A recent member of our community was talking about how he applied for the Acquisition Lab because he had recently read Robert Kiyosaki’s book, Cash Flow Quadrant, the sequel to the national bestseller, Rich Dad, Poor Dad, which just so happens to be the best-selling personal finance book of all time.

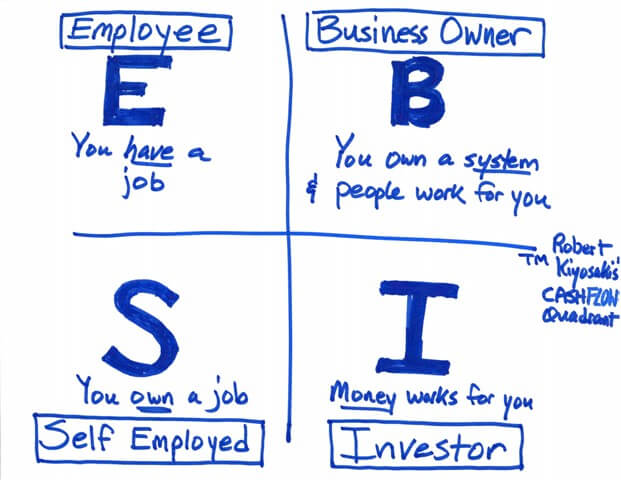

In the cashflow quadrant, he discusses the four ways that people can make money.

(1) Being an employee

Something most people understand – this is when you’re working for someone else.

(2) Being self-employed

Likely some type of service professional, e.g., a doctor, a lawyer, a business broker, etc. They are executing daily on the attracting & converting customers and delivering services.

(3) Building businesses

You have an asset that generates revenue for the individual rather than working for money.

(4) Being an investor

You reach financial freedom because your personally owned assets generate enough income for you passively so that you don’t need to actually work anymore.

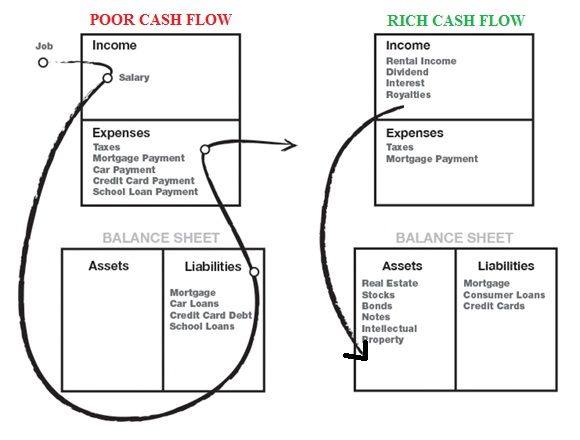

As a result of these different ways to make money, their personal income statements and balance sheets will look different.

(1) Poor Cash Flow: He’s talking about is people go to work and they make income. The poorest people will have the cash come in and go toward their personal expenses and then out that’s

it. They never generate any assets. If they’re really poor, they really don’t generate any significant liabilities. Other than potentially a small mortgage in the middle class.

People come in and work for money. Then what happens is they have to first pay off their liabilities (i.e., this is going to be a car, a mortgage, the other things that trap us in this sort of system). The big takeaway is you’re never really building any big assets that you own.

(2) Rich Cash Flow: The personal financial statements of the rich outlines as a bunch of assets that then generate income.

So Cashflow Quadrant is the goal – having assets that generate income. When it comes to acquisition entrepreneurship, many are using debt to buy these companies because even if you can pay cash, your ROI is tremendously better.

When you buy a company. It becomes part of your personal balance sheet. When you acquire the business with debt, that debt becomes the liabilities of the business. As your business generates income or revenue, it pays off the expenses and liabilities. It increases the net worth of the business over time with the equity buildup and ideally, the fact that you’re growing it.

This asset generates money to you personally.

I’ve never taken the time to apply the lessons of Buy then Build to Rich Dad, Poor Dad but it was fun to think through.

Robert says that you want to try to get out of the rat race and onto what he calls the fast track with the advice to always be anchored in two of these quadrants. Obviously, he pushes for the investor quadrant for good reason so if you’re an employee, make sure you’re also an investor. If you’re self-employed, he mentions learning to start businesses or learn to buy businesses with the goal to ultimately becoming an investor.

He says the ultimate sort of combo of the rich is to build passive income.

I want to make one clear point though. A lot of debt is okay especially when you’re starting out or even mid-career even though much of this debt needs to be personally guaranteed.

It’s just a fact. There are ways to get around it but 95% of people that are going out to buy a company using SBA financing will not get around it. That’s simply how it works.

I never say go buy a company and hire someone you don’t know to run it. And then move on and buy other companies.

No. I simply tell people to take their time. Build safety. Work in the business for a while. As you work in the business for a while, make sure you’re building systems to ultimately get yourself out of it. This is also making your business transferable so that one day you can sell it. The ability to sell it is what makes it an asset.

If you plan on buying a business in the next 12 months, please consider applying to the Acquisition Lab, our do-it-with-you buy side advisory service. Gain access to world-class education, support from our team of experienced advisors, a suite of tools, and a vetted community to help you succeed in that first acquisition or in implementing a grow-through-acquisition strategy.