Usually when I talk with entrepreneurs about acquisition entrepreneurship, I get a lot of blank stares and raised eyebrows.

Why?

Because acquisition entrepreneurship doesn’t follow the traditional way of thinking about business ownership.

For one, most entrepreneurs believe that entrepreneurship is solely in startups, but that’s completely untrue and I’ll explain why soon.

Today, I’m going to unpack the five myths of entrepreneurship. I’m going to share, instead, what the truth is around these misconceptions — truth based on data, my almost 20 years of experience, and observations from within the industry.

Let’s dive in.

Myth #1: “I need to be passionate about an original idea to be a successful entrepreneur.”

If you’ve read PayPal Co-Founder Peter Thiel’s book Zero to One, the premise of the book is that anyone can take something that exists and do more of that, but to truly change the world, you need to create a business from scratch.

This philosophy is ambitious, wonderful, and ubiquitous. In fact, most of the entrepreneurship community believes, either outright or deep down, that you have to create an original, world-changing idea to be successful and have a large-scale impact.

In my 20 years of experience, though, I’ve actually seen majority of entrepreneurs not following the Zero to One model. Instead, they’re following the n+1 model.

N+1 versus Zero to One

What’s n+1? Instead of Zero to One, where you create something from nothing, in the n+1 model, you take something that exists and you simply make it better. We’re trying to build a better mousetrap in the n+1 model, not recreate markets from the ground up.

For the six years I was in Entrepreneurs Organization (EO) and served on the board, I was surrounded by entrepreneurs all the time. If you understand them like I do, you’ll understand that there is a very thriving and robust community of largely n+1 type of people.

Some of the most successful people I know aren’t changing the way we do things. They’re simply introducing an n+1 solution to the right people at the right time.

Does Passion Come Before Cash Flow…? Or the Other Way Around?

One of the most successful entrepreneurs I know who started multiple companies said to me one time,

“Walker, sometimes I’ll start a business and I’m really passionate about it, and I put in the time and effort, but it just doesn’t get going. Then I lose passion about it because it’s not going. On the other hand, sometimes I see an opportunity and I start working toward that because I think it’ll work. I know how to run those operations and make money here. Then once it gets going, this new opportunity will start to make money. And then! I’ll get passionate about it because it’s picking up momentum and the flywheel is finally going.”

People often think that an original idea backed by passion is the ticket to success as an entrepreneur, but that’s not necessarily the case. It’s fun to get excited about an original idea, but if it doesn’t have proper execution behind it, it won’t make money.

And if it doesn’t make money? The idea doesn’t work – period.

And you can forget about passion.

But, if you can start or find a sustainable business that has positive cash flow, then the passion you’re searching for will come right along with it.

The point here is that buying a business that has existing infrastructure doesn’t fall into Peter Thiel’s Zero to One concept, BUT an existing business is an already established platform for you to turn into your own n+1 business – one that will continue to make things better, solve people’s problems, and make money.

Myth #2: “I have to innovate to be an entrepreneur.”

We often associate innovation with entrepreneurship. The two concepts tend to go hand in hand, and many entrepreneurs believe if they create a business, it has to be innovative.

If you’re not innovating, you’re dying. That’s how the saying goes, right…?

If you read How the Mighty Fall by Jim Collins, a four-year long study of why the most successful businesses in America failed, this is what you’ll discover about the ones that were able to thrive:

It wasn’t the innovators that dominated industries. It was the incumbents that made the leap.

Innovators create the Zero to One businesses that change the way we do things, but it’s always the incumbents that take those Zero to One businesses, sustain them, and improve them (n+1).

It takes a certain kind of person to innovate and create from scratch. It takes another to sustain and improve.

Innovators get adopted or overtaken. And the ones that don’t make the leap will typically fail.

But as an incumbent, you don’t need to continually innovate to be a successful entrepreneur. You simply need to adjust the business based on the trends and grow from there.

Myth #3: “Venture capital is the only way to start a business.”

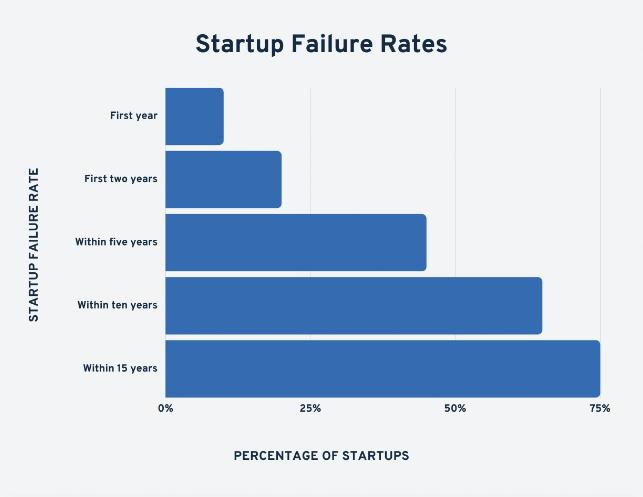

Everyone knows that startups have a high failure rate. So when we try to engineer a better way to be entrepreneurs, one that limits the downside, inevitably you get people who say that venture capital is the only way to start a real business.

There’s VC then everything else.

Is that really true, though?

A Harvard Senior Lecturer conducted a study on 2,000 companies that received venture funding between 2004 and 2010, which showed that 75% of VC-backed businesses fail. Only 25% only have an exit.

In Early Exits by Basil Peters, Peters talks about the fact that the exits behind VC-backed funds are getting smaller and happening earlier in the process everyday. Now, even though there’s success for an increasingly smaller number of businesses, here’s the real point:

The house always wins.

Venture capital is a venture capital game. It’s not an entrepreneur’s game.

It’s great for entrepreneurs to have a shot to bat, but venture capital as a whole only works because of portfolio theory – balancing the numerous losses with the extraordinary wins. So while starry-eyed entrepreneurs feel like they’ll luck out if they get a VC to back them, venture capitalists inherently understand the 75% failure rate and they factor that into their decisions.

At the end of the day, VCs don’t solve the struggle of startups being a bad vehicle to get into entrepreneurship, and it is certainly not the only way (or the best way) to start a business.

Myth #4: “Startups drive the economy.”

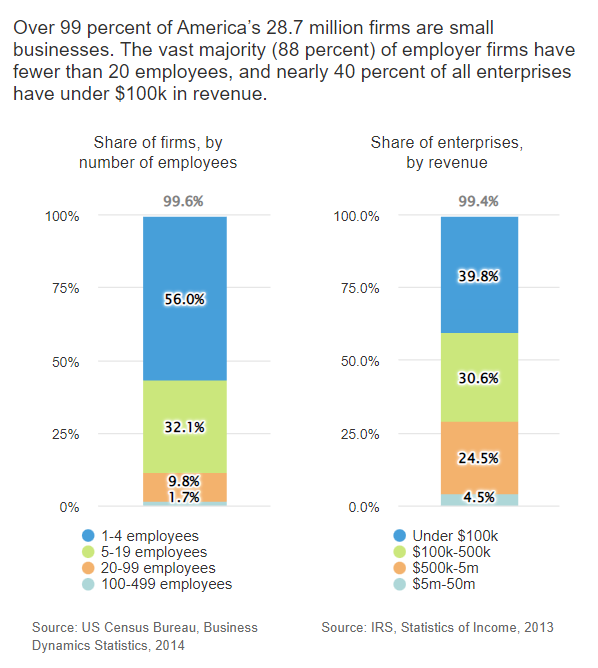

Many entrepreneurs believe that startups are what drive the economy and provide the majority of the jobs in the US.

That’s actually incorrect.

In 1987, author and economist David Birch developed the idea of “gazelles” to describe one million dollar revenue businesses that grow 20% every year for four years.

In his book Job Creation in America: How Our Smallest Companies Put the Most People to Work, Birch asserted that small companies were the biggest creators of new jobs in the economy. Gazelles make up only 4% of all US companies, but they account for 70% of new jobs.

Here are stats from the last decade:

Unlike what most people and entrepreneurs think, it’s actually not the startups or even the big companies that provide the most jobs – it’s the businesses right in the middle.

Interestingly, it’s not even the size of the company that determines its ability to drive the economy and provide jobs. It’s the steady 20% growth every year that accounts for that company’s ability to employ more and more people.

Myth #5: “I need to be rich to buy a business.”

There’s a common misconception out there that you need to be loaded to buy a business. That’s not true, and I’ll explain why.

Due to trends in the Small Business Administration (SBA) that started in January 2018, you are now able to get cash-flow based loans to buy businesses.

Now, if you remember that only 4% of all companies in the US reach one million dollars in revenue, the greater point here is:

You can buy one of the top 4% of US companies for less than $100,000.

The only way this works now is because you have access to loans from the SBA. Nowadays, there are also other lenders that will provide you the funding you need to pay for a business you might not ordinarily be able to afford.

It’s certainly easier to raise $100,000 to $200,000 than it is to raise $1 million, and at the terms some of these loans are offering, you only have to pay a small fraction of the overall purchase price for a cash-flowing business.

And sure, there are institutional investors moving into this space, but it’s not so overly saturated that you don’t have a shot.

The point is still the same – you don’t need a lot of cash to buy a business, and becoming an acquisition entrepreneur is very much a real opportunity available to you right now.

You can take a fraction of the risk in order to have a greater impact – sooner.

Watch Walker’s vlog here as he talks about the 5 Myths of Acquisition Entrepreneurship here.

Interested in acquiring a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get everything you need to know about becoming an acquisition entrepreneur.