“What do I need to evaluate in a business to determine if it will make a good acquisition or not?”

This is the question that weighs heaviest on the hearts and minds of buyers in the Acquisition Lab.

And rightfully so. As a new buyer, you want to make sure the business you decide to purchase is going to be a worthwhile one. The biggest thing new buyers fear is that the profitability of a business is going to suddenly vanish when they take over.

There’s a lot that goes into these determinations, and today I want to talk about a concept I use whenever evaluating a business for purchase: Porter’s Five Forces.

I’ll explain what Porter’s Five Forces are, why this concept is useful, and I’ll run you through an example with a previous acquisition of mine to illustrate how to apply Porter’s Five Forces to your own potential businesses.

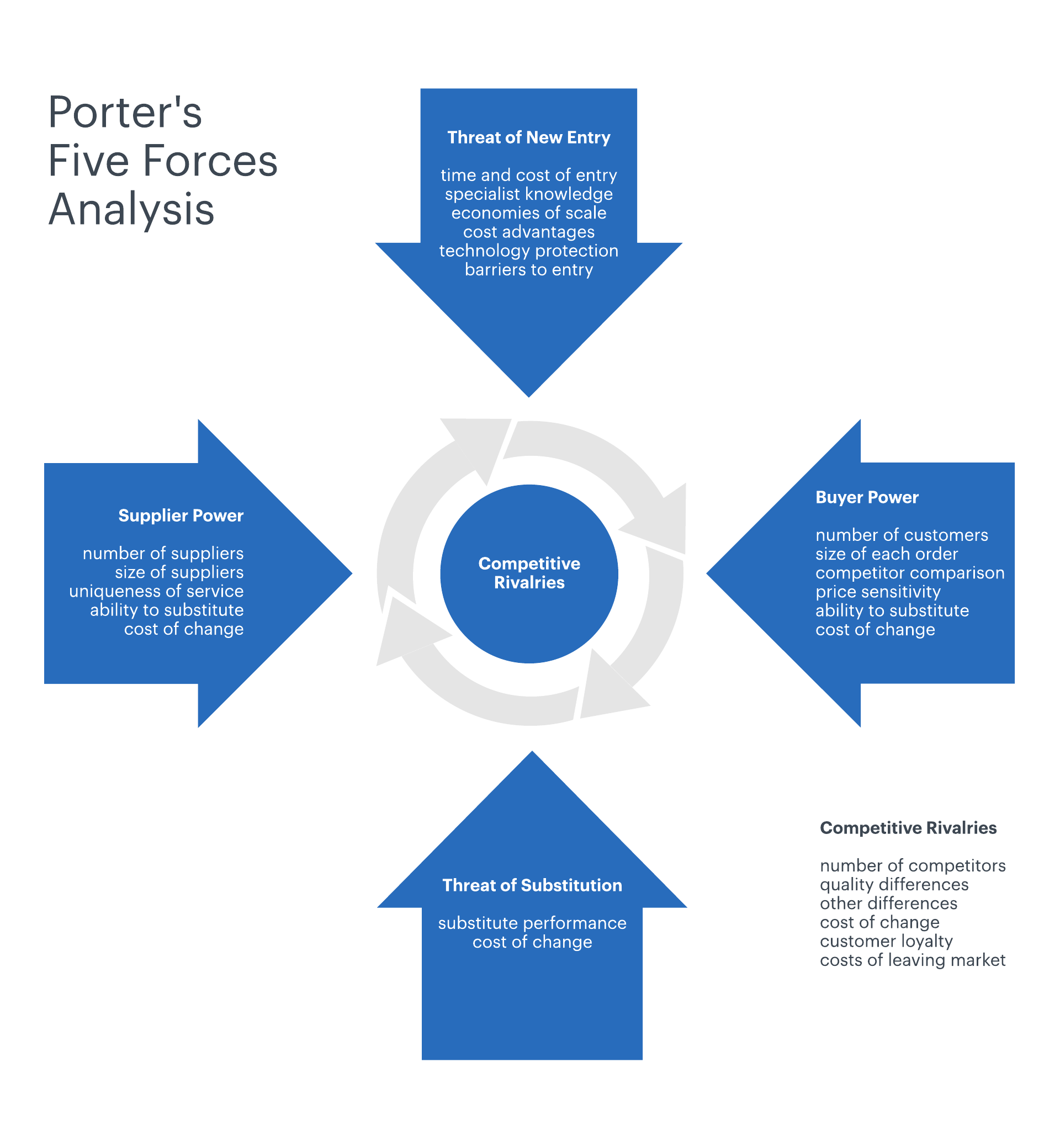

What are Porter’s Five Forces?

Porter’s Five Forces was created by Harvard Business School professor Michael E. Porter in 1979 as a framework for analyzing a business’s competitive landscape. This concept is commonly taught in MBA programs across the country.

Interestingly, when I learned about it in school, a lot of my classmates figured Porter’s Five Forces was a textbook concept they needed to memorize for the exam but would never actually use again.

My experience has been the complete opposite. I’ve applied this model to all acquisitions I’ve made in the past, and I continue to rely on it when evaluating listings.

The Five Forces are often used to “measure competition intensity, attractiveness, and profitability of an industry or market.” It can help highlight where the pressure lies in a business, and, as a buyer, it can help you identify the threats you may need to anticipate if or when you buy the business – especially in an inflationary environment.

The Five Forces are:

- Industry Rivalry: How competitive is the industry itself? Are there a ton of competitors or is there a monopoly?

- Supplier Power: Does the current supplier have the power to make unilateral decisions that can dramatically affect your business’s operations and sales?

- Substitutes: How easy is it for buyers to find a substitute company or product to replace yours?

- New Entrants: How easy is it for new companies to break into the industry and become formidable competitors?

- Buyer Power: Is there customer concentration in this business? Do your customers have the power to drive down prices?

Applying this Concept to a Real Business

I don’t want to just tell you the Five Forces are useful in evaluating businesses – I want to show you. So let’s use a business I personally have acquired as a case study to walk through these Five Forces and see what they tell us about the viability of the business.

Years ago, I bought an online business that’s the country’s number one online distributor for a certain type of toilet. Let’s see how it stacks in an evaluation of the Five Forces, and, hopefully, I can illustrate why I decided to purchase it.

Industry Rivalry

In the toilet industry, there’s a decent amount of competition. However, in the online space, the competition for this type of product is fairly limited since there are only a few distributors that are authorized to resell this particular type of toilet.

The supplier had decided to only allow a few authorized dealers, so although offline rivalry in the toilet industry was much more rampant, it was limited online, so ultimately I accepted the level of industry rivalry risk.

Here’s a pro tip: The quickest way to determine if there’s high industry rivalry is by looking at gross margin as a percentage of revenue. The lower the margins, the higher the competition. Conversely, the higher the margins, there’s a lot of room to make mistakes because it’s less competitive.

Supplier Power

The supplier we work with actually has a lot of power. It is not easy to find a substitute supplier that can create the same type of product at the same quality.

That means the supplier could one day say, “This is the new price” or “We’re going to sell online now” or “We’re extending authorized dealers to everyone in the world.” Any one of these decisions would drastically affect our business and its ability to sustain itself.

However, just because a supplier can make such changes doesn’t mean they will. For our supplier, their business model relies on us as resellers. Their chosen distribution channel is to work with resellers instead of selling individual units themselves. I buy from them, then I resell the product online by effectively marketing it. In turn, I sell toilets to thousands of people.

Our supplier doesn’t want to sell toilets to thousands of people. They would rather sell these toilets to a small group of resellers who will then sell them to multiple thousands of people.

Ultimately, even though the supplier could make a strategic decision that would adversely affect my business, the chances of them doing so was slim. I accepted the level of supplier power risk.

Supplier Concentration Issues?

As a side note, if you find yourself evaluating a business with significant supplier concentration, where one supplier makes up for a significant portion of your production, this isn’t necessarily a liability.

If the supplier has something unique that is hard for another supplier to replicate, then yes, they have power over the relationship you have with them. They can dictate terms that you have no say over. However, typically, even if the majority of your products come from one supplier, if you have the ability to switch suppliers with little to no effect on your product quality, then having a supplier concentration isn’t an issue.

Substitutes

A substitute in the toilet industry would look something along the lines of a customer saying, “I’m not going to buy this brand of toilet, I’m going to buy that one.”

Another option is if the product were an optional one where a customer could choose a different type of product to replace the original choice, but that’s not possible with toilets since everyone needs one.

In this industry, most of the competitors for this type of toilet are international. It’s a very established type of toilet outside of the US, but it’s been increasing in interest in the US only in the last 20 years.

The threat of substitutes within our industry and within our country is low. Any brand that might be sourced overseas and for cheaper tends to be a poor quality product in comparison.

New Entrants

The threat of new entrants revolve around the question: what is the barrier to entry?

In my case, the fact that the supplier was keeping a limited number of authorized dealers for online distribution was going to limit new entrants. Additionally, I built a defensive moat to prevent international parties from coming in and creating competition by creating brand presence and awareness – our company owns it in this space as far as branding goes. New entrants wouldn’t be able to compete.

In the few cases where international brands have attempted to break into the US market, their products have been subpar. They’re cheap and they break easily. If you pay for ours, you’ll get ten years of life out of our product, versus one year with a foreign competitor’s.

The combination of having a superior product, top-notch branding, and being one of the few authorized dealers for online distribution all contributed to lowering the risk of new entrants in our industry and market.

The one thing I didn’t anticipate was the possibility of offline distributors increasing their online presence and increasing the competition in the space. Although competition has increased, ultimately, we’re still doing well.

Buyer Power

Buyer power is where customer concentration comes into play. If you have one customer that makes up for a lion’s share of your revenue, that buyer has significant buyer power.

Within our business, we didn’t have anyone buyer that had significant buyer power since we had tens of thousands of customers.

However, on the Amazon platform, where we operate, buyers do have power through the reviews they can leave. Because reviews can make or break a brand’s performance on the Amazon platform, the ability for buyers to leave reviews gives them buyer power. That being said, our company delivers on our promises and creates a long-lasting product people are generally satisfied with, so the threat of buyer power is largely non-existent for us.

As you can see, running your listings through Porter’s Five Forces can help highlight where the weaknesses and threats lie. Utilize this model next time you evaluate a business to see if it will continue to operate well beyond post-close. It will help you succeed as a buyer before and after closing.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.