Buying a new business for the first time can be an exciting new venture. Acquiring a business instead of starting one from scratch inherently carries different risks but higher likelihood of success because you can already look at the business cash flow, its assets, operations, and profits before investing your time and money in it. You already have the consumer base, list of clients you are dealing with, and talented employees. Therefore, you don’t need to find a successful formula to run that business since it already exists. You simply add your unique skills & experience to increase the value over time.

This article discusses how first-time buyers can structure their offer to get the best deal, covering the most important steps that should be followed while making an offer.

Understanding the Fundamentals of Acquisition Entrepreneurship

The first step to buying any business is coming back to your fundamental questions associated with acquisition entrepreneurship:

- What are the benefits of acquiring this company?

- What are the wealth advantages and cash flow?

- Is this the right business for me?

- Does this business have real value?

- What can I bring to increase the business value?

Once these questions have been answered, you need to assess whether this business meets your investment goals and is within your personal margin of safety.

Assessing Your Margin of Safety

The term ‘margin of safety’ was coined by Benjamin Graham, the godfather of value investing. It is essentially to reduce the risk of losing money. Often, it is built into the price you are paying to acquire a business. The margin of safety is commonly driven by the following factors:

- Low Multiples

Buyers pay the lowest acceptable multiple on the seller’s discretionary earnings. The valuations for Main Street transactions will be around two to four times the seller’s discretionary earnings. - Price to Earnings Ratio

A high price-to-earnings ratio may indicate a company’s potential to generate high profits for all its stakeholders. For instance, publicly traded companies may sometimes trade for over 30 times the price to earnings ratio. - High Cash Flow to Investment Ratio

An important component of margin of safety is its tendency to be bankable, i.e., it can be financed by a bank using bank lending. That will give a high cash flow to investment ratio as well.

It’s time to start developing your offer if your core investment criteria are met by a business of interest.

Preparing Your Offer

Three core components should be top of mind as you’re starting to put together your preliminary offer.

- Determining the Right Price

Usually, buyers and sellers will have different opinions on the fair price of the company. So, imagine a Venn diagram with the buyer on one side and the seller on the other. Both buyers and sellers know how high and how low they are willing to go in that transaction. This is the range or spectrum of any business. In theory, there will be an overlap between the purchase price the buyer is willing to pay and the seller’s price. This intersection is where the buyers and sellers agree to a definitive transaction. The intersection is where the negotiation for sale price happens.

- Seller Transition Period

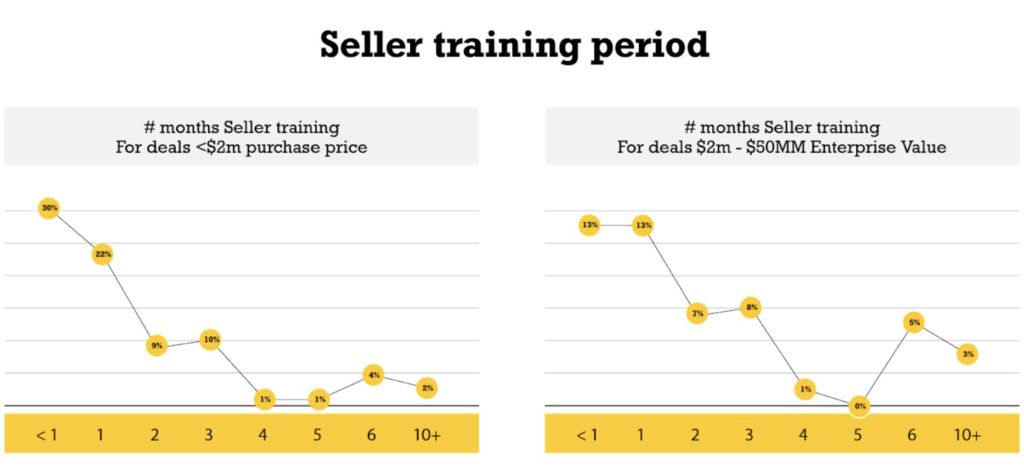

Most of the time buyers and sellers agree to a transition period in which the seller remains on board with the company helping the buyer understand the business, handing over key arrangements and so on. This seller transition period is agreed upon as a part of the sale price if it is under 3 months. If longer than 3 months is necessary then typically a consulting agreement is utilized. A survey suggests that 52% of deals in the sub-$2 million space had a transition period of a month or less.

- Employment/Consulting Provided by Seller

Sometimes, the buyer and seller may negotiate an employment contract for the seller to remain on board for different reasons including the seller’s expertise, relationships, involvement or when the seller is looking to stay with their business. It’s critical to also consider the requirements associated with the lending programs being utilized when developing your future plans.

Setting yourself up for Long-term Success

Execution risk is the largest risk in acquiring any business.

Let’s delve into how the buyers can minimize that risk:

- Confidence is the Key

The key to reducing business risk is ensuring that you are the right buyer for that specific business.You need to be confident with your business model and ensure that you’re the right person to grow the company or you must have the right people on board to execute your business plan successfully. That is the best way to make the business equation work.

- Understanding the Worth of the Business

The easiest way to get a company is by agreeing to overpay the seller. Sometimes, it is worth paying that extra money because the business is worth that offering price or you might get some additional things like working or intangible capital. The important point is that you pay what the business is worth to you and what amount makes sense for the overall goals of the transaction. At the end of the day, your offer needs to be anchored in financial analysis ensuring that the price you’re paying will support your future goals.

- Seller Notes and Holdbacks

Another way to minimize risk is by using seller financing often referred to as a seller note. A seller note is when the seller agrees to finance a portion of or the entire acquisition in a series of debt payments. A second technique, referred to as a holdback, is where the buyer will withhold a portion of payment until some post-closing condition is met.

- Pay for Quality

There is a school of real-estate thinking that believes buyers should pay the least possible price when purchasing a business.

However, this thinking does not work in business, and the top business practitioners believe in paying for “quality”. Buyers are recommended to find a business with as little intrinsic risk as possible and pay a fair price.

Are you planning on buying a business in the next 12 months? Consider applying today to the Acquisition Lab, our do-it-with-you buy-side advisory service. You’ll gain access to world-class education, support from our team of experienced advisors, a suite of tools, and a vetted community to help you succeed in that first acquisition or in implementing a grow-through-acquisition strategy.