If you’re like most of our buyers in the Acquisition Lab, you may be calculating how large of a business you can afford based on how much you have saved up for a down payment.

Depending on how much you can pool together, you may not currently be able to afford the size of business you were hoping to purchase, and this is where an investor can help.

There are perks to buying bigger businesses. With a bigger business typically comes a product or service that has been proven in a market, operations are more established and tested, and more importantly, a bigger business equals greater cash flow.

With more cash flow, not only do you have more money to be able to pay yourself a salary, but you also have the leeway to reinvest that cash flow to scale the business. Scaling a small company with “resource poverty” is more difficult than scaling a larger one. In a small company, a $10,000 mistake could kill you, but sometimes you have to take those $10,000 risks to capitalize on opportunities to grow.

Having enough cash flow to reach your goals is vital to give your business the chance to live up to its fullest potential.

With that detour out of the way, today’s post is all about how to find investors so you can get the money you need to buy the size of business you want. (Last week, we discussed the seven types of investors, in case you missed it.)

We’re going to assume that you’re already going through the steps to get SBA lending or another lending option to finance a majority of your purchase, so we won’t be discussing lending options.

Instead, we’ll cover the five main ways you can find investors:

1. Ask friends and family for capital

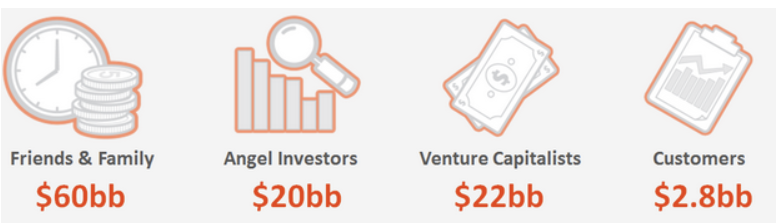

Asking friends and family for cash may be the easiest way to raise money (depending on who you ask, of course). It also is one of the most common ways business owners raise money. Friends and family invest over $60 billion per year. 38% of startup founders report raising money from friends and family, with the average amount being $23,000.

Friends and family can provide the capital buyers might need for the down payment, and depending on their interest and experience, they can also become a partner in the company.

You can decide if you want to structure the capital received as a loan or as an investment that you pay back later on. With an investment, your friends or family may have a stake in your company, sharing risks with you. On the other hand, you also won’t need to pay monthly installments as you would with a loan.

Many people are wary to rely on friends and family for money, but the key is having a very detailed plan outlining how much friends and family are willing to invest and terms of repayment and equity. This can be the quickest and most cost-effective type of capital to raise.

Pros

- Familiarity. Friends and family are more inclined to help because they know, like (love), and trust you.

- Less bureaucracy. This is an easier means of getting funding that doesn’t require a long timeline or a qualification process.

- Negotiable rates and terms. Investments from friends and family don’t need to follow the same regulations and requirements bank financing does, so there’s leeway here on both ends to negotiate.

- Not a loan. The investment doesn’t have to work as a loan, so you don’t need to pay monthly installments.

Cons

- Worst-case scenario. If things go south, this may put a strain on your closest relationships.

- Familiarity breeds contempt. Having friends and family as investors who hold equity in your business may be mixing work and family a little too closely for comfort.

Suggestions

Although raising capital from friends and family may be a little more informal, we wouldn’t recommend approaching this casually or assuming that it’s guaranteed. We suggest conducting a proper pitch with your business plan and clearly outline when and how they will make their money back. Don’t fail to cover the risks they’re taking by investing with you.

Make sure you have an agreement created that governs your relationship with them, what your individual responsibilities are, and the payment plan. Having something written will formalize the process and protect everyone involved.

2. Network

Networking is a great way to find an investor, build business relationships, and establish your reputation as a business owner. Typically, people tend to run in the same circles, so once you start to meet a handful of people, you can easily get connected with others who are aligned with your goals.

Networking is also helpful because you want to meet investors where they are. I’ll provide some recommendations below, but overall, you want to brainstorm where other business owners and investors may frequent.

Pros

- Expanding your circle. Even if you don’t meet investors, you will still meet people who can help you solve business problems or become partners/investors in the future.

- Accessible networks. The great thing about many groups is that there aren’t many restrictions on who can participate. You can join a number of different groups and have access to relevant people in the industry.

Cons

- Time investment. Networking is an investment in itself. It may take a long time to meet the right people and get going, but in the long run, you’ll have a contact list of people who will help you for years to come.

- Pitch perfect. When meeting new people in networking environments, you have to make sure you can make the best first impression and convince them in a short timeframe to work with you. There is no room for error in these conversations.

Suggestions

Here is a list of different places you can check out to start networking with investors:

- Co-working spaces

- Industry trade shows

- Accelerators

- Chambers of commerce

- Other business associations (e.g. BNI)

- Alumni groups

- Local schools

3. Crowdfunding

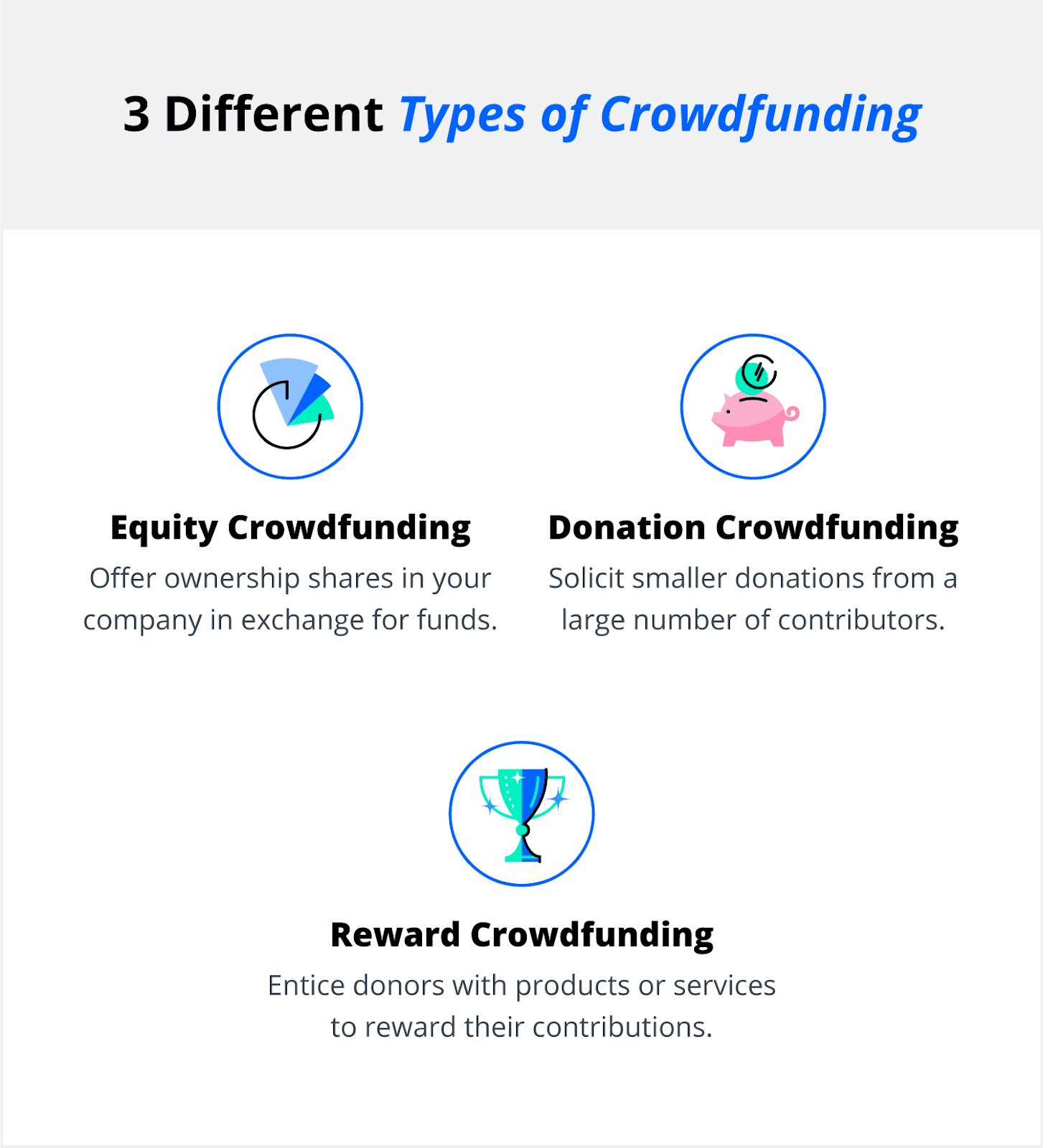

Crowdfunding is just like it sounds. It’s “the use of small amounts of capital from a large number of individuals to finance a new business venture.”

There are three types of crowdfunding:

- Equity crowdfunding

- Donation crowdfunding

- Reward crowdfunding

Equity crowdfunding

In equity crowdfunding, you will offer shares of your company to investors in exchange for their funds. This setup doesn’t utilize debt and substitutes equity instead.

Pros

- Not a loan. The investment doesn’t have to work as a loan, so you don’t need to pay monthly installments.

- High ceiling. You can raise up to $5 million each year from accredited and normal investors. Additionally, you may be able to raise more cash since you’re providing equity in your company.

- Good marketing. Crowdfunding from equity investors can create a buzz about your business and create new connections with customers.

Cons

- Legwork. You’ll have to put in a lot of time and effort to prepare a pitch deck that extensively covers your business plan and company operations.

- State and federal requirements. You’ll have to keep an eye out for filing rules, and you also have an obligation to report to your shareholders about the health of your company.

Suggestions

Here are a few platforms that can offer equity crowdfunding. You’ll have to research further to determine if these are a good fit for acquiring businesses or only for startups.

Reward-based crowdfunding

Otherwise known as “seed crowdfunding,” reward crowdfunding offers a reward to donors that is usually the product or service you sell.

This type of crowdfunding is generally reserved for smaller startups working to develop a product – versus an existing business.

Pros

- Cheap. Since you can produce a product or service at-cost, it’s a cheap way to raise capital.

- Low requirements to obtain. No requirements for collateral, credit check, or previous business experience.

- Retained equity. You don’t give up control of your company in exchange for capital.

Cons

- Small amounts. Individual donations don’t tend to provide the large amount of funding you may be looking for.

- High stakes. You may need to forfeit money you’ve raised if you don’t reach your goals.

Suggestions

If this type of crowdfunding is aligned with the business you purchase, here are some recommendations:

Donation crowdfunding

Donation crowdfunding is just as it sounds–you collect donations from donors who support or believe in your business without any expectation of return on their money.

Pros

- No reimbursement. Donated capital doesn’t need to be reimbursed.

- No equity. You do not share equity with the donors.

Cons

- Lower amounts. Donations can be much lower than funds from other sources.

- Low success rate. Donation crowdfunding campaigns often don’t meet their fundraising goals.

Suggestions

For donations, you can try Kickstarter or Indiegogo.

4. Peer-to-Peer Lenders

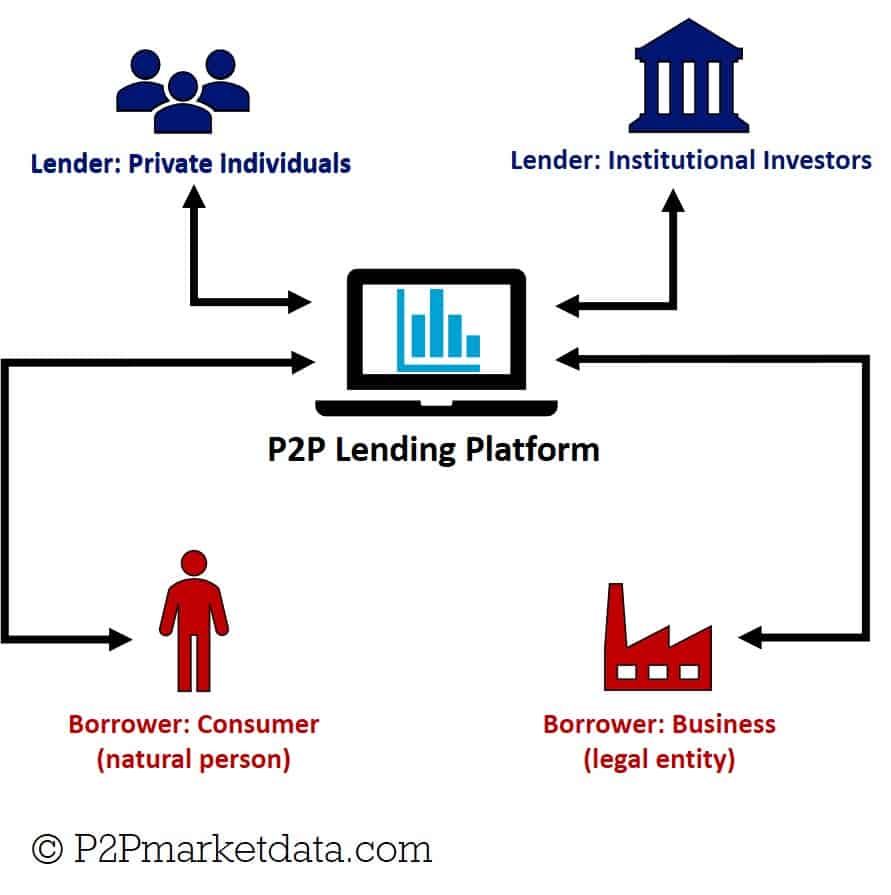

Peer-to-peer (P2P) lending connects borrowers with investors who can provide you with a loan. Sometimes, investors are looking to maximize their returns, but in other cases, there are mission-oriented investors who like to lend to businesses they believe in.

Pros

- Less lending qualifications. You may have an easier time qualifying for a P2P loan than a bank loan, especially if the loan operates similarly to crowdfunding.

- More attractive rates. P2P lending platforms and provide more competitive rates than a standard bank loan.

Cons

- Additional fees. There’s a chance you may have to pay other fees on top of the interest rate charged for the loan.

- Lower amounts. Loan amounts can generally be much less than you might get if you were to go through traditional bank financing.

- No protection. In the event you default on the loan, you may not get the same protect you would if you go through a traditional lender.

Suggestions

If you’re looking for a peer-to-peer lending platform that supports business acquisitions, check out:

5. Social Media

Social media is the digital version of networking. There are many easy features about it that make it a viable alternative to in-person networking.

Pros

- Cost-effective. Whether you utilize free platforms or upgrade to access paid features, the costs involved in using social media are minimal, especially when compared to in-person networking opportunities.

- Easy to get discovered. You don’t have to go anywhere to connect with people. Your profile and content can sit there, and with the right effort, investors can easily discover you.

- Various approaches to connect. Whether you prefer to cold message investors or attract them based on the quality of your content, there are many different ways to build relationships online.

Cons

- Noisy. Social media can be saturated with other voices and competition potentially asking the exact same thing you are.

- Time investment. Building out your presence online and conducting outreach can be pain-staking and take a lot of time for seemingly little effort. However, if it pans out, it can be worth it.

Suggestions

Here are the most relevant channels for you to use to find investors:

- LinkedIn for direct messages to or introductions with potential investors. They can easily review your profile to get a quick idea of your professional background, and it can serve in some ways as a continuation of your pitch. LinkedIn Premium may be worth it to you to gain access to additional searching features.

- Facebook “for meaningful relationships after you have been able to meet with an investor once or twice.” It’s not enough to make a connection–building it is important to generate trust and Facebook can allow you to do that.

- Twitter is a platform packed with relevant information, thoughtful conversations, and hot takes by people in the industry. Because there is so much content available around business and investments, this is a great platform to connect with potential investors by getting in on conversations.

It’s not enough to simply be on these platforms. Follow these tips to maximize the time on social media:

- Build social proof

- Be visible

- Maintain presence by staying active

- Share stories – people connect most to stories

- Create a sense of urgency

You now have five ways to search for and find investors to help you buy your business.

Whatever means you decide on, make sure you are ready for any opportunity that comes your way to communicate your business plan and specifically how you’re looking to partner with these investors. Frame the opportunity as a way for you both to “partner” together in a mutually beneficial scenario, versus “asking” them for a favor.

Stay tuned next week, when we discuss what investors are looking for and what you should avoid in your partnerships with them.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.