What separates Shark Tank contestants who successfully convince investors to invest in their businesses versus those who don’t? It comes down to knowing your business thoroughly and giving the investors confidence that you’re the person for the job.

Preparation is key when approaching prospective investors in helping you purchase a business.

“What do investors want? What do I have to show them to get funding?”

Today, we’re going to help you answer these questions. There are three elements to a successful investment when acquiring a business: you, the business, and the investor.

There’s also a fourth factor that encompasses these three things, and that factor is your pitch – how you package and deliver the information about these three elements.

Let’s talk about what an investor wants to know before investing in a business acquisition with you.

Past Financial Performance

One of the first things an investor is going to evaluate is the business’s past financial performance, starting with at least the last two to three years, if not going back to the infancy of the business.

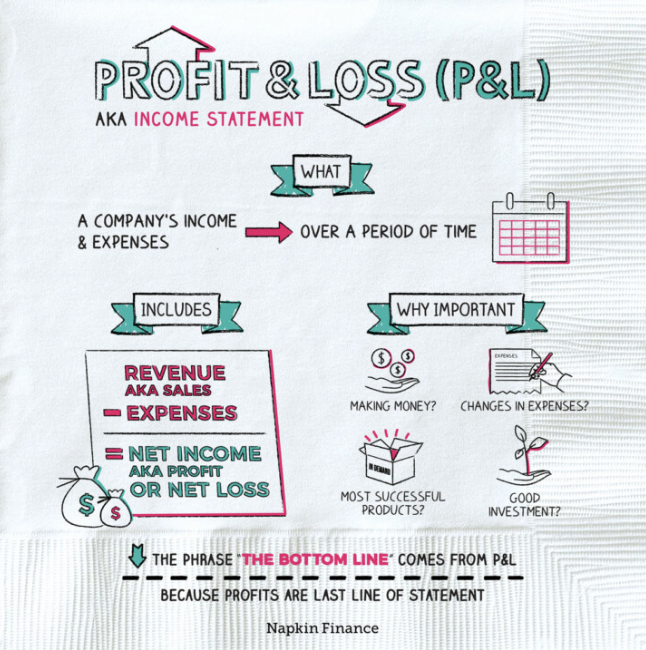

Financial statements will generally include the business’s profit and loss statements and balance sheet. Investors will be evaluating these metrics:

- Net profit

- Sales & revenue growth

- Debt level

- Profit margin

- Free cash flow

These metrics indicate the overall current and projected health of the business.

Effective and Resilient Business Model

An investor is constantly managing risk – balancing an opportunity to make a return and the potential threats that may detract from that return. In order to assess the risk, an investor is going to want to see that the business model is profitable, sustainable, and resilient to any threats.

Here are some of the factors investors will consider when evaluating if a business is worth investing in:

- Profitability: Cash flow will provide the buyer not just with money to take home but also financial leeway to take the necessary risks to scale the business.

- Recurring revenue: Monthly and annual recurring revenue indicate financial stability and a tighter relationship between the business and the customer base.

- Average Order Value (AOV): AOV tells you the average amount spent per order, and it allows an investor to assess and make decisions on customer buying patterns.

- Customer Lifetime Value (CLV): CLV shows how much a customer will make repeat orders. This metric points to customer satisfaction and return on marketing spend.

- Recession-proof: A business that can do well during a recession demonstrates resilience and stability – two things investors will love about a business.

- Low seasonality: Some products are highly seasonal, such as gifts, so low seasonality also points to financial stability, with projections that are easier to forecast.

- Low concentration: A business that doesn’t have product or supplier concentration will not suffer if one product or supplier stops working. This ensures no one product or supplier is a single point of failure, which is a major risk for any investor.

- Defensive moats: Anything that allows a business to maintain its competitive edge over its competitors, defensive moats help lower the investment risk.

- Unique product or service: A business can compete either through cost or differentiation, so having a product or service that is unique and even superior to competitors is important. Effective product differentiation allows sellers to gain a competitive advantage.

- Market size: Market size is an indicator of the potential for new business, product, or service, and points to how high the ceiling is for your business.

- Staff organization: Employees can be a liability if there are too many, not enough, or not the right ones. An investor will want to know how you team is made up and if they will transfer over upon closing.

- Transferability: Transferability of a business from the seller to the buyer is key in minimizing risk. The last thing an investor wants is for the current cash flow to vanish upon closing because the seller was able to hold the business together in a way that you can’t.

You

Investors aren’t just investing in a business–they’re investing in you.

What’s your background and how does it relate to the business you’re looking to acquire?

What skills and strengths do you bring to the table? How do they mesh with the needs and growth opportunities of the business?

Part of managing the investment risk for an investor is making sure you are uniquely suited to run the business you’re looking to purchase. If you can tie your previous experience and strengths to what the business needs, you can help the investor connect the dots as to why you and the business are a good decision.

This is a perfect opportunity to refer back to your target statement. What opportunities are you looking for and why?

Do you have any social proof? On LinkedIn, you can collect endorsements and recommendations from people in your network, validating your skills and strengths.

Investor

As I talked about last week, investors aren’t simply funding sources. They can provide a number of things to you and your business, and it’s important that you recognize these things when pitching an investor.

Highlight the specific investor’s appeal. Have they specialized in a certain type of business or industry that matches the one you’re looking to purchase? Can they provide business mentorship, influence, and network? Name the facets about an investor that make them uniquely suited to invest in your business.

An investor is also going to want to feel comfortable with the business she or he is investing in. They’ll likely be looking for an industry or type fit.

Both you and the investor should want to approach this as a partnership, not simply as a lending solution.

Pitch

None of the things listed above matter if you can’t package this information and deliver it well to a prospective investor.

Craft a clear and concise pitch. No matter where you meet potential investors, you’ll need to be able to summarize what you’re looking for in a few sentences that tell investors what the business is, who you are in relation to that business, why it will provide the investor with a great return, how much money you’re trying to raise, and what you envision the partnership with the investor looking like.

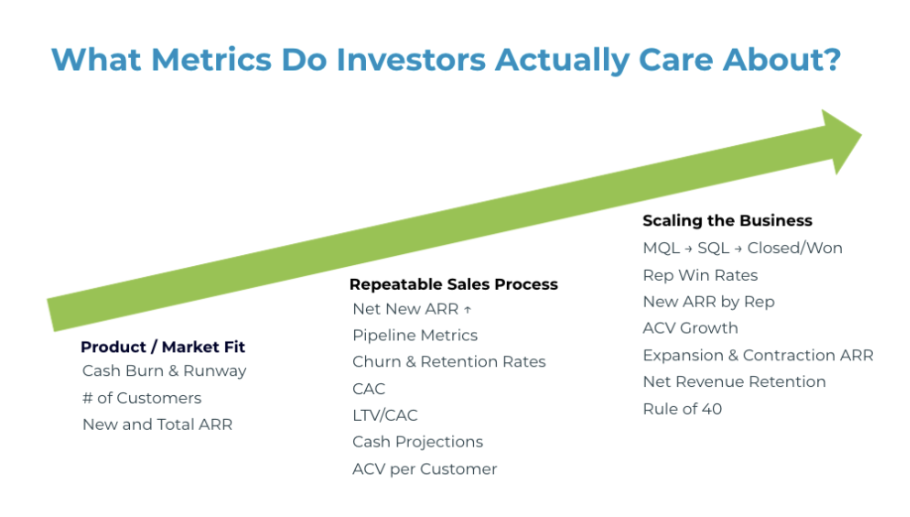

Share your detailed business plan. When an investor agrees to learn more about the business you’re looking to purchase, you’ll want to present a business plan. In it, you’ll outline what this company sells, your vision, product/market fit, management team, exit strategy, and funding needed.

Occasionally, investors may ask for a one-page executive summary of your business plan that offers a quick overview for them to review.

Describe growth opportunities. In your vision, outline what growth opportunities you envision the business having and how you plan to scale the business once you take over as the new CEO. What are the opportunities? How are you, along with the investor, uniquely suited to scale the business?

Clearly outline investment structure. When discussing what funding you need, talk about potential investment structures you’re proposing or willing to consider. An investor is going to be most interested in what he or she can expect as a return and under what timeline.

Ready to acquire a business in the next 12 months? The Acquisition Lab is your first stop. Reach out to us today and get on the fast track to becoming an acquisition entrepreneur.