There’s no better way to build personal wealth than to buy a business.

Baby Boomers are retiring in droves, many of them ready to exit profitable businesses they’ve built over the last few decades.

And now, since 2018, you can now use SBA-backed loans (with up to 90% financing) to acquire a business.

That said, with any trend picking up steam, there’s bound to be a wave of misinformation that follows. This noise I see in the acquisitions world has a lot to do with the best ways to buy a business. People talk about the merits of seller-financed acquisitions and search funds in helping you buy a business, but in my experience, the reality of those approaches isn’t as easy as we’d like to think.

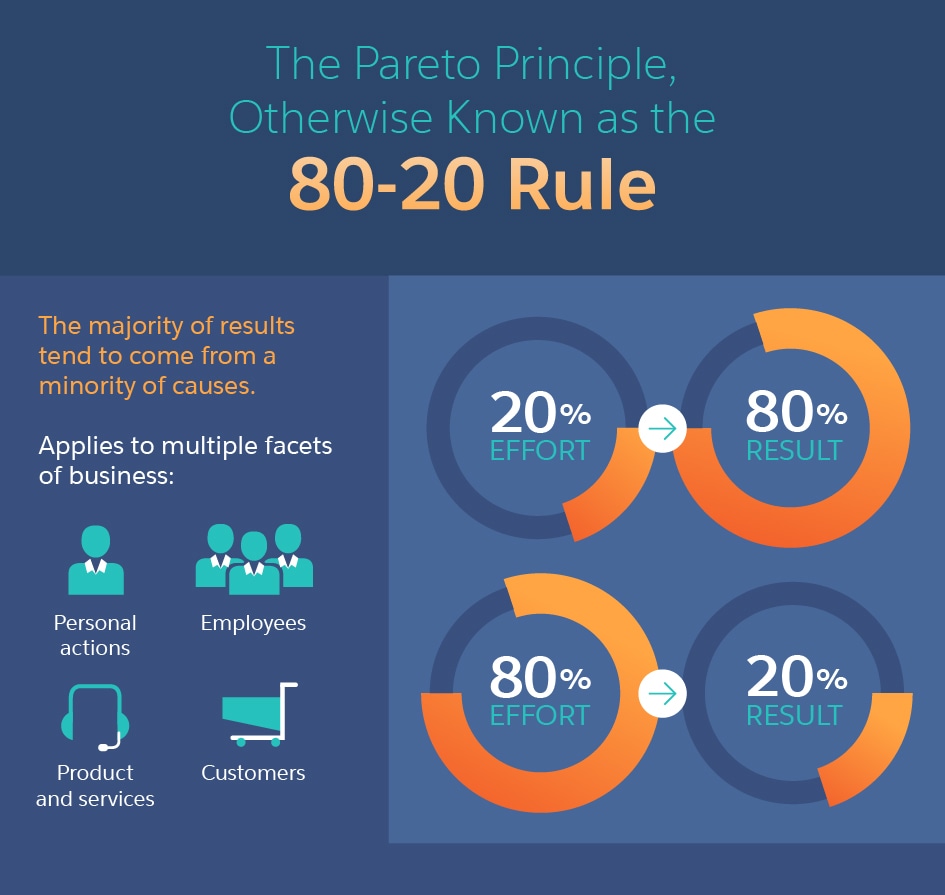

A good principle to remember in situations like these, where you can’t discern good advice from bad advice, is the 80/20 rule, otherwise known as Pareto’s Principle.

What is the 80/20 Rule?

Vilfredo Pareto, an Italian economist, came up with the Pareto Principle, or what is also known as the 80/20 Rule. While at the University of Lausanne, Pareto was working on his first work when he discovered that 80% of land in Italy was owned by just 20% of the Italian population.

Put in its simplest terms, the Pareto Principle is based on the observation that, in reality, things are not distributed evenly.

The 80/20 rule is the assertion that 80% of results come from 20% of effort.

In business, the Pareto Principle is often expressed by understanding that 80% of a company’s sales will come from just 20% of its clients. Likewise, just 20% of a company’s sales staff may generate 80% of the company’s overall profits.

How Does the 80/20 Rule Apply to Acquisition Entrepreneurship?

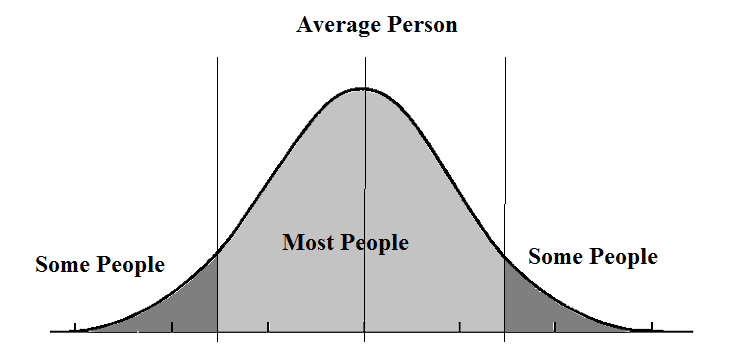

If you take the 80/20 rule and display it as a bell curve, you’ll find that roughly 80% of the results people get are in the center, the area between both extremes.

Acquisition entrepreneurship is no different. When buying a business, there are certain activities, efforts, and approaches that are going to yield the most results. Similarly, there are ways to acquire businesses that you can certainly pursue, but you may be wasting a lot of your time and resources attempting to make those ways work.

Here’s a revised version of the 80/20 bell curve as it applies to acquisition entrepreneurship.

On one end, you have buyers who are looking for opportunities that require no money down and mostly (if not all) seller-financing. On the other end, you have search funds. In the middle, you have 80-90% of the market that operates by primarily utilizing SBA lending.

Now, are all three valid ways of buying businesses? Absolutely. But are they common and reliable ways to buy businesses? Not exactly.

Three Main Ways to Purchase a Business

Let’s break down the three different ways to purchase a business based on its advantages and disadvantages, taking the time to discuss the feasibility of each.

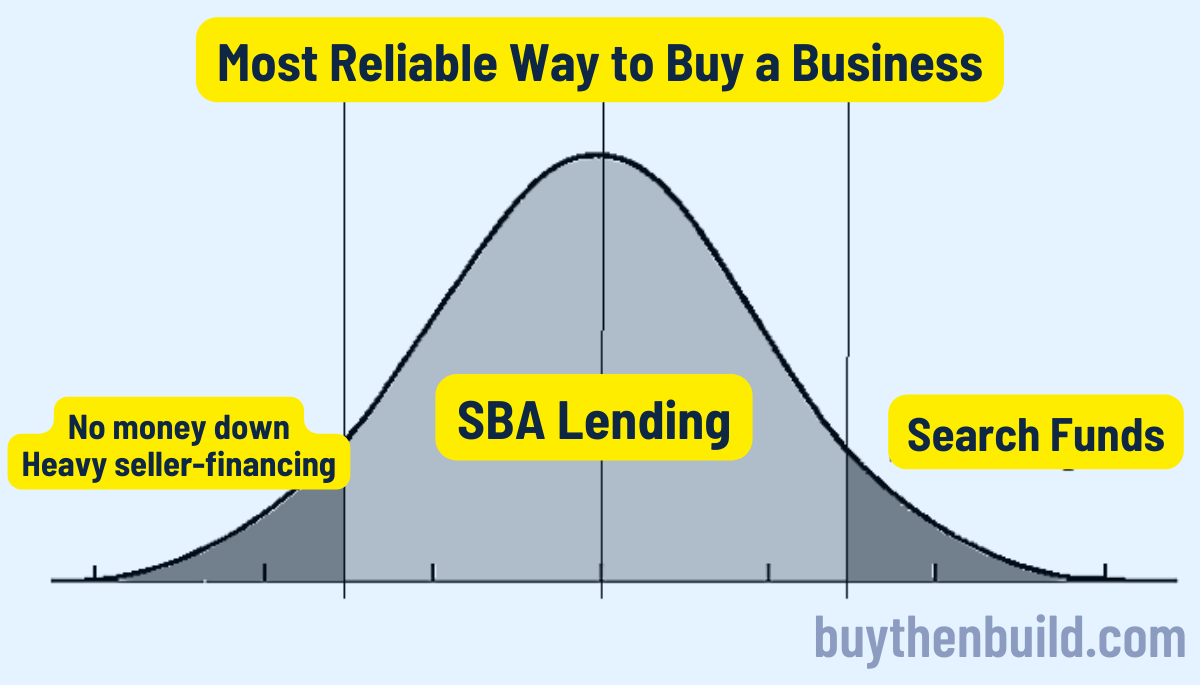

Heavy Seller-Financing

With no money down, seller-financed opportunities, the main advantage is self-explanatory. You can buy a business without using any of your own money. The purchase price can be paid by the cash flow generated by the business. Additionally, because it’s seller-financed, you don’t have to pay the purchase price in one lump sum – your business can pay it in monthly installments.

Here are other advantages to seller-financing:

- The seller can offer more flexible terms than a bank traditionally does.

- Qualifying may be easier than with a bank loan.

- Closing costs can be significantly reduced.

- The seller will continue to have a vested interest in the ongoing success of the business.

- From the seller’s perspective, they can maximize tax benefits by not receiving the purchase amount in full.

Sounds like an incredible deal for you, right? That said, if you’ve ever sold your house before, would you have considered selling it if the buyer asked you to sell your house as a 30-year note? Probably not. This type of scenario just doesn’t happen.

Unfortunately, the disadvantages may outweigh the benefits for a seller in this position:

- There is more risk involved. The seller is taking a risk that s/he may not receive the entire amount, and s/he also has to evaluate whether or not the buyer will reliably make payments.

- The seller will continue to have a vested interest in the business, which is oftentimes not what the seller is looking for. Sellers typically are looking for a clean break.

- Although there are tax advantages, the seller won’t have immediate access to the capital. This may prohibit the seller from being able to reinvest or achieve another goal without the cash.

- If the buyer defaults, the seller may have to take back the business, possibly in a poorer condition than when the seller originally sold it.

Not only is it rare for the seller to finance the entirety of the asking price, but if you do come across an offer like this, you probably should be wary of the opportunity and ask yourself why the seller is willing to expose him or herself to that amount of risk to sell the business.

Typically, seller-financing is usually just one piece of the larger financing puzzle, making up anywhere from 30-60% of the financing, if used at all. Buyers can rely on seller-financing in conjunction with SBA loans, investors, and other types of financing.

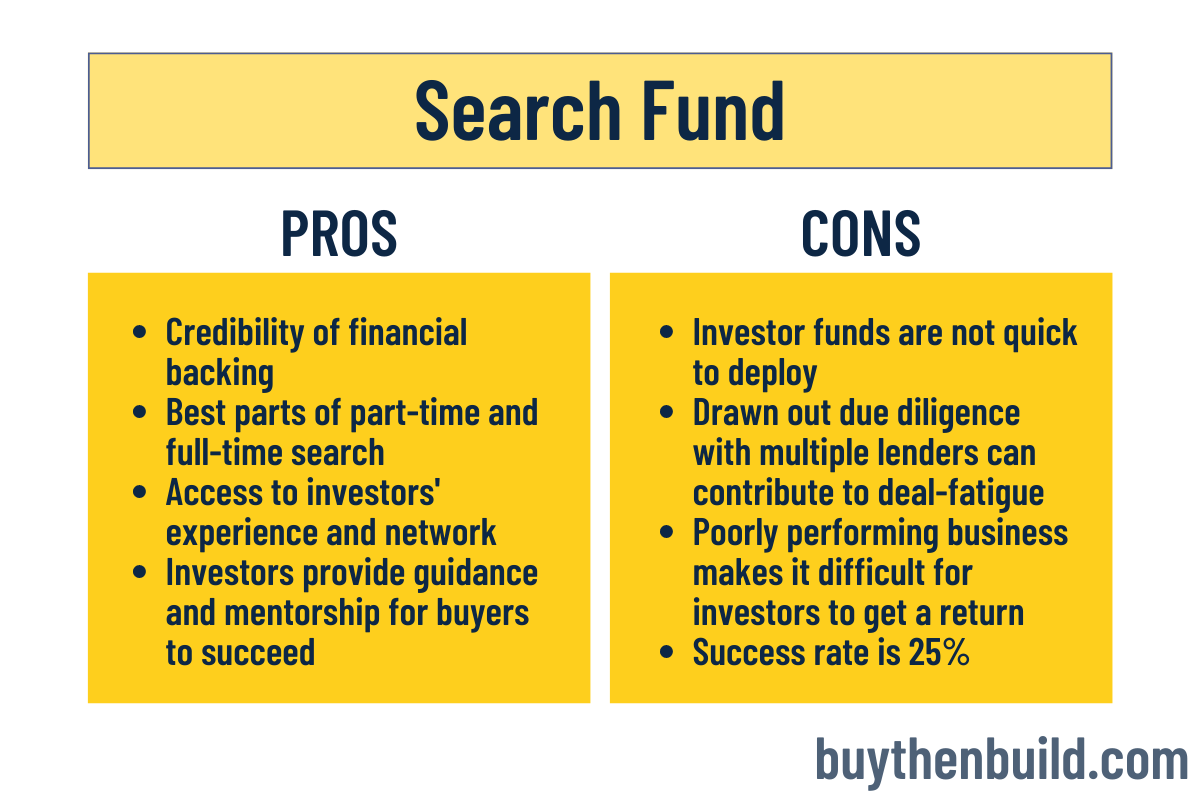

Search Funds

Search funds are a type of buyer where investors will pay you, the buyer and future operator, a salary to search full-time for a business that you will eventually run and they will have equity in. This sounds like a great opportunity for both the operator and investors. As the buyer, you get to search for a business while not having to worry about a steady paycheck, and the investor gets to capitalize on the potentially high returns of a small business.

There’s many reasons why many buyers at one point in their search consider the viability of a search fund:

- Sellers are more willing to work with you, knowing you have the financial backing to purchase their business.

- Search funds combine the best of searching part-time and full-time, allowing you to keep a salary while you search for a business to acquire and run.

- Searching for a business and running for a business can be lonely endeavors, but within a search fund, you have access to investors with relevant experience and networks to help you thrive.

Now for the challenges with search funds:

- The investor funds are there but aren’t as quick to deploy. Once you, as the buyer, are convinced a business is worth purchasing, now you and the seller have to sell the investors on it once again.

- With multiple lenders involved, there are multiple people conducting due diligence, which can create more opportunities for things to go wrong and contribute to deal-fatigue for all parties.

- If the business doesn’t perform up to expectations after being acquired, it can make it difficult for the investors to monetize their investment, creating additional stress for you as the CEO.

Although search funds have a lot of merit, the potential roadblocks with too many “cooks in the kitchen” can prevent you from being able to ever acquire a business. 25% of search funds actually don’t close on a business. It’s not an impossibility, but certainly not the path of least resistance.

That being said, similar to the more common situations involving seller-financing, acquisition financing in these situations will typically include a combination of investor capital, bank loan, and seller-financing.

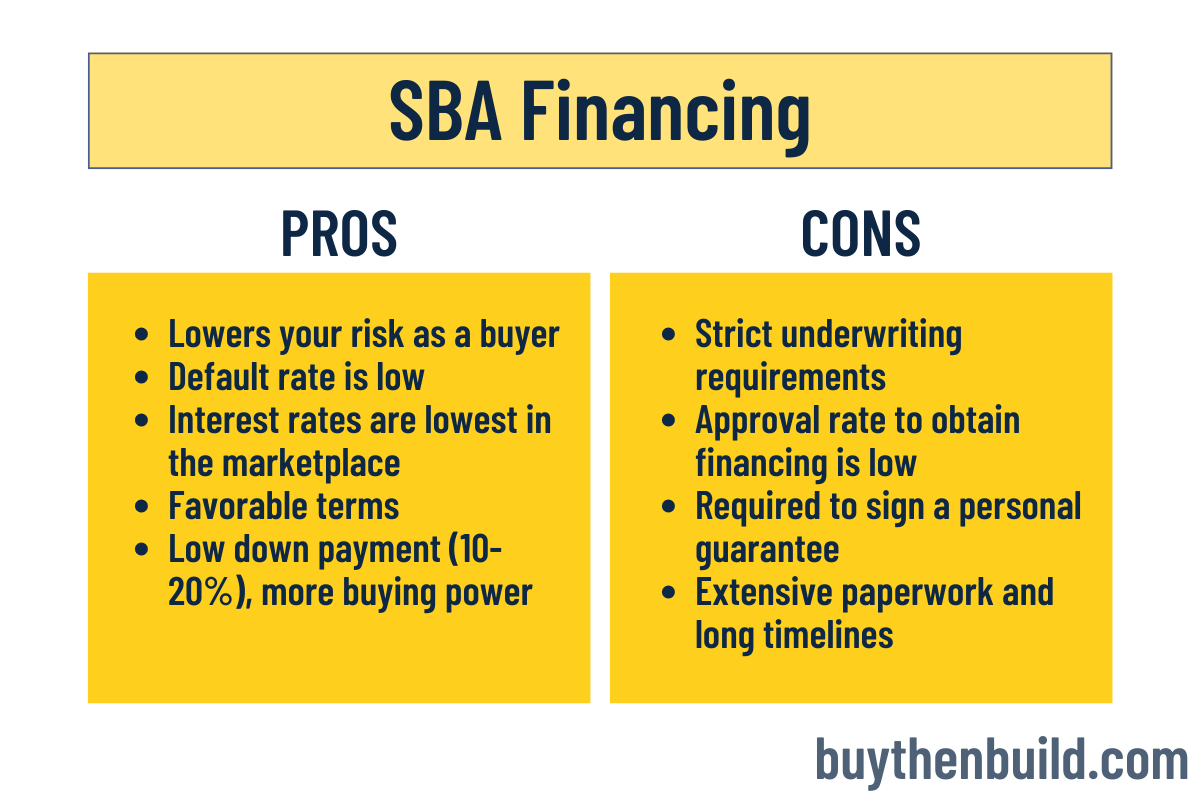

SBA Lending

An SBA loan is a bank loan guaranteed by the SBA. A business must meet strict requirements to qualify, but rates are competitive and repayment can be made over a longer time period.

The advent of the SBA loan in helping buyers acquire businesses has changed the acquisition landscape, democratizing what used to be an activity for private equity and M&A firms only. There are huge upsides to utilizing SBA lending if you can qualify for it:

- Lowers your risk because qualifying depends not only on you as the buyer but on the existing cash flow and viability of the business itself.

- Interest rates for SBA loans are about as low as you’re going to find in the marketplace. You could be looking at rates as low as 6.75%.

- You have access to a lot of capital for putting down a relatively small amount (10-20%). This give you the buying power to finance a bigger acquisition that has higher cash flow.

- Repayment terms are longer (typically 7-10 years), which allows you to stretch out your payments without putting undue financial stress on you and your business.

Low down payments, lower rates, and favorable repayment terms are wonderful, but they come at a cost. Here are some of the challenges you’ll need to overcome when obtaining SBA financing:

- Strict underwriting requirements: High credit score, bankruptcy-free record, clean criminal record, and strong business and financial histories are some qualifications you’ll need to meet.

- You typically have to sign a personal guarantee. Personal guarantees can be a big fear of many buyers, as they worry what will happen if they default, but the actual risk of default is low.

- With SBA financing comes extensive paperwork and long timelines (usually 60-90 days or as low as 45 in rare cases). This can deter sellers who want funding quickly.

Although it’s difficult to obtain SBA funding, if you can do so, you have access to some of the best rates and terms out there.

Returning to the 80/20 Rule

There’s something to be said for a higher barrier to entry.

An SBA loan is not easy to secure, but that’s because it’s a highly competitive means of financing your business.

On the other hand, if there are deals where the seller is willing to completely finance the sale of their business, you might want to ask why they’re choosing to put themselves at a higher degree of risk for what should be a highly profitable and valuable acquisition.

As for search funds, they can certainly work in helping you acquire a business to run, but the search can be laden with too many players and a drawn out acquisition process. These factors contribute to a high failure rate for search funds.

As you can see with the 80/20 rule, not all options for acquiring a business are created equally. It’s important to cut through the noise and understand what options are viable and realistic, while minimizing risk for you as the buyer. I hope this post lent perspective on what will save you time, money, and energy in the long run.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.