Many investors and entrepreneurs are drawn to the idea of starting a fund.

Why? Because being part of a fund can provide an unbeatable return on your money.

Today we discuss everything you want to know about starting a fund, including why it could be a good idea for you, types of funds, most common structures, and steps to starting one successfully.

Let’s dive in.

Why Start a Fund?

There are three main reasons to start a fund.

High Returns. The financial industry is one of the largest industries financially in the world. Funds are the vehicle for private capital markets – buying small businesses and real estate – and are how private investors and wealthy people can get exceptional returns.

Other People’s Money (OPM). The second reason is the opportunity to use other people’s money (OPM) to build wealth for everyone involved. By raising funds from a group of people, you’re getting to raise enough funds for a number of deals, not just one, and you can allocate funds as you see fit. You’re funding multiple deals simultaneously. It’s important to hve an investment thesis, where you can back up your approach.

Infinite Returns. Infinite returns are what happens when you make your original investment back and you’re still making money on top of that. This is a way people play the financial game, by relying on their equity, time, and expertise to gain infinite returns on OPM.

Why Invest in a Fund?

Of all the vehicles in the financial industry, funds are the most profitable. Great returns come from a skilled team’s efforts, which includes you and the management team.

Investors get access to preferred returns. Preferred returns are a percentage of profits that investors will receive before the investment management team receives any profit. Percentages typically fall between 8-10%.

There’s tremendous upside potential. Not only can an investor expect to make his or her original investment back and then some, but there is an opportunity for outsized gain if a team does really well in managing the fund.

What are the Different Types of Funds?

There are three main types of funds:

- GP/LP

- LLC

- Syndication

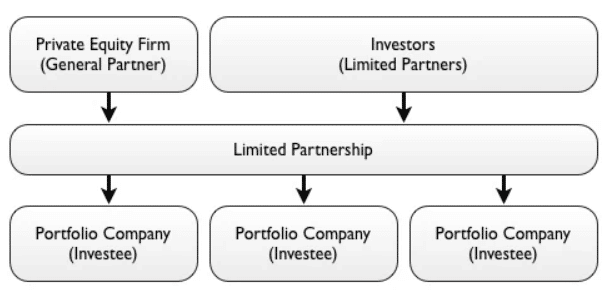

In a GP/LP structure, the GP or General Partner is the private equity fund or the investors who manage the fund and deploy the capital. LP or Limited Partners are the investors.

Sometimes people will prefer to create an LLC instead of a GP/LP entity. An LLC protects its owner from being personally responsible for business debts and liabilities in most cases. It also allows for pass-through taxation. From there, the shares are split into Class A and Class B, with different rights and roles for each. Class A shares are held by investors and Class B shares are held by the fund manager.

Lastly, sometimes people will consider creating a syndicate. It operates similarly to the first two entities in the sense that a group of people are coming together to raise capital in order to purchase deals. That said, syndicates tend to operate on a deal-by-deal basis – a syndicate would be formed to make one acquisition versus an ongoing fund managing a portfolio of businesses.

Who are the Different Types of Investors?

There are four main investors when it comes to funds:

- Non-accredited

- Accredited

- Qualified

- Institutional

Non-accredited investors are investors who make under $250,000 per year in salary or have a net worth of under $1 million. These investors are labeled non-accredited because the SEC deems that these investors are not “sophisticated” enough to invest in deals that an accredited investor can. The SEC protects non-accredited investors because it assumes that they cannot afford to take the risk.

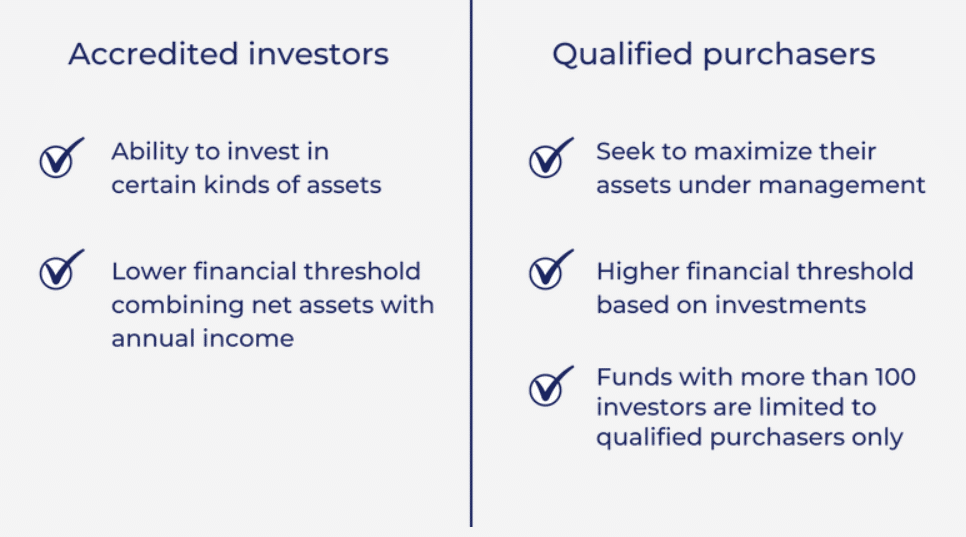

Accredited investors make $250,000 per year in salary or have a net worth of at least $1 million. They have access to a broader pool of deals simply by being accredited (I’ll share an example later).

Qualified purchasers are individuals or a family businesses with an investment portfolio of $5 million or more. If an individual operates on behalf of a group of qualified purchasers and is capable of investing $25 million or more, this also makes the individual a qualified purchaser. The primary benefit for qualified purchasers is having an even broader pool of investment opportunities to choose from than accredited investors have.

Institutional investors are other funds or institutions that manage money on behalf of other people. Some examples include mutual funds, pensions, and insurance companies. They are considered more sophisticated than the previous investors, and, therefore, have less restrictive regulations imposed on their investments.

Common Structures

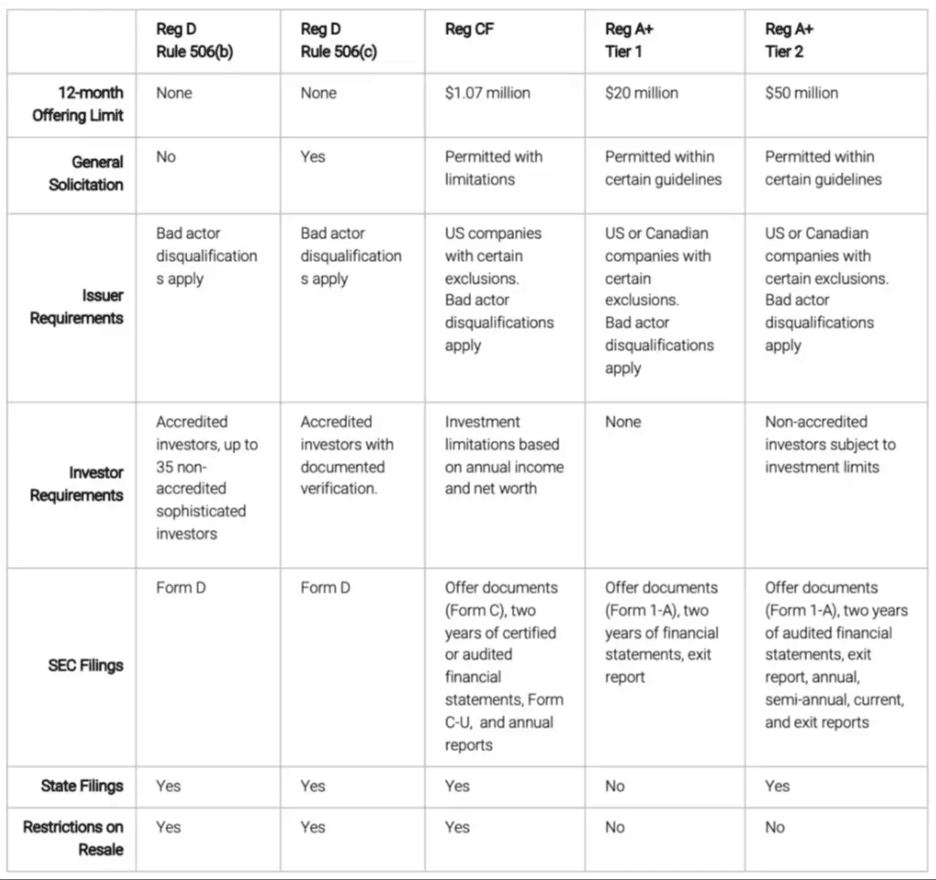

Funds typically follow Regulation D, which are a set of Securities and Exchange Commission (SEC) laws that regulate private security offerings but also allow companies to obtain funding fast and at a lower cost than with a public offering. The regulation allows companies to raise capital through equity or debt without needing to register those securities with the SEC.

Here are the main Regulation D structures that apply:

- 506(b)

- 506(c)

- Regulation A

506(b)

This is the most common structure private equity funds have. There’s an unlimited number of accredited investors from which the fund can raise capital, and there’s a limit of 35 non-accredited investors. Accredited investors only need to self-verify – the fund is not responsible for verifying accredited investor status. The main disadvantage of 506(b) is that the fund cannot advertise. They must rely on word of mouth and networking to raise capital.

506(c)

With a 506(c), these funds can only raise capital from accredited investors (and above). They are not allowed to raise money from non-accredited investors. The fund is responsible for verifying the investors’ status as accredited, and it can publicly advertise.

Regulation A+

Regulation A+ is different from Regulation D, but it is also another way to raise capital. Regulation A+ companies can raise up to $75 million per year from investors around the world, of any wealth level, and the company can publicly advertise. Unlike Regulation A+, Regulation D does not have a capital limit. However, the reporting for Regulation A+ companies can be extensive. Although no state registration is required, they have to file everything pre-emptively and follow auditing and reporting criteria on a regular basis.

3 Steps to Successfully Starting a Fund

Interested in starting a fund yourself? Here are the three steps you need to follow:

- Find a deal first.

The two things you need before starting a fund are a deal and a track record. People are investing in you and your management team, not just the deal itself. They want to see that you have prior experience and success in growing businesses with investors. If you don’t have that experience, someone on the management team must.

Finding a deal before you begin to raise capital is important because it will create a sense of urgency and encourage investors to commit to the deal because there’s a deadline.

- Find investors.

Only after you’ve found a deal should you start raising capital from investors. The best way to approach this initially is by getting soft commitments from investors, asking them, “Can I count on you for this money?” Utilize the verbal commitments to snowball the deal to hit your target capital goal. If you can tell other investors that you already have majority of the money soft committed, they will be much more likely to help you raise the remainder of the capital you need.

- Create the fund.

Now that you’ve found the deal and investors, it’s time to create the fund. The best approach here is to find an attorney that can help you create the necessary documents and file with the SEC. Whatever you do, make sure you get these documents correct: Private Placement Memorandum (PPM), Limited Partnership Agreement (LPA), Operating Agreement (OA), and Form D to be filed with the SEC. I highly recommend working with an SEC-specialized attorney to create your fund properly. This is not an area you want to DIY.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.