There’s a reason why I wrote Buy Then Build and built an educational platform and community around acquisition entrepreneurship. It’s because I believe and know from decades of experience that acquiring businesses is one of the most reliable ways to generate significant wealth.

That said, acquisition entrepreneurship is still fraught with risk. If it wasn’t, everyone and their moms would buy a business.

However, risk doesn’t inherently make acquisitions bad investments – risk is simply something that needs to be managed. Identifying and managing risk in the acquisition process, pre and post close, allows you to reach your goals while mitigating any associated losses that come with the process.

Today, I’m going to discuss what risk looks like in acquisitions and how you can offset these risks to maximize your success as a buyer and acquisition entrepreneur.

The Nature of Risk in Acquisitions

Business risk, put simply, is an accumulation of controllable and uncontrollable factors that can contribute to an acquisition’s success or failure.

Source: Investopedia

But taking on risk is the gamble entrepreneurs and investors take for a potential greater pay off. As a buyer, when you take on risk, you do so with the expectation of achieving an outsized return or at least securing a margin of safety for the risk you’re assuming.

However, the challenge lies in the varying unpredictability of outcomes.

Two buyers can take on identical risks but experience complete success or failure in their acquisitions due to external factors beyond their control. Unfortunately, one is deemed a business genius whereas the other one, well, isn’t.

As Warren Buffett aptly put it, “When the tide goes out, you can see who’s been swimming naked.” When it comes to acquisition risk, this means that while risk is invisible, external events can eventually expose whether you’ve managed your risks wisely or not at all.

Types of Risk in Business Acquisition

When it comes to business risk, there are four types of risk:

- Strategic: Strategic risk is what occurs when a business deviates from its business plan, which can lead to reduced effectiveness and difficulty in achieving goals.

- Compliance: Also known as regulatory risk, compliance risk is found largely in industries that are highly regulated, such as energy, healthcare, vehicle manufacturing, finance, and more.

- Operational: Very simply, operational risk is what occurs when a business’s day-to-day operations make the business fail to perform.

- Reputational: When a company suffers from damaged reputation, for whatever reason, this can cause customers to leave or diminished brand loyalty.

Although these types of risks certainly apply to business acquisitions, there’s an additional layer of risks buyers face in acquiring a business.

Here are just a few examples of risks specific to business acquisitions:

- Transferability: Transferability of a business from the seller to the buyer is key in minimizing risk. So many known and unknown things can occur during the transition from the seller to buyer that the entire process of transferring becomes a risk on its own. The easier it is to transfer a business (think turnkey businesses), the less risk there is.

- Financial stability: Because of the inherently risky nature of transferring a business, having adequate profitability and secure revenue models (e.g. recurring revenue) can create a buffer of stability during the transfer process when acquiring a business.

- Low Concentration: A business that doesn’t have product or supplier concentration won’t suffer if one product or supplier stops working. This ensures no one product or supplier is a single point of failure, which is a major risk for any buyer.

- Staff Organization: Employees can be a liability if there are too many, not enough, or not the right ones. A smart buyer will gauge how much risk the current staff presents and what steps to take regarding the staff to manage those risks upon taking over.

- Deal Structuring: How you and the seller decide to creatively structure a deal (using seller financing, cash down, loans, earn-outs, and more) will determine whether you can afford the business and generate cash flow from day one – or if you’ll lose money in the long run.

Evaluating Risk in Business Acquisition

Risk can frequently go one of two ways: really good or really bad.

Risk combined with volatility can lead to disaster, while risk coupled with a tailwind can result in remarkable success.

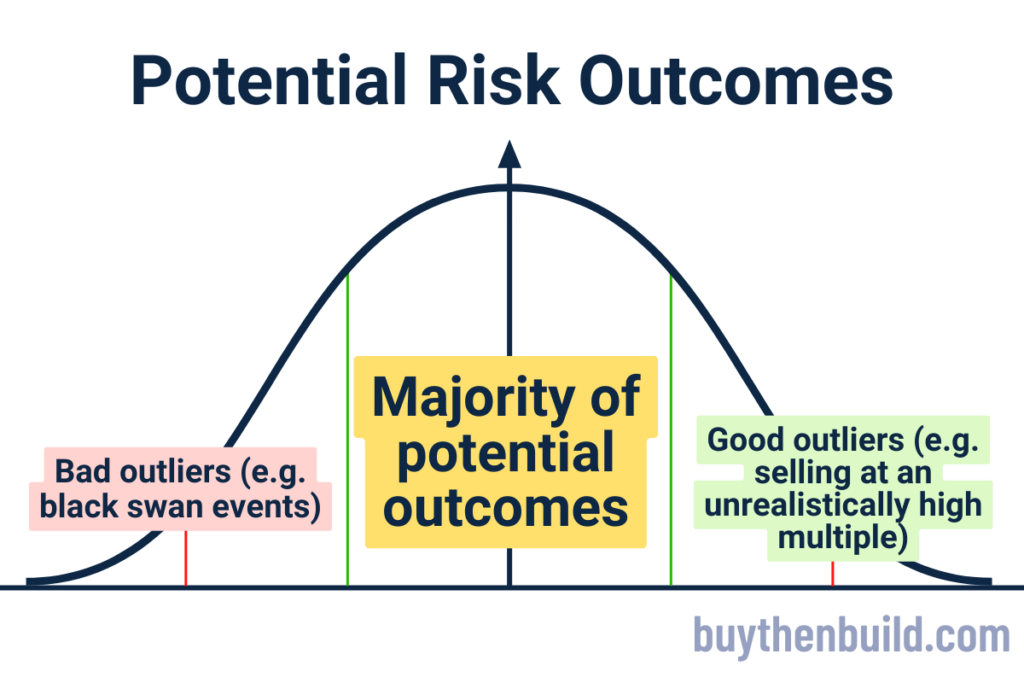

When evaluating an acquisition opportunity, it’s important for you as the buyer to consider what the potential outcomes will be and the likelihood of those happening. Typically, the majority of outcomes can be represented by a bell curve, where 80% of results fall within a standard deviation of the average.

We base our expectations on what is likely to happen in the near to midterm future. However, outliers—both positive and negative—can occur. Extraordinary events like black swan events (e.g. housing market crash of 2008, pandemic, etc.) disrupt expectations entirely and can lead to significant downturns or unsustainable bubbles that will require a correction later on.

The Right Way to Approach Risk

It’s important to remember that risk is something to be managed, not avoided.

Approaching life with excessive caution to avoid all negative events will ultimately limit your success. You’ll be unable to create significant value, impact, wealth, and enjoyment, as your decision-making stems solely from a place of fear.

On the other hand, obsessing about the outliers to the right of the bell curve isn’t healthy either. If you find yourself doing this, you might be dealing with unchecked greed that can lead to unrealistic expectations and impulsive decisions.

That said, as acquisitions entrepreneurs, you can only achieve your desired outcomes by taking calculated risks that others shy away from. Having been around entrepreneurship since the late 90s, I’ve consistently observed that those who thoughtfully embrace risk are the ones who succeed in the long run.

Put simply: you don’t want to inflate or marginalize risk. You don’t want to run toward it or avoid it. You do, however, want to identify all the risks in a potential acquisition and come up with strategies to mitigate and overcome it.

How to Manage Risk in Business Acquisitions

Now that we understand how to approach risk, how do we best manage and offset risks in acquisitions?

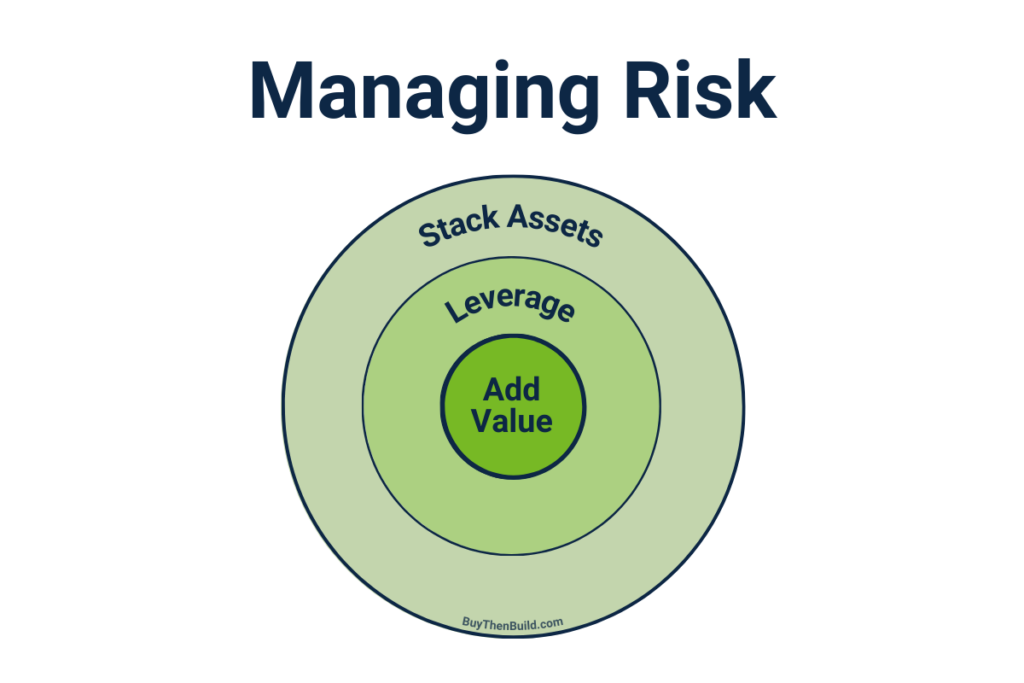

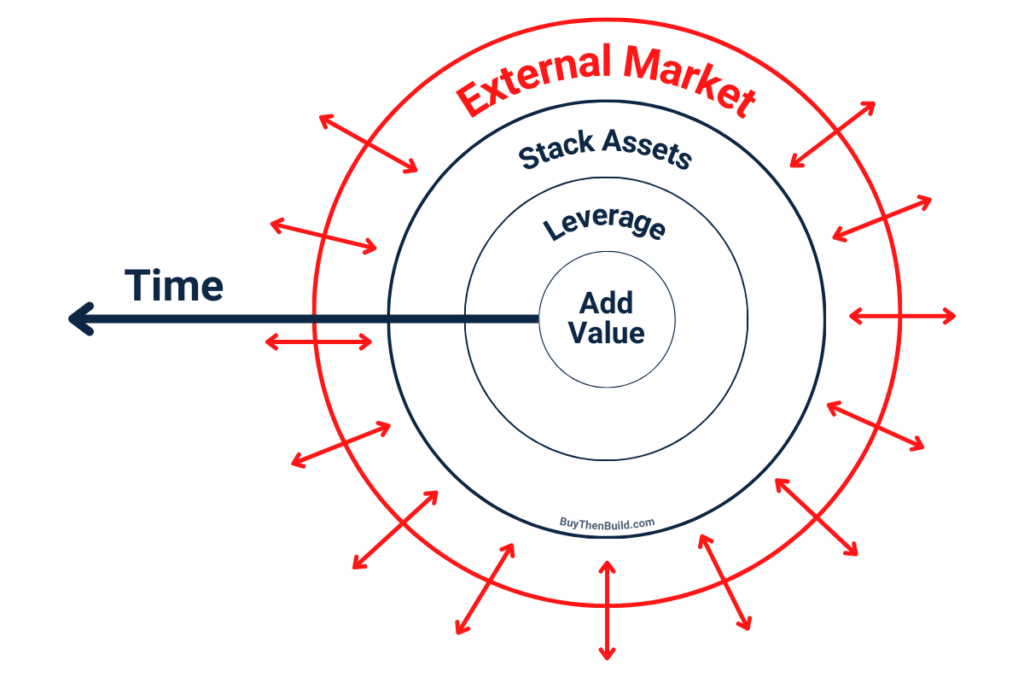

There are three elements of managing and mitigating risk, in this order: add value, leverage resources, and stack assets.

1. Add Value

Regardless of the endeavor—whether it’s a job, a high-paid skill set, or an entrepreneurial venture—the fundamental goal is to create value. Essentially, this means to leave your business better than you found it. Adding value is the cornerstone of mitigating acquisition risk, and there are different ways to add value depending on the type of business you acquire.

I talk about this at length in Buy Then Build, but your ability to add value to your business depends on you and finding a business that is a uniquely good fit for you.

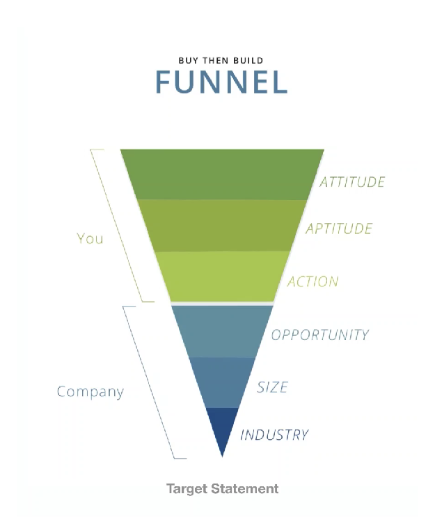

In the Acquisition Lab, we often talk about the “Three A’s”:

- Attitude

- Aptitude

- Action

When you align your attitude, aptitude, and action with a specific business opportunity, you are buying a business that is a perfect fit for you – one where you can add a significant amount of value that potentially other buyers cannot (because they aren’t you).

Once you establish this foundation of adding value to your business, the next step is to expand the value you create through leverage.

2. Leverage Resources

Archimedes said, “If you give me a lever and a place to stand, I can move the world.”

Source: Visualize Value. Illustrator: Andrew Yu

Leverage allows you to amplify your impact beyond what you can achieve alone. Leverage isn’t just about debt; it’s about utilizing other people’s resources. Here’s a broader definition:

- Other People’s Money: This includes investors, bank loans, senior debt, and even equity from others.

- Other People’s Time: Hire assistants, employees, or contractors to grow your business and increase productivity.

- Other People’s Assets: Utilize intellectual property, email lists, marketplace platforms, or partnerships with established companies to enhance your reach.

3. Stack Assets

Lastly, the third piece of offsetting acquisition risk is to start stacking assets on top of the foundation of building value and leveraging other people’s time, money, and assets. You do this by acquiring valuable resources that appreciate over time due to your efforts. Here’s how you can do it:

- Solve problems: Create new products or services that solve problems and create a business around your solutions.

- Create intellectual property: By creating intellectual property, you can add to the defensive moat of your business by further establishing your brand identity and preventing the competition from using your unique assets.

- Acquire additional assets: Grow your business through acquiring new business (growth through acquisition) or real estate. Successful companies often grow through acquisitions, as seen with Amazon’s purchase of Whole Foods.

These steps are within your control and are important in offsetting risks in acquisitions. As the CEO, you add value by pulling deals together, finding opportunities, and figuring out how to create better products and services for customers. By leveraging other people’s money, time, and knowledge, you can scale your businesses successfully.

How to Handle Unpredictable External Forces

External market forces—such as economic fluctuations and black swan events—can pose significant risks that are outside of your control. Over my 25 years of experience, I’ve witnessed two major recessions and several black swan events. However, by continually adding value, leveraging resources, and stacking assets, you can mitigate external risks in the long run.

How much or how little the external market affects your business depends on how well you lean into these three risk mitigating strategies.

The key factor here is time. Over the years, the entrepreneurs who I saw thrive, despite setbacks, focused on their core competencies and leveraged opportunities, consistently and without fail.

The ultimate strategy for managing risk and achieving long-term success is encapsulated in a simple formula:

Effort + Time = Control Over Risk

To navigate the uncertainties of the external market, focus on your ability to create value over a period of time.

Said more succinctly, hustle every day for your entire career and use all of the things that are available at your disposal.

While risk in business acquisition is inevitable, understanding its nature and strategically managing it through value creation, leverage, and stacking assets can lead to sustained success and growth.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.