Inflation is on everyone’s mind and rightfully so.

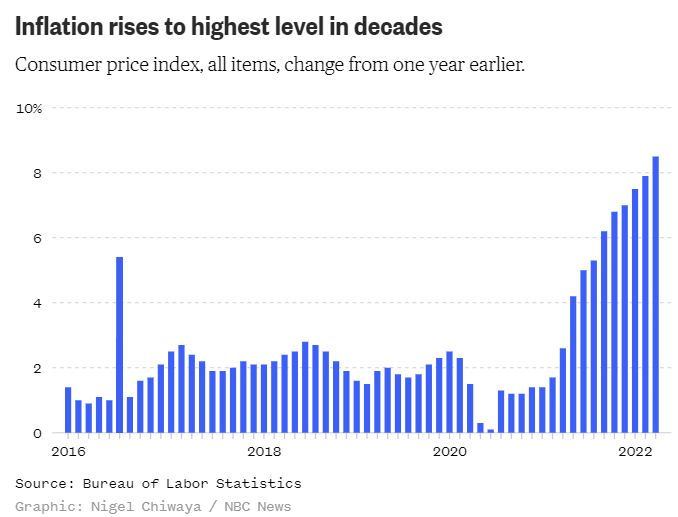

Inflation has risen to the highest level it’s been in decades, and it doesn’t look like it’s lessening anytime soon.

Everyone is talking about inflation because the higher inflation is, the less your money is worth. So your dollar won’t be worth a dollar. It’ll be worth 90 cents… 70 cents.. 45 cents… and so forth.

If you hold onto the money you currently have, you’ll be able to afford less in the future than you can now with it.

What can you do? We’ll get into that in a minute. First off, let’s talk about what inflation is and why we want to hedge against it.

What is Inflation and What Can We Do About It?

Inflation is defined as “the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising.”

It’s a natural occurrence in an economy, but our currently elevated inflationary environment can be traced back to supply and demand issues from the start of the pandemic.

At the beginning of the lockdown, people spent less money on goods and services, but when restrictions eased, there was a dramatic swing in consumer behavior from saving to spending. Because of shipping delays and shortages in labor and key materials, companies couldn’t meet the sudden consumer demand, and prices shot up for most goods and services.

In times like these, people are smart to adjust their budget, pay off variable debt, find ways to increase household income, and save more of it.

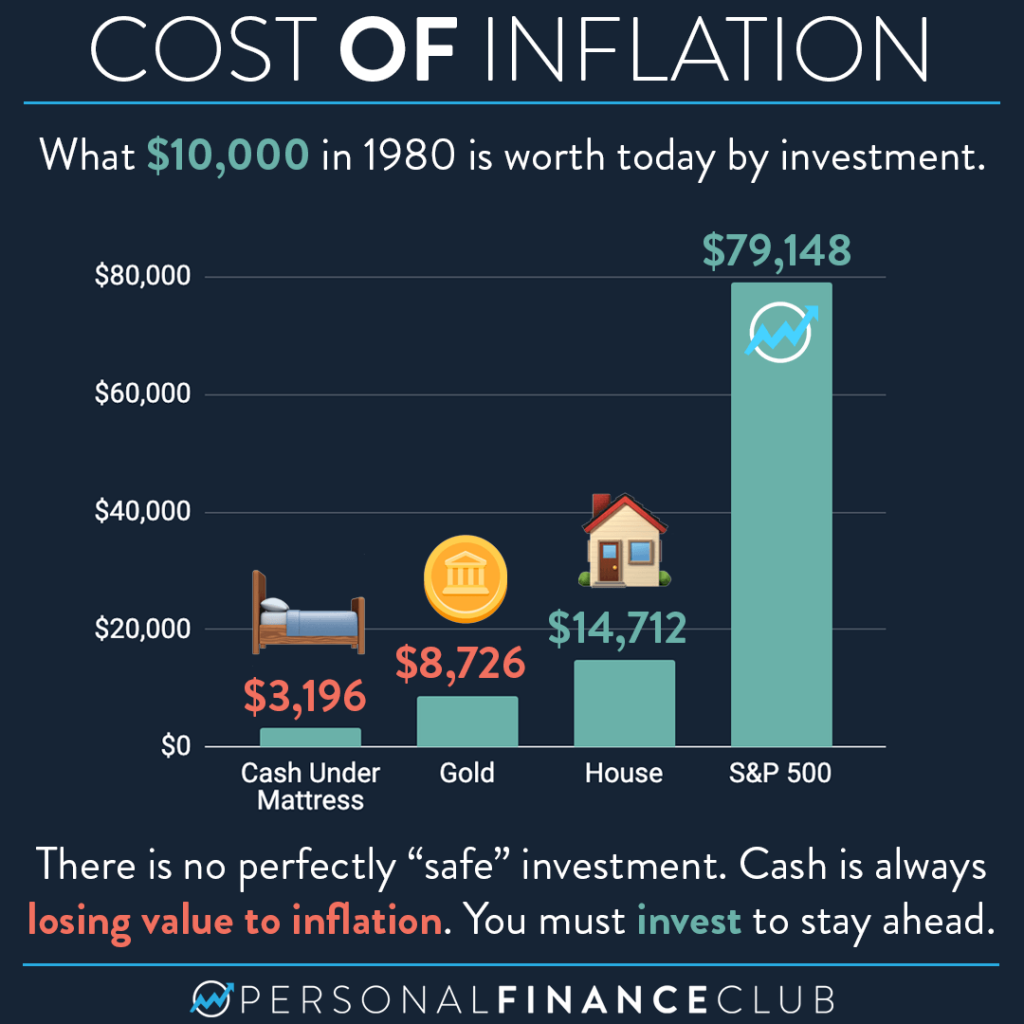

That said, saving money, although better than nothing, doesn’t allow you to beat the rate of inflation, and this is where inflation hedging comes into play.

Inflation hedging typically involves investing in an asset that is expected to outpace the current rate of inflation.

The reason why is that although some investments may look like they provide a good return, when inflation is factored in, the investment may prove to be an overall loss.

The key is to find assets that outperform the market.

What Are Common Hedges Against Inflation?

Beating inflation in a normal economic environment requires a return of at least 4-6%, but in our current economy, you’ll be safe to shoot for well over 8%.

Here are just a few assets you can consider investing in to protect your money:

- Buy gold, bitcoin, and other hedges against the US dollar

- Invest in the stock market and take a long-term investing approach

- Buy assets with debt

Since gold and bitcoin are restricted commodities, the inherent scarcity makes them more resistant to inflation. And while the stock market experiences ups and downs, generally speaking, its returns have beat inflation.

But How Does Buying Assets With Debt Help Protect Your Money?

Taking on debt in an inflationary environment may seem like a poor financial decision, but in many ways, it’s the total opposite.

As we talked about earlier, inflation causes money to be worth less and less as time goes on. This concept also applies to the purchase price when buying an asset.

So, in essence, to purchase an asset with debt, what you’ll pay in monthly installments over time, even if it’s the same number on paper, will be worth less, and you’ll be paying “less” for the same (if not growing) asset.

Let’s use an example.

Let’s say we’re going to buy a building. The purchase price is $1 million, and I’m going to borrow $800,000 of that. The loan is going to be paid over 20 years. That $800,000 will be getting paid off using future dollars, so when I’m paying off the $800,000 15 years from now, the value of the payments I’m making will be worth less and the asset I own will be worth more.

This situation applies to buying businesses as well, too.

“I can use debt to buy a business?”

Yes. Private equity groups have been using debt to buy businesses for years.

You can learn more in my book Buy then Build: How Acquisition Entrepreneurs Outsmart the Startup Game. The entire premise of the book rests completely on the opportunities made available to us through debt.

Since 2018, the SBA 7(a) loan has been modified to allow normal people like you and me to acquire profitable businesses by only putting down 10-20% down.

So when we talk about buying assets with debt, we’re not just talking about real estate – we’re talking about businesses as well. Establish a purchase price with 2022 dollars, and hedge against inflation by protecting your investment.

If you read my book and watch my videos, you’ll know there’s more to being an acquisition entrepreneur that I espouse: the opportunity to have a greater impact on others and live the most engaged life possible.

That said, buying businesses can be a financially sophisticated way for you to achieve your financial goals.

Businesses Do More Than Appreciate

Now, let’s talk about the number of ways businesses beat inflation.

Similar to real estate, businesses appreciate in value over time. The M&A landscape has exploded over the last couple years with no signs of slowing down, and this demand alone increases the value of profitable businesses across the board.

Additionally, not only will you pay “less” for a business as time goes on, any value you create within the business as the CEO will increase its overall value, as well.

In the long run,, you will pay “less and less” for your business and your asset will be worth “more and more.” For these reasons, buying a business is a great hedge against inflation, if not one of the best.

Bottom Line

We don’t know how long inflation will stay this high, so it’s still not too late to think about measures you need to take to protect your money and build your wealth.

I wish I could say saving money is enough, but unfortunately inflation can erode the value of your savings over time. You’ll need to take stronger measures if you want to get to the other side in a stronger financial position than you are today.

Plan to make your money earn for you by choosing an approach that will keep up, if not exceed, the inflation rate.

My thoughts? Buying a business is a smart way to do that.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.