often larger than VC deals.

Additionally, another defining feature of VCs is that there are two types: early-stage and late-stage.

An early-stage VC looks for companies with a proven concept and generating some revenue, needing more funding to invest in sales and marketing efforts to grow.

Late-stage VC invests in companies that are positioning themselves for a sale or initial public offering (IPO). These companies are cash-flow positive, know what it takes to grow in the market, and present investors with a lower risk than early-stage deals.

VCs won’t typically be a viable option for acquisition entrepreneurs. Acquisitions don’t fall into the early-stage company category, and with late-stage VC focusing on potentially going public, the size and involvement of these deals tend to surpass small business acquisition.

Personal Investors

Personal investors are just like they sound–they can be any individuals investing on their own. They invest their own capital in an acquisition in exchange for equity in a company. They are not professional investors. They simply have the additional capital to be able to invest and are looking for assets that can provide a higher return than normal investment vehicles you might normally find.

One type of personal investor that is more common than you might think are friends and family.

Friends & Family

Investors in small businesses often come from this pool. Friends and family invest over $60 billion per year. 38% of startup founders report raising money from friends and family, with the average amount being $23,000.

Friends and family can provide the capital buyers might need for the down payment, and depending on their interest and experience, they can also become a partner in the company.

Many people are wary to rely on friends and family for money, but the key is having a very detailed plan outlining how much friends and family are willing to invest and terms of repayment and equity. This can be the quickest and most cost-effective type of capital to raise.

Friends and family are a great pool of investors for acquisition entrepreneurs.

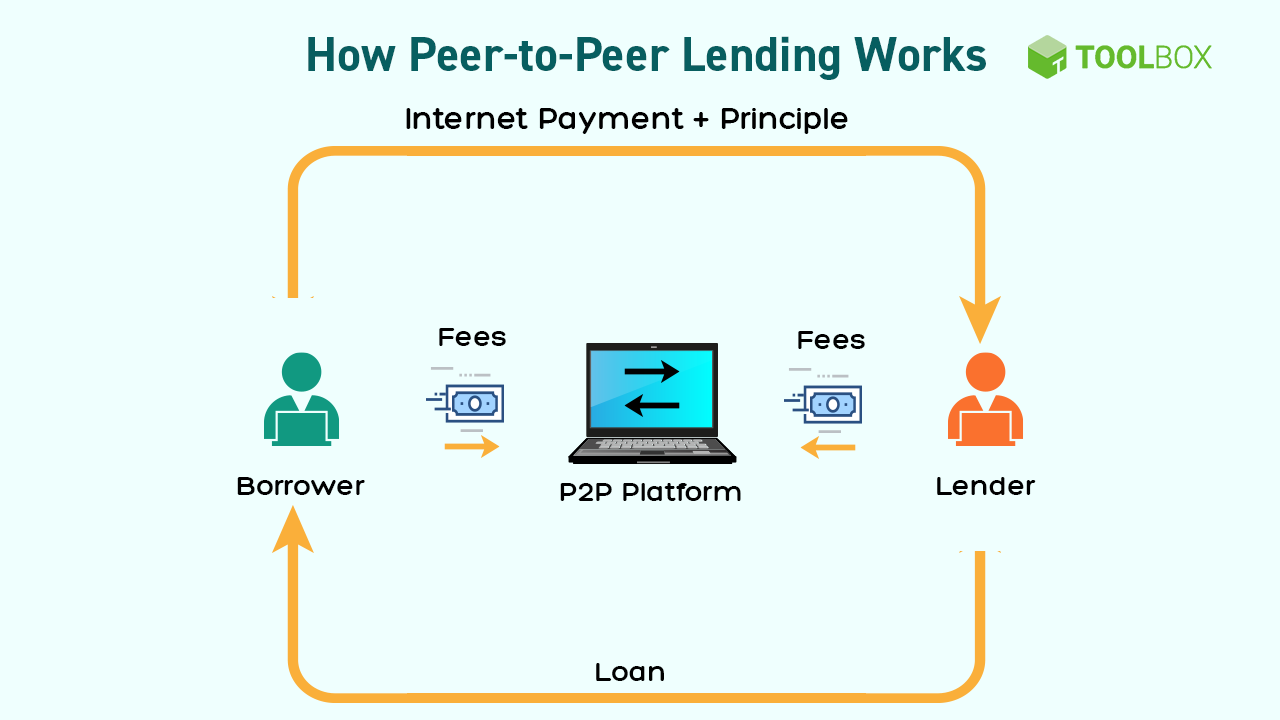

Peer-to-Peer Lenders

Another type of personal investor is peer-to-peer (P2P) lenders. P2P lenders are individuals or groups that invest in a company directly without going through a bank or investment firm. This type of investing tends to be organized on brokerage websites, where business owners are connected directly with investors, enabling the transaction between both parties.

Similar to applying for a loan, business owners who want to qualify for P2P lending should be prepared to present themselves and their businesses in a way that will encourage investors to loan money to them. There’s a good chance investors will pull credit history, as well, but one unique feature about this type of lending is that rates can be negotiable between both parties.

There’s no reason why P2P lending is off the table for acquisition entrepreneurs. As long as you can make a case for the company and you as the future CEO, these transactions can be a win-win for both parties involved.

Crowdfunding

The internet has made raising funds from strangers easier than ever, and that’s evident in crowdfunding.

Crowdfunding platforms can connect entrepreneurs with people who are interested in investing in their businesses. Crowdfunding operates on a different model than the ones above, namely in the sense that crowdfunding collects smaller investments from a larger group of people. Because of that, companies don’t give up equity in their business. Instead, they provide their investors with initial access to a product, exclusive ability to provide input on product development, and other benefits.

Search Funds

Search funds are another type of investment vehicle where investors come together to financially support an entrepreneur in sourcing, acquiring, managing, and growing a privately held company.

As an acquisition entrepreneur, finding or creating a search fund to be a part of is a viable option, but there are drawbacks to search funds, for both the buyer and the seller. I discussed these pros and cons in depth here.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.