There is no such thing as passive income.

All income costs something: it costs time, it costs money, or both. We cannot pretend that time is free.

Let’s discuss a different framework to navigate this path.

Earliest Pursuits of Passive Income

Early in my career after acquiring my first company, I was trying very hard to build a small content site on the side. Something like a blog that I could build to generate passive income. After working on it for a few months, I remember thinking, “This is a lot of work”.

This was the same realization that I had when exploring the idea of real estate. While trying to figure out rental strategies, marketing techniques, how to maintain them, and the overall management of them, I realized that it was very, very time consuming. This led me to understanding the need for a property manager.

Ultimately once I hired property managers, I realized that I didn’t have time to work on it. As a result, I was giving away all the profits to a bunch of other people. This led to the understanding that I needed more properties to fund these people which drove me to building my own team.

In other words, build a business around building passive income. Therefore, it takes a lot of work.

Active Investing vs. Passive Investing

The best way to accelerate wealth and lifestyle is through active investing as opposed to passive income.

If we invest our time, it’s called active income or earned income.

If we invest our money, it’s called passive income.

It all seems to come down to whether you’re spending your time or your money.

But at the end of the day, what I want to emphasize is they both take time which is why it’s not truly “passive” in the sense of not requiring effort or time.

Real Estate

You can go to Bigger Pockets, one of my favorite real estate sites for real estate investors and search “how long does it take to manage real estate properties?”. You’ll see rules of thumb of four hours per unit. This is what it costs of your time.

One common theme repeated throughout was I’m spending X amount of time managing my facilities and then an additional 15 to 20 hours a week looking for new properties so I can expand.

In other words, I’m building a business by building different passive income items.

Laundromats

The thing is people that become ultra-wealthy don’t end up owning 20 laundromats. That’s not really what’s happening. They’re stacking the income upon something else. Unless you want to be cleaning and picking up quarters or whatever else for your 20 laundromats, then you’re going to be managing and paying for a team to work the business for you.

Digital Asset Strategy

For the past 3 years, I’ve made between $3,000 and $5,000 a month completely passive from book proceeds from Buy Then Build.

However, let’s break down how much time and energy went into being able to write this book and have this level of success.

- 10 years buying companies

- 2 years getting an MBA

- 1 year as a stockbroker

- And a little time working in Corporate America

Let’s look at the financial investment that I made which allowed this book to be written.

- My entire net worth

- Millions of dollars of personal guaranteed debt over 10 years

After all that work and all those funds, I spent four and a half years writing it. I started over from scratch three times. I then spent over a $100,000 on the best teams I could find to help launch the best product possible.

There’s always time involved in things that are passive.

A Mindset Shift

What I’ve come to find out is that the goal shouldn’t be trying to increase passive income.

Instead focus on be increasing the dollars that we make per hour worked and then apply income stacking on top of that.

Look at someone like Elon Musk. Iconic classic entrepreneur.

Last year, he was paid $6.6 billion in income from his companies.

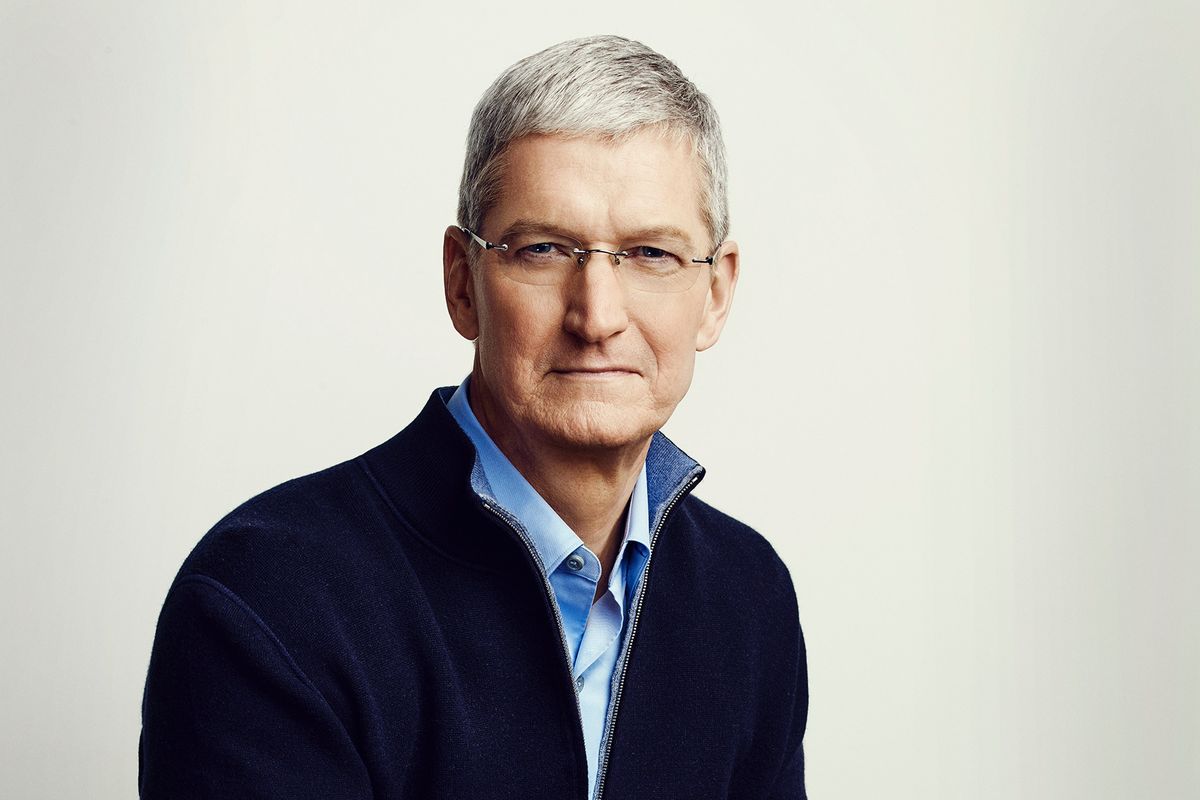

Tim Cook, the CEO of Apple, was paid over $300 million in annual salary last year. He’s likely not working more hours than every other person because we all have the same amount of time. He is not making $350 million a year by focusing on passive income. He’s comfortably living off a portion and then finding investments for the rest.

By focusing on increasing your dollars per hour, you’re then able to take that cash and income stack on the back end by building up teams.

Income stacking requires building teams to create profitable businesses that you don’t spend a lot of time in.

Passive income is having profitable businesses that don’t require much of your time. So, after spending 4.5 years writing and a whole bunch of money, now I get passive income.

When you look at highest dollars per hour, you’re able to focus on what it is that you want to do.

You’re finding the thing that matters, which is dollars per hour worked, and you’re overlapping it with things within your control and that’s where you should focus.

That’s where you’re going to be able to create the lifestyle you want. You’re going to be able to build wealth for you and your family and your employees and have an impact in the world in terms of helping your customers and doing the things that you want to do.

- You can build a team, make less money, and have them do a lot of the work…

OR

- You can be active and grow and build your business, your wealth, your customers, et cetera.

Active Investing Approach

When looking at where someone can put their money to work, there are so many different potential paths to follow.

What if I said, “Hey, recognizing that passive investments also require your time, here’s this investment that is going to give you 25 to 30% returns. Are you interested?”

Most people would think you were confused. They’d question the stats there.

But yes, buying an existing company repeatedly shows 25%, 30%, even 35% annual returns on your investment.

The reason for that is because it’s an active investment.

It’s an active income or what should be called active investing.

So, with a passive investment like a real estate building, you’ve got the benefit of the equity buildup. The appreciation is going to be about 2% a year on average. The value of that building is going to increase at a slow 2% rate and the cap rate might be like 6%.

Let’s take that cap rate and apply that capitalization rate to a business. You’re typically going to get about a 30% return plus or minus. Instead of growing 2%, you’re active in the business and you can grow your business to whatever you’re able to grow it to.

This is aligning your time and your earned income with invested dollars to get these exceptional returns.

Most people with the biggest names in entrepreneurship founded companies but many acquired them at early stages and then grew them. Elon Musk bought Tesla or PayPal was purchased, too

With the equity buildup and aligning your time with your invested dollars, you can actually get outsized returns. You also have control over that appreciation factor.

Find the impact that you want to have in your life. Find the lifestyle that you want to have in your life, put your back into it, and then either start that business and build it from scratch or buy a business and build it. I have done both. I am a fan of both. Neither one should apply all the time.

Planning on buying a business in the next 12 months? Consider applying today to the Acquisition Lab, our do-it-with-you buy side advisory service. You’ll gain access to world-class education, support from our team of experienced advisors, a suite of tools, and a vetted community to help you succeed in that first acquisition or in implementing a grow-through-acquisition strategy.