As a buyer, knowing how to analyze a business is crucial to the search process. I’ve talked about how to evaluate a business’s opportunities in the past, and the reason why is that you need to have a clear idea of where point A is (where your business is today) and where point B will be (where you’re taking it).

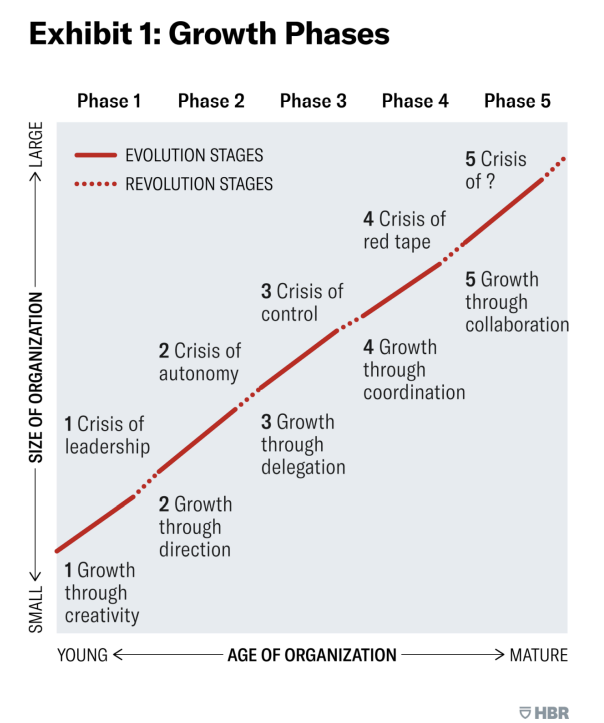

A number of analysis models can help you identify and articulate the current state of your business and the potential it has to grow, and one of these helpful frameworks is the five stages of small business growth.

This model was developed by Professors Churchill and Lewis and was published in the Harvard Business Review in 1983. This framework will help you understand what stage your desired business is in, what its next stage can be, and how you as the new owner can help it get there.

Existence Stage: The Starting Line

The first stage of growth in any business is to just exist. Its strategy here is to simply remain alive.

In order to exist, the business is primarily concerned with how they’re delivering the product and whether or not they can attract and convert customers. The key challenge for a business in this stage is establishing product-market fit.

The weight of this stage is usually lifted by two things: one, the owner’s ability to execute on product delivery and make sales, and two, cash flow to support operations. More likely than not, the owner is doing everything, and if s/he has any subordinates, s/he is directly supervising them. There aren’t many systems or processes to back up the company’s operations, and the owner oftentimes is the business. Without the owner performing most, if not all, of the tasks, the business would wither away.

Most startups fall into this category. These businesses are just starting from scratch, regardless of the industry (e.g. retail, software, or any other), and they have yet to stabilize production, product quality, or customer acquisition.

For businesses that continue to garner a greater share of the market by attracting more customers and delivering better on a quality product or service, they move onto the survival stage.

Survival Stage: Making It Through (<$1MM)

Companies in the survival stage have established product-market fit: they have enough customers and are able to satisfy them with their products or services. However, their main concern at this stage is cash flow. Although there’s an existing product-market fit, the business is generally cash poor. It’s covering its expenses and the owner probably draws income from the business, but the business isn’t able to get out of the owner-operator model.

Companies at this stage should ask themselves two questions:

- Does the business have enough cash to break even and keep up with necessary expenses, including repair and maintenance of inventory?

- Can it continue to generate enough money to stay in business and grow to the next stage?

I categorize businesses in the survival stage as making less than a million in annual revenue. Considering that 96% of all companies that continue to exist never exceed a million dollars in revenue, that means 96% of all businesses don’t transcend the survival stage.

Similar to the existence stage, companies in the survival stage may have a limited number of employees, but no one makes major decisions and instead relies on the owner for clear guidance and direction. The survival of the business is wholly dependent on the owner, still. Mom-and-pop businesses fall into this category.

Being in the survival stage is an exalted version of existence – the business exists but never actually goes on to thrive. It will either grow and move onto the next stage, or it will maintain marginal returns on time and money, going out of business when the owner retires or moves on.

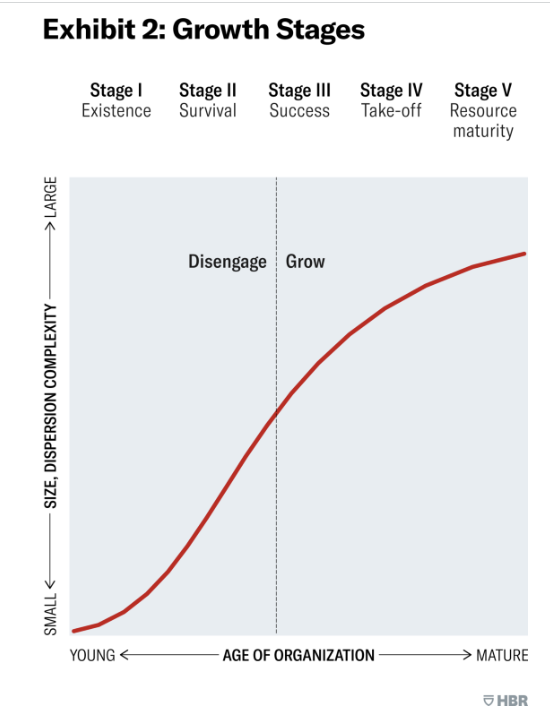

Success Stage: Decision at the Crossroads ($1 – 25MM)

The next stage is success. This is where a business faces a fork in the road: it can either be a platform for growth, on a well-defined growth path, or the owner can simply use the business as a “cash cow” while s/he hires managers to run the business so s/he can disengage from the business. I also define this as a company with an annual revenue of anywhere from $1 to $25 million.

We break down the two paths as disengagement and growth.

Success-Disengagement

In the success-disengagement substage, this is where the owner has decided to disengage from the company while maintaining its level of success. From a performance standpoint, the company is financially healthy, has established product-market penetration, and earns above-average profits. Barring a massive and unexpected change or ineffective management, this company can stay here indefinitely.

Unlike with a survival or existence business, the owner is choosing to disengage to enjoy the next level of his or her life, whether that be through retirement, starting a new business, running for office, or simply pursuing his or her interests outside of work.

As a buyer, these are great businesses to buy. They can serve, at the very least, as a cash cow for you as the new owner, but there may also be low-hanging fruit you can address, such as increasing online marketing or streamlining operations, in order to see wins and growth in the short-term.

At this size and level of success, the company will likely need functional managers to take over duties the owner performed, and systems for finances, marketing, and operations are in place. Planning, budgeting, and forecasting occurs and supports the operations and employees of the business.

There are certain circumstances, such as a product-market niche that doesn’t permit growth, that prevent a company in this stage from growing; however, other owners actively choose to disengage from the business, later deciding to sell or merge their business for a profit.

Success-Growth

The success-growth substage is when small companies go on to become larger companies, and in order to make that leap, this is when the owner risks it all. The owner says to themselves, “Okay, I’ve gotten to this place where I own a successful business. I could chill out, play golf, and own a cash cow, or I can pull all the resources together to push the company to the next level.”

The success (and growth) of the business from this point is going to heavily depend on the people in the business (necessitating the owner’s ability to delegate), strategic planning, and the systems put in place to execute operations. That said, although the owner needs to delegate to the business’s growing team, this doesn’t mean the owner disengages, like in the alternate substage. The owner is more engaged in the business than ever, working on the strategic planning required to take the business to the next level.

For example, there’s a gentleman I knew who read Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game and already had a successful business. To grow his business, he went out and raised $10 million in debt from the value of his intellectual property. Now, he’s growing through acquisition, adding to his team, and rolling out different aspects of his roadmap. Today? His company is currently valued at $80 million. He did all this simply by strategically planning his growth through acquisition and having the capital and the right team in place to make it happen.

There are two important things to do in this substage.

- Ensure the business stays profitable, so there’s continual cash flow to support its growth.

- Hire managers that are primed for the future of the company – not the current reality of the company.

If the company isn’t successful in its efforts, the leadership may be able to diagnose why and shift the company to disengagement or it may fall back into the survival stage (before a possible bankruptcy or distress sale).

However, if it’s successful in growing, the company in this substage moves onto the next stage: take-off.

Take-off Stage: Launching Toward Growth

In this stage, a company is in the middle of growing rapidly, and the main problems revolve around how to grow and how to finance it. This will depend on the owner’s ability to properly delegate, allowing employees to make mistakes and learn throughout the process – instead of simply letting go of roles and expecting them to be performed at a high standard from day one. Additionally, this phase requires the owner to be patient and control unnecessary expenses in the meantime in order to free up adequate cash flow to support growth.

The organization of employees looks similar to that of the success-growth substage, but it’s important in the take-off stage for managers to be competent enough to handle the complexities of an expanding business environment. As the company grows, its systems become more sophisticated and extensive, as they have to handle a large amount of input due to the growth that’s happening. Although the owner isn’t involved in all the processes it takes to run the business, the company is still very much driven by the owner.

Whereas in earlier stages, the business relied on the owner for its mere existence or survival, now the business relies on the owner, financially and managerially, to grow into a big business. If the owner isn’t able to rise to the leadership challenges required in this phase, the business can be sold profitably, if s/he makes this realization early enough in the process.

Maturity Stage: Reaching the Plateau

After the take-off stage, the final stage is maturity. Here, the main concern a company has is to manage the financial gains from the growth phase while maintaining the entrepreneurial spirit of a smaller company. From an organizational standpoint, the business is staffed appropriately and systems have been battle-tested. The owner is separate from the business, as the business is largely running on its own, with the help of a full staff and well-developed systems.

From this point, the company will continue to be a powerhouse in its industry if it is able to retain its entrepreneurial spirit – otherwise, it will inevitably experience an “ossification” that comes from lack of innovation and risk-taking.

Managing Cash Flow and Equity after Business Acquisition

It’s important to note – when you acquire a business, especially one in a later stage like success-disengagement, your company may be reverted back to an earlier stage, such as survival, because the influx of debt you’ve suddenly taken on can significantly restrict cash flow. When this happens, shift your focus back to the foundational aspects: building equity, preserving cash flow, and learning how to operate the business yourself as the owner.

Private equity firms, for instance, typically invest 40 to 60% in cash upon acquisition to manage the debt load effectively, aiming to lower principal and interest costs to make more cash available for operations and growth. They strategically cut expenses and plan exits within three to five years, aiming to sell the business at a higher valuation. As an acquisition entrepreneur taking on substantial debt—around 80 to 90%—you effectively find yourself in the same cash flow constraints of the existence stage. At this point, you have to go back to basics for some time before you can look to scale operations or optimize systems for growth.

That said, once you’ve stabilized the new business and built up equity, you can make your own decision in the success phase: manage the business conservatively as a cash cow or aggressively drive growth towards the take-off stage.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.