When evaluating small and medium-sized businesses, your primary goal is to identify areas of risk. You’re analyzing every aspect of business from the financial performance to supplier relationships to employee turnover. Your goal is to identify potential red flags that could threaten the success of your acquisition.

According to Forbes, one of the very first areas you will evaluate is customers/sales.

Every company, customer, industry, culture, and buyer is unique. So, given the particulars of any given company, it’s important that you:

- Grasp potential problems related to customer concentration

- Develop a way of navigating those problems

- And, finally, evaluate your comfort level with making an offer

What is customer concentration?

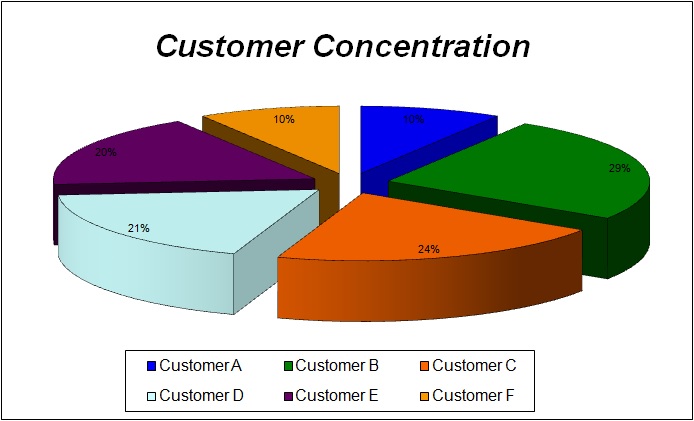

Every buyer needs to understand whether there’s a significant portion of revenue coming from a single or small group of clients. This is commonly referred to as customer concentration.

Unfortunately, evaluating customer concentration is not a science. There are a variety of “rules of thumb” to use to determine if there is a high level of concentration.

Credit insurance leader, Euler Hermes, defines high customer concentration as any single customer accounting for 20% or more of revenue.

Forbes uses the rule of thumb that no single customer should constitute more than 10% of your revenue.

The actual risks of high customer concentration

There are a few reasons having the majority of revenue from a single or small group of clients is a red flag:

(A) There’s a significant impact to the bottom line if a single customer is lost creating a small margin of error

(B) Lenders will often take into consideration customer concentration when determining whether to extend a loan or line of credit to your business

(C) Customers having the ability to control certain aspects of service because they recognize the power they hold within the relationship

(D) When considering future exit strategies, customer concentration will more than likely be a driver of lower valuations limiting your long-term returns on your investment

A real-life customer concentration story

Personally, I’ve proceeded with an acquisition knowing significant customer concentration was present.

For instance, I once acquired a business where 25% of revenue was really one customer. When I eventually sold the company, despite the fact that we significantly grew the company, because that specific client also doubled its size, it now accounted for 30% of the revenue. Having evaluated the company and its clients, I went into the situation feeling both confident and comfortable.

But once I started working that one main customer, I found myself having to address things that were over and above what would—or should—have been expected in a normal client relationship.

We became stuck in a loop in which he’d ask me to do something, I’d decline, and then he would persist in asking me again.

The relationship became a tug of war between us, with him continually wanting to remind me that he and his big company had an upper hand over me and my small company.

As an owner, it made me feel uncomfortable.

That’s a tough situation to be in, knowing one person or one small group of people make up a large part of your revenue. I wouldn’t recommend it.

Frankly, if you think there’s a high likelihood that you’ll find yourself in that situation if you proceed with a purchase, then that’s truly a red flag to which you need to pay attention when evaluating a potential acquisition—especially if you’re acquiring a company with a lot of accumulated debt and monthly bills to pay.

Managing customer concentration

One of our search forum members recently commented that she was evaluating a company for acquisition. It had two main customers that represented over 50% of revenue. (Indeed, sometimes customer concentration may be spread out over 2 or more clients. But you still need to be asking the same kinds of questions.)

My first advice is that customer concentration is a risk that you can knowingly manage. The primary strategy for managing this is to actively plan to diversify your revenue base. When acquiring a company make sure that there’s a plan in place to expand the number of clients served. However, keep in mind that even if you diversify like I did in the example I gave earlier, it isn’t a guaranteed way to eliminate this risk because if the client grows substantially like my client did then the level of concentration continues to grow with it.

In the event that you cannot avoid the concentration, which can be common in niche markets like B2B service businesses, I told her that, you may be able to deal with it. That being said, it does add a layer of complexity that is not ideal. Because in addition to sorting through details such as what kind of offer will satisfy both you and the seller, you’ve now got to account for keeping this other party (or parties) satisfied in the dynamic, too.

If you proceed, then from the first day you wake up as the owner, you’ve got the added responsibility of tending this extra stakeholder (or stakeholders, as the case may be) tied to your bottom line. They’ve also built-up expectations about what:

- You do for them

- How you do it

- When you do it

- And how much it costs them

Obviously, the best approach to managing this situation is to talk with your biggest customers and be as transparent as you reasonably can. This can help preserve and perhaps even grow a business relationship.

Be curious about your clients before acquisition (and even after). Seek to understand:

- What deliverables are most important to them?

- What timeline or constraints they’re managing?

- Why does what you’re selling matter to them?

And then work hard to assess how realistic their expectations are with your reality. Note that it’s possible that there may be some tough conversations to be had if you need to reset expectations that are out of alignment with reality.

Another thing to assess: How replaceable is your company should the customer lose faith in your management?

Remember:

- If competition for your product is high, you’ve got less room to risk losing a client.

- If, however, you’re offering something from medium to high difficulty for your customers to source, then you’ve got a little more leverage.

Buyers and sellers: Important considerations

Sellers may know something critical about a client, such as the fact that the customer is struggling or is otherwise a flight risk.

In fact, that’s exactly why valuation and diligence are so important in the M&A process. You may have great rapport with a seller, but you still must take a cold, hard look at the numbers while being thoughtful and curious enough to ask the right, good questions.

Also, in a customer concentration scenario, you’d be smart to tease out if there’s some special dynamic in play between the seller and the client. Do they attend religious services together? Live on the same street or socialize with their partners, spouses, or kids?

In other words, try to determine whether that main customer relationship is with the business or the person who currently owns it.

Granted, personal relationships help drive revenue. When acquiring a business where customer concentration is present and significant, you’ve got to assess as soon as possible whether you and the main customer can capture that magic. You also need to gauge if there’s danger the relationship between two businesses dissolves as soon as the seller walks away.

Ask yourself: “Can I manage this client relationship optimally on my own?”

The answer to that question—taken with a good, clear grasp of the relevant financials and market realities—should help you make a solid decision about whether customer concentration is manageable in any given potential acquisition.

Finally, remember that if you plan on later selling the business yourself—and presumably you do, then at some point you’re going to need to start thinking about how your own numbers stack up.

So, once you’ve made the purchase, focus on continuing to strengthen bonds you’re your main customers while also diversifying your customer as much as is suitable for your product and the industry it serves.

Planning on buying a business in the next 12 months? Consider applying today to the Acquisition Lab, our do-it-with-you buy side advisory service. You’ll gain access to world-class education, support from our team of experienced advisors, a suite of tools, and a vetted community to help you succeed in that first acquisition or in implementing a grow-through-acquisition strategy.